U.S. Economic Prospects in 2025: Justifying Positivity

A decade ago, I started talking about the economy by saying: "With the stock market reaching record highs, unemployment at 5.8%, the economy growing at 5% in the last quarter, moderate inflation, and cheap gas prices, there's a sense of optimism about the US economy."

This feeling of optimism persists today. The stock market is almost at its peak and has nearly doubled compared to ten years ago. Unemployment, at 4.2%, has dropped by a quarter. Although inflation is higher than it was in 2015, it's on the decline. The economic growth towards the end of Obama's presidency was slightly higher than it is now.

The participation in the labor force hasn't changed much. Although it has recovered from its COVID-19 low, it currently stands at 62.7%, which is the lowest since the late 1970s. Over 6 million people have left the workforce since Obama took office, including many who left during the pandemic restrictions, and the number hasn't improved significantly.

I started worrying about inflation during the Bush and Obama years, and in 2015, I predicted, "The hour of reckoning for the Fed is near." Like other monetary hawks, I was mistaken about the timing. It took until 2021, around seven years, for inflation to kick in. Quantitative easing, a discreet way of plundering for the government, was a strategy used by many countries since the beginning of the century. The monetary flood finally affected prices during the Biden-Harris administration.

The current issue that concerns me is government debt. A decade ago, I wrote, "With $7 trillion in new borrowing, no other president in US history has increased debt as much as Obama." President Obama, indeed, has the record for the most debt increase in terms of actual dollars. Percentage-wise, President George W. Bush had the worst record; he increased the public debt by 105%, compared to Obama's 70% for an eight-year period. Trump initially increased debt at a slower rate, but COVID-19 led to another surge. Government debt now stands at 120% of the GDP, offering less financial flexibility. The Euro, at $1.04, is trading at a similar price as it was at the end of 2015, and both currencies have lost more than half of their value against gold.

Terror or wars can also impact the US economy, but they're harder to predict. A decade ago, there were two significant threats: the Russian intervention in Crimea and the rise of the Islamic State. Today, we're facing similar threats on the same battlefronts. During Trump's first term, ISIS was defeated, and Russia didn't invade any further. In his second term, he's likely to follow the principle that imperfect peace agreements are better than prolonged wars. Although there will be geopolitical risks, this approach should be good for the US economy.

I expect Trump's policies to again reduce oil prices, strengthen the US economy, and weaken Russia and other oil-producing countries. However, it's challenging to predict the impact of policy on oil stocks. For instance, Exxon stock fell by half when Rex Tillerson became the Secretary of State during Trump's first term. Paradoxically, the stock reached record highs during the Biden presidency and has lost almost 13% of its value since Trump won the 2024 elections.

Healthcare law is another challenge for the US economy and has had a significant negative impact on productivity. I used to label this issue as Obamacare, but it's fairer to call it "uniparty healthcare": a mix of crony capitalism and crony socialism that can be bought with lobbyist money. It increased the cost of full-time employment and encouraged part-time work and the growth of the informal economy, as few other policy changes have or could. Robert F. Kennedy will need wisdom, courage, and good luck to change policy rules and incentives in healthcare.

Immigration was and still is a controversial subject. In 2014, amnesty was granted to many immigrants, but I didn't expect it to have a significant impact. I've always stressed the importance of advancing to a market-based immigration system that respects the rule of law and human dignity, such as the "Red Card solution" (invitation-based immigration managed by the private sector). The immigration debate is still divisive but essential.

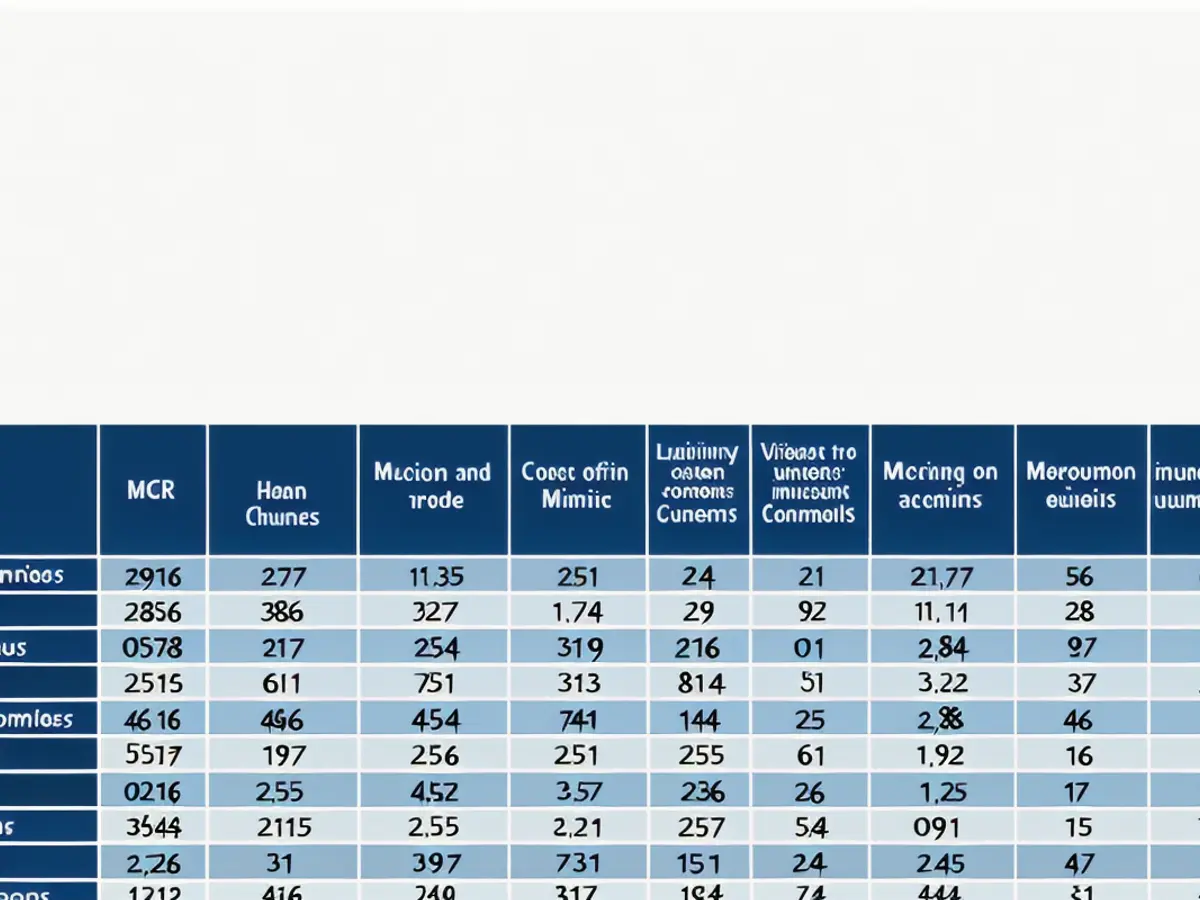

Protectionism or free trade is a significant engine for growth, but I don't expect many countries to open their economies in response to Trump's threats. 2025 will be a year of negotiations, with a president who thrives on them. Progress towards free trade took a hit after the pandemic restrictions. Metrics such as the Heritage Foundation's Index of Economic Freedom show the US with a lower free trade score than the Eurozone and its other major trading partners, except China (see table below).

Trump understands the importance of low taxes, but there are two schools of thought among his supporters regarding tariffs. One advocates for using tariffs to achieve a freer and more just trading environment, while another sees tariffs as a social engineering tool to reward political or business cronies at the expense of the majority.

It remains to be seen if the "supply-side champions" (as referred to in a Politico article), such as Stephen Moore, will resurface in Trump's second presidency. I am a fellow board member of Moore's and recently engaged in discussions with the current figurehead of the supply-side "movement," Dr. Art Laffer. Laffer, who advises leaders worldwide on economic policies, cautions his associates that Trump is inherently pro-free trade. He frequently recounts an instance where Trump told the Europeans, "if you go all-in on free trade, so will we." The Europeans responded by staying quiet.

During Trump's prior term, he and his gang utilized the term "reciprocity" to describe their trading ideals. The term "reciprocity" carries a more complex and favorable connotation than "tariffs." In a piece I wrote, I highlighted the risk of misusing the "principle of reciprocity" for fair trades, a concept championed by philosophers like Aristotle and Aquinas for centuries. Peter Navarro, who communicated this concept, may rejoin the administration as senior advisor for trade and manufacturing, making "reciprocal" tariffs a significant influence during Trump's upcoming four years. Implementing "reciprocity" is less threatening to free enterprise and the U.S. economy than incorporating tariffs into a broader national economic strategy.

The Argentine Phenomenon and the Brazilian Nightmare

I have never included Argentina in my yearly evaluation of the U.S. and global economy due to its miniscule economic size in comparison with the USA (just 1/40th) and its conventional misguided economic policies. However, small economies can provide valuable insights to the world.

Argentina, led by Javier Milei, is generating attention with its advancements in deregulation and cuts in government spending. Elon Musk has taken note of Argentina's experiment, and some of its approaches have motivated him to make changes in his own operations. Despite its shrinking economy, Argentina boasts the power to positively influence the world through its example, rather than through military might. However, the disruptions in the U.S. economy are less pronounced than those in Argentina due to the stronger and more organized bureaucracy present in the U.S. I am confident, though, that the DOGE team will add momentum to Trump's well-known dislike for bureaucratic red tape. In his first term, which will extend into 2025, Trump will likely carry out even more deregulation than he implemented prior to the COVID-19 pandemic.

Brazil, with nearly half the GDP and population of South America, holds significant importance in the global economy, and under leftist President Lula, it has once again wasted its potential. Its currency has depreciated significantly against the dollar (approximately 30% so far this year), and the country faces the task of selecting a successor for its highly respected central bank president by 2026. Long-term investors stay cautious, but Brazil's economic troubles are unlikely to have a significant impact on the U.S. economy in 2025.

A Prosperous 2025 for the U.S. Economy

I anticipate a prosperous 2025 for the U.S. economy, outpacing current projections. It showcases a stronger standing than most western nations, mainly due to the incoming administration's pro-anti-regulation and low-tax policies. Most of Europe is burdened with an expensive social welfare system and an even more detrimental regulatory environment, and I do not foresee any significant changes in the foreseeable future.

Moving past economics, I have continuously warned about the adverse economic effects of a weakening rule of law, an increased reliance on executive power, and the growth of entrenched privileged forms of capitalism, often referred to as "crony capitalism." Regrettably, the trajectory points in the opposite direction. Since 2015, the U.S. has fallen from 20th to 26th place in the World Justice Project's rule of law index. The Corruption Perception Index of Transparency International also demonstrates a decline in the U.S., moving from 17th to 24th position during the same period.

Luckily, improvements in the tax and regulatory environment may offset the reduced rule of law and the higher costs of heightened protectionism. On immigration, I expect that Trump's approach towards the illegal and informal labor supply will become more lenient, limiting aggressive deportations only to illegal immigrants apprehended for serious crimes.

On monetary matters, I anticipate that there will be no significant changes. As most businessmen, it appears that Trump holds a soft spot for easy money, but advocating for such policies would resemble the "Argentine path," which many Trump appointees would caution against.

While flawless predictions are impossible, I have yet to make any significant blunders in my forecasts throughout the past decade. If you wish to select a country for investments or relocation, the U.S. in 2025 presents a reliable and promising choice.

- During his second term, President Trump is expected to advocate for protectionism, but it's uncertain if other countries will respond to his threats, as mentioned in the context of economic negotiations in 2025.

- The Trump administration, known for its pro-business policies, supports lower taxes and deregulation, as expressed by the appointment of supply-side champions like Stephen Moore and Arthur Laffer.

- Mentioning Argentina's economic reforms under Javier Milei, the text highlights the influence of deregulation and lower government spending, even in a smaller economy like Argentina's.

- Concerned about the rule of law, the text discusses the United States' decline in rankings in the World Justice Project's rule of law index and Transparency International's Corruption Perception Index since 2015, despite improvements in the tax and regulatory environment.