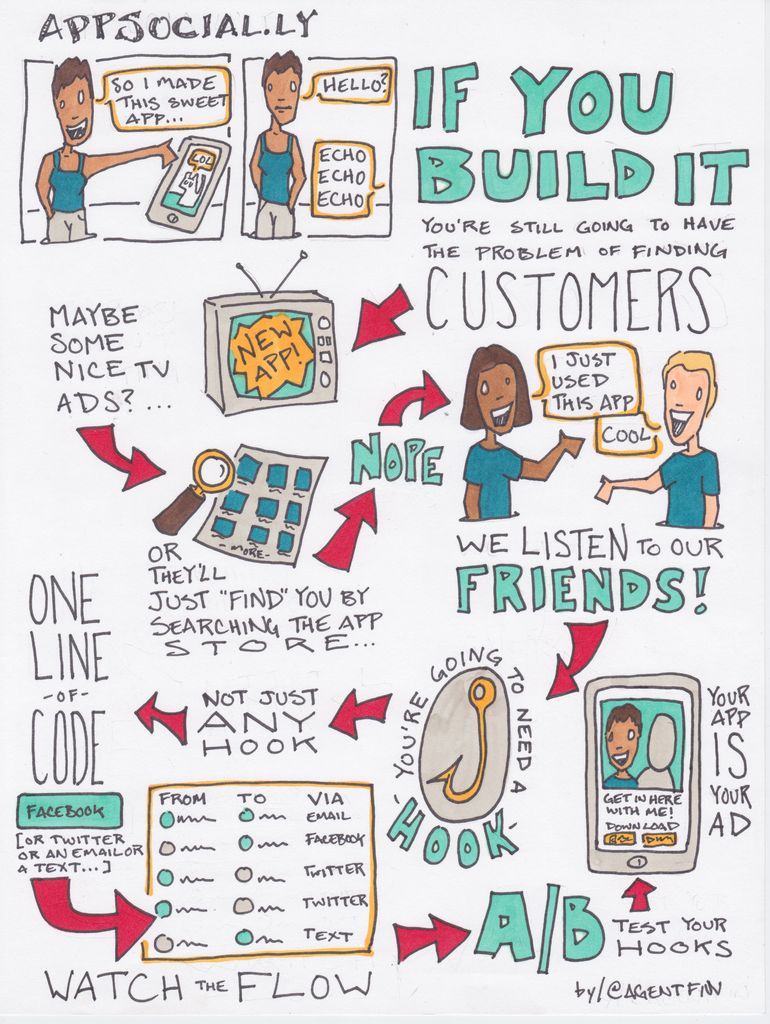

Understanding Operating Leverage: Its Significance, Method for Computation

Taking a Gander at Operating Leverage

Wrap your head around operating leverage, a fantastic tool that reveals how much a company's operating expenses are tied to fixed costs. If a company boasts high leverage, that means a considerable chunk of its expenses is fixed. On the flip side, a low leverage signals a smaller proportion of fixed costs compared to its total operating expenses.

Swing and a Miss?

Operating leverage carries some risk because it impacts the sensitivity of future earnings and cash flow. Should a company have high leverage, even the smallest change in sales could have a significant impact on profits. On the other hand, when the leverage is low, the proportion of variable expenses is higher. In such a case, changes in sales will bring about changes in total costs proportionally. Therefore, profits remain stable.

Why Operating Leverage Rules

Here's a lowdown on why operating leverage deserves your attention:

- ** Feel the Squeeze:** Quantify the sensitivity of a company's earnings and cash flow

- ** Cue the Breakfast Club:** Calculate the breakeven point

- ** Playing it Safe or Taking a Chance:** Measure the risk of business operations

- ** Game On:** The effect on the rivalry of companies in the industry

Feeling the Squeeze

Firms with high operating leverage have profits that are highly sensitive to sales fluctuations. Even a slight change in sales can lead to volatile profits with costs remaining unchanged, causing sales forecasting to become perilous. If the leverage is low, a larger share of variable expenses is present, and changes in sales generate changes in total costs at a relatively steady pace, keeping profits stable.

Bringing the Breakfast Club Back Together

The breakeven analysis enables a company to determine the target selling price or sales volume at which revenue equals total costs. The difference between the contribution margin (S-VC) and total fixed costs (FC) indicates the company's profits. When a company generates a substantial contribution margin, it can use it to cover fixed costs with the remaining amount representing the company's profits.

Feeling the Heat

Operating risk represents the uncertainty of future operating profits and depends on the stability of the company's revenue and operating cost structure. Sales stability refers to revenue fluctuations due to sales volume and price changes. If the company's revenue is stable, the selling risk is low, implying that the company's pricing and marketing strategies are effective. Operating cost structure reveals the extent to which the firm relies on fixed costs. If fixed costs account for a considerable proportion of total operating costs, the firm is considered high risk. To generate sufficient sales to cover fixed costs, the company must compete fiercely against market forces.

The Industry's Showdown

Highly leveraged industries typically carry high entry barriers, forcing new entrants to invest hefty sums for expensive equipment. Upon failure, these newcomers face significant financial losses. Moreover, operating leverage often impacts the intensity of competition within an industry. Constrained market demand necessitates that individual companies maintain steady sales volumes to cover high fixed costs.

Putting Operating Leverage to the Test

To calculate operating leverage, use several approaches:

- ** Match the Moves:** Compare the percentage change in operating profit to the sales percentage change. Operating profit equals revenue minus fixed costs plus variable costs.

- ** Crunch the Numbers:** Compare the total contribution with operating profit. The total contribution (or contribution margin) exhibits how much sales can cover variable costs. Calculate this by subtracting total variable costs from revenue.

- ** Set the Record Straight:** Compare total fixed costs to the total operating costs. This measure provides insights into the extent to which the company's operations are subject to fixed costs.

In simple terms, operating leverage can be positive or negative. Positive leverage shows that the company is generating sales greater than total costs while negative leverage demonstrates the company is not generating enough revenue to cover costs when the contribution margin is less than the total fixed cost.

Operating Leverage: Financially Speaking

Operating leverage refers to the proportion of fixed costs in the operating cost structure, while financial leverage measures the proportion of debt to the company's overall capital structure. Like fixed costs, a company must service its debts regardless of the prevailing business conditions. Accumulating a high proportion of debt increases the company's financial risk and default risk.

Making Operating Leverage Work for You

High operating leverage isn't always a bad thing. Some industries require an elevated proportion of fixed costs due to their nature. When analyzing, remember to compare the ratio with peers or the industry average for a fair evaluation. Whether a company has a high or low operating leverage, factors such as its sales strategy, market environment, and pricing decisions play a crucial role in its overall performance.

- To properly understand the impact of operating leverage on the finances of a company, consider the following: if a company has high operating leverage, it may indicate that a significant portion of its business operations are tied to fixed costs, making its earnings highly sensitive to changes in sales and overall financial performance controllable.

- For any company looking to invest, understanding its operating leverage is crucial: a company with low operating leverage may demonstrate a smaller proportion of fixed costs, suggesting its earnings are less sensitive to sales fluctuations and potentially more stable, which can be an attractive investment opportunity in the world of business.