XRP Targeting Potential $3 Spike Following CME Futures Introduction Endorsed by Brad Garlinghouse

Ready, Set, XRP! CME Group's Big Move and What It May Mean for XRP's Future

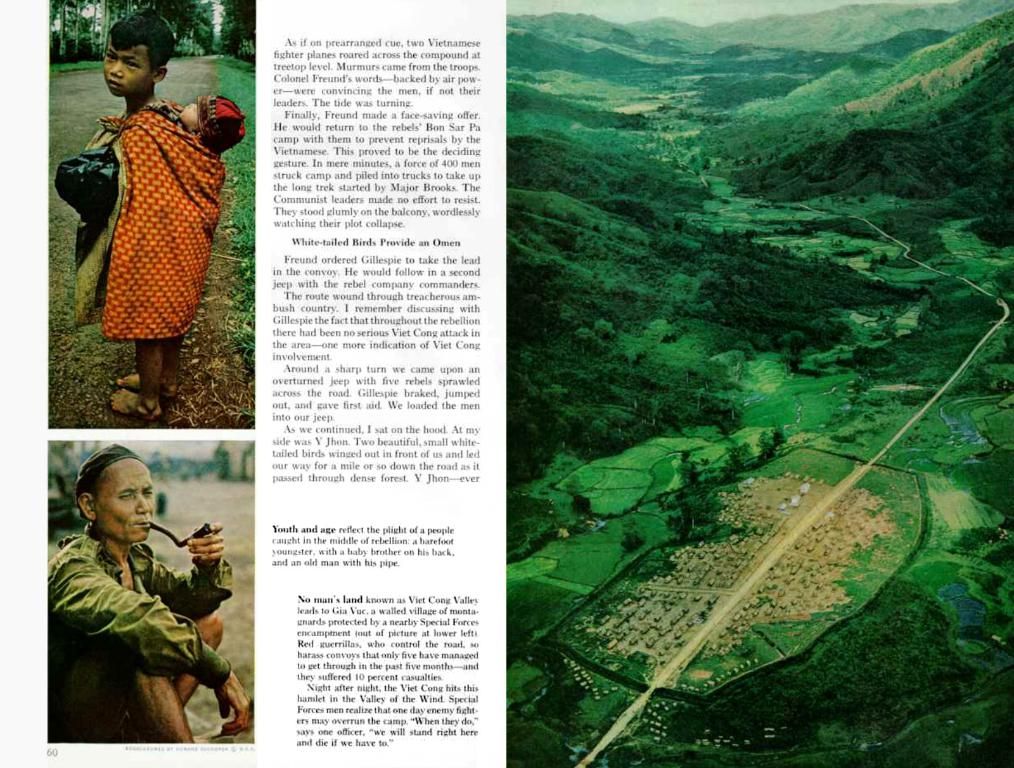

Prepare for takeoff, XRP fanatics! CME Group is about to drop XRP futures into the mix, setting a launch date of May 19th. Bulls are eagerly eyeing the chance to smash the $3 threshold.

Ripple CEO, Brad Garlinghouse, shined brightly at the announcement, calling it "a massive step forward for the XRP market!"

"Although late in a bunch of ways, this is an incredibly significant moment for the continued growth of the XRP market!"

CME, one of the world's prime derivatives markets, deeming XRP worthy is a vote of confidence for the token's institutional acceptance. Their new product brings regulatory-grade futures to one of crypto's most scrutinized coins to date.

This announcement and endorsement could stir up a bullish sentiment around XRP. As of now, it's stationed in a major accumulation area, ready to bust through the $3 resistance.

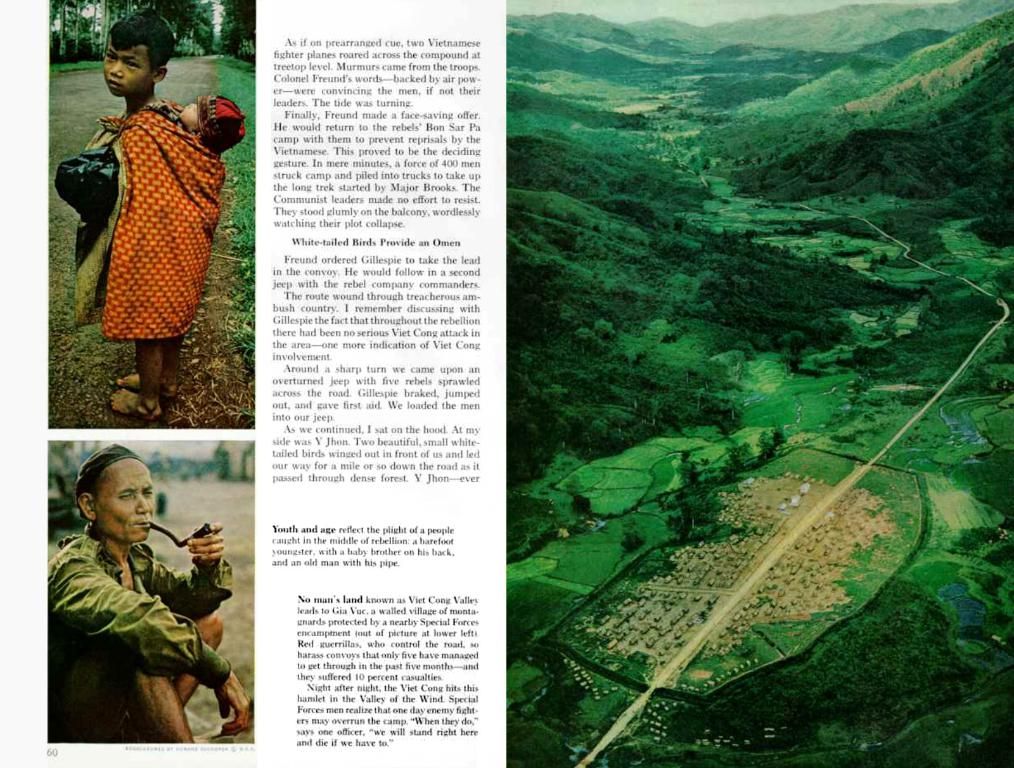

The chart suggests a successful breach could initiate a new wave of upward momentum, taking us to the $8-$10 range in the long haul. But we'll need plenty of support from the community and a whole lotta liquidity to keep that price riding high.

XRP's been under pressure due to Ripple's legal scuffle with the U.S. Securities and Exchange Commission (SEC), but recent court developments and Ripple's payment technology's global rise have rejuvenated investor belief.

CME's upcoming offering will cater to both the retail and institutional crowd with both standard and micro-sized contracts. This move is music to traders' ears and an excellent opportunity to experiment with diverse trading strategies.

The launch of CME-listed XRP futures could also bring risk-hedging options to the table, upping the chances of liquidity influx in the XRP ecosystem. And let's not forget—CME already offers futures for Bitcoin and Ethereum. Adding XRP to the roster could add some much-needed legitimacy among mainstream investors.

Now, as we edge closer to May 19th, everyone's eyes are pinned on how the futures launch will affect XRP's price journey. Will this institutional tidal wave be mighty enough to propel the token beyond the psychologically significant $3 barrier?

Keep your eyes peeled for that action, folks! The future of XRP could very well be brighter than ever before. And hey, if you miss the boat this time, who knows what else could be coming down the pipeline for your favorite cryptocurrency!

Also Read: CME Group to Debut XRP Futures on May 19

Bonus Insights

CME Group's decision to launch XRP futures may well mark a significant turning point for XRP's price trajectory. Here's a round-up of the possible effects:

Potential Price Actions

- Institutional Appeal: Regulated futures could draw in institutional capital, driving up XRP's value.

- Risk Management and Speculation: Futures grant traders the chance to hedge their positions or wager on future price movements, potentially magnifying liquidity and price action.

Factors Impacting the $3 Barrier

- Adoption and Appetite: Growing interest and use of XRP's underlying technology, XRPL, bolsters XRP's price potential.

- Competition and Market Forces: The success of CME's XRP futures hinges on how they stack up against other crypto derivatives. Market conditions, like liquidity and tight spreads, influence price directions.

- Regulatory Environment: Regulatory approval will lend credibility to XRP, boosting investor trust and, ultimately, contributing to price growth.

Breaking the $3 barrier requires several conditions to align: increased adoption, positive market sentiment, and favorable global economic conditions. Keep that in mind while you're riding the XRP wave!

The launch of XRP futures by CME Group on May 19th could significantly boost XRP's price, with institutional investors potentially pouring capital into the token. XRP futures will provide traders the opportunity to hedge their positions or speculate on future price movements, indicative of an increased liquidity and price action.

The success of XRP futures will largely depend on various factors, such as competition among crypto derivatives, market conditions, and regulatory approval. As the XRP ecosystem grows and adoption of XRPL technology increases, this could fuel XRP's price potential, possibly leading to breaking the psychologically significant $3 barrier.

However, achieving this milestone requires significant alignment of multiple conditions, including increasing adoption, positive market sentiment, and favorable global economic conditions. Thus, it is essential to keep an eye on these factors while embracing the XRP wave.