Thyssenkrupp to Dish Out Generous Share Packages in Marine Stock Listing

Thyssenkrupp Offloads Half of Subsidiary Marine Unit

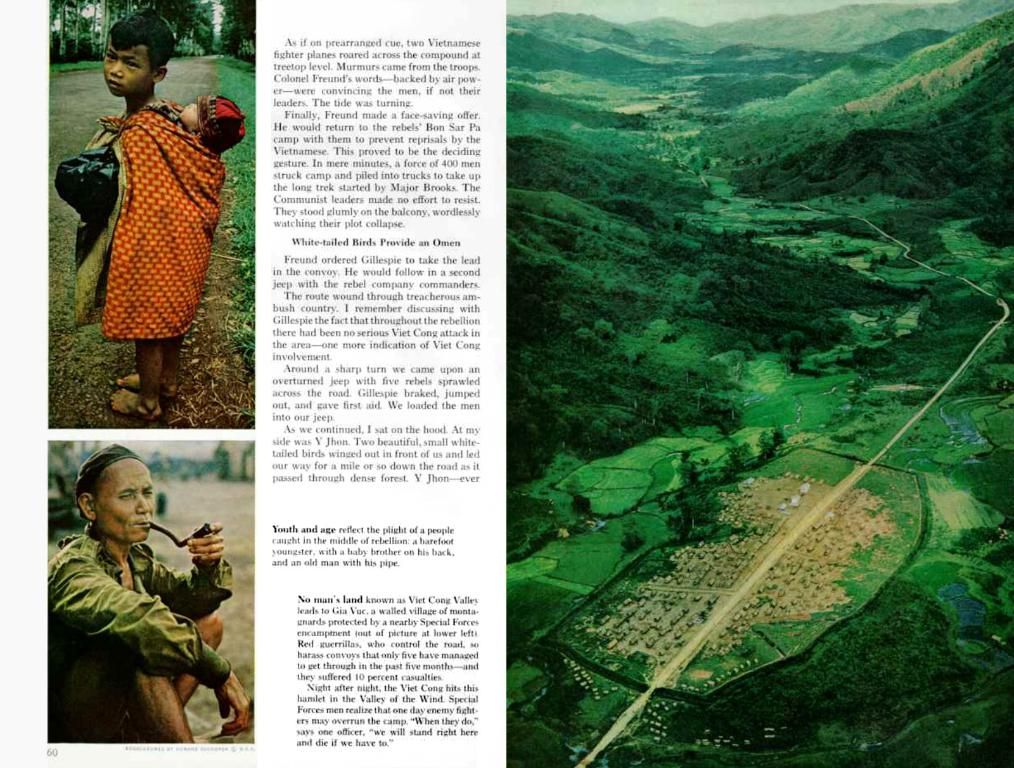

Industrial heavyweight Thyssenkrupp isn't messing around. They're diving headfirst into the deep end by planning to float nearly half of Thyssenkrupp Marine Systems (TKMS) on the Frankfurt Stock Exchange.

At a company event in Kiel, board member Volkmar Dinstuhl announced that shareholders would own 49% of the new TKMS holding company, with an extraordinary general meeting deciding on the matter. The marine division, renowned for constructing submarines and frigates, has been profit-churning due to the booming global defense business.

The decision to take TKMS public is part of CEO Miguel Lopez’s ambitious plan to equip all divisions for a sale, IPO, or partnerships, as he gears them up for the big leagues.

Dinstuhl's announcement coincided with TKMS's rebranding celebration, marking a fresh start and expanding market reach under the new initials TKMS.

This strategic move could bring Thyssenkrupp several advantages:

Thyssenkrupp

- Financial Agility: The IPO could net Thyssenkrupp between €1 billion and €1.5 billion, freeing up funds for debt reduction and growth investments.

- Market Tailwinds: TKMS's substantial order backlog of €16.4 billion and the lucrative defense market, particularly European NATO member spending, could boost the company's fortunes.

- Operational Flexibility: The restructuring grants operational autonomy to divisions, potentially attracting investors and fostering innovation.

- Expanded Market Presence: The rebrand may enhance TKMS's profile, aligning with Thyssenkrupp's broader strategic realignment.

Xetra ·

However, the IPO comes with risks, such as market volatility and regulatory factors that could affect its success. It's a gamble, but one that could pay off big for Thyssenkrupp.

Thyssenkrupp's strategic move to take Thyssenkrupp Marine Systems public is part of the company's broader business strategy, aiming to secure significant funds from the IPO and utilize them for debt reduction, growth investments, and operational flexibilities. This move is also expected to expand TKMS's market presence and align with Thyssenkrupp's broader strategic realignment in the finance and industry sectors.

By floating nearly half of TKMS on the Frankfurt Stock Exchange, Thyssenkrupp aims to capitalize on the lucrative defense business and tap into market tailwinds, particularly the increasing defense spending by European NATO member countries. Additionally, the restructuring grants operational autonomy to divisions, potentially attracting investors and fostering innovation within the marine unit of Thyssenkrupp's broader business interests.