Textile Giant on Brink of Bankruptcy: Investor Steps In to Prevent Collapse - Yet No Official Agreement Signed

Title: Palmers Revival: A Shocking Revamp

At Tuesday's jaw-dropping creditors' meeting, a shocking revelation emerged: An unnamed international textile titan is eyeing Palmers for a potential takeover! This stock-listed heavyweight, hailing from outside Austria, plans to keep Palmers in the premium segment and support its global expansion. But, the clock is ticking: The deal must be finalized by May 20th, or it's back to square one!

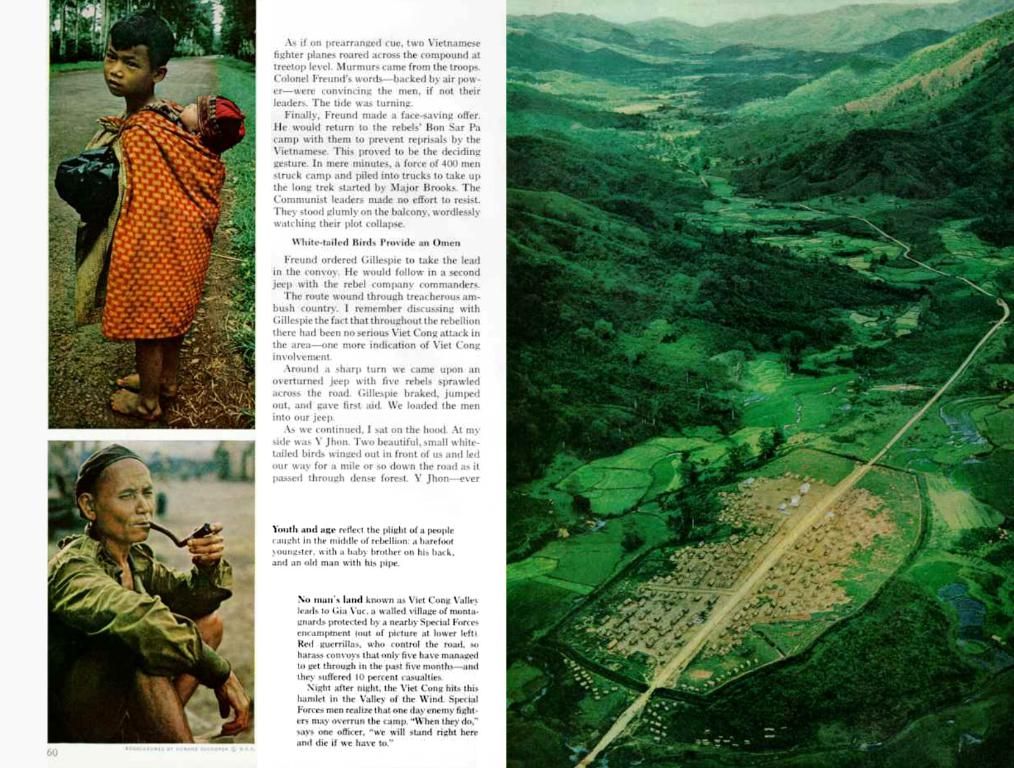

The Premium Segment's Lifeline

According to the latest scuttlebutt, Palmers will stay as an independent brand in the premium market under the new owners, with the existing management team running the show. This investment group isn't just bringing cash to the table but also contributing expertise for penetrating new markets. However, before these plans come to fruition, a major obstacle looms large: The deal needs to be sealed by the next creditors' meeting on May 20th—a heart-pounding race against time!

A Bleak Future for Creditors

New details about Palmers' financial mess have surfaced:

- The initial claimed claims amount of 77 million euros has been whittled down to 17 million.

- The rehabilitation manager is fiercely disputing the rest of the claims.

- "However, it won't come as a surprise if the recognition of payable debts continues to grow," warns Alexander Greifeneder from KSV1870.

Initially, Palmers proposed a rehabilitation quota of 30% for creditors. However, it now seems they'll barely get a 20% slice. "In the report, Palmers Textil AG, in agreement with the rehabilitation manager Mag. Maria-Christina Nau, has drafted the self-administration for the rehabilitation process. The main reason for this move is the investor group's desire to keep the requirement for the rehabilitation plan as minimal as possible and to invest the capital in the future," goes the official word. The revised rehabilitation plan will be presented for a vote at the upcoming creditors' meeting on May 20th.

Dire Actions Taken

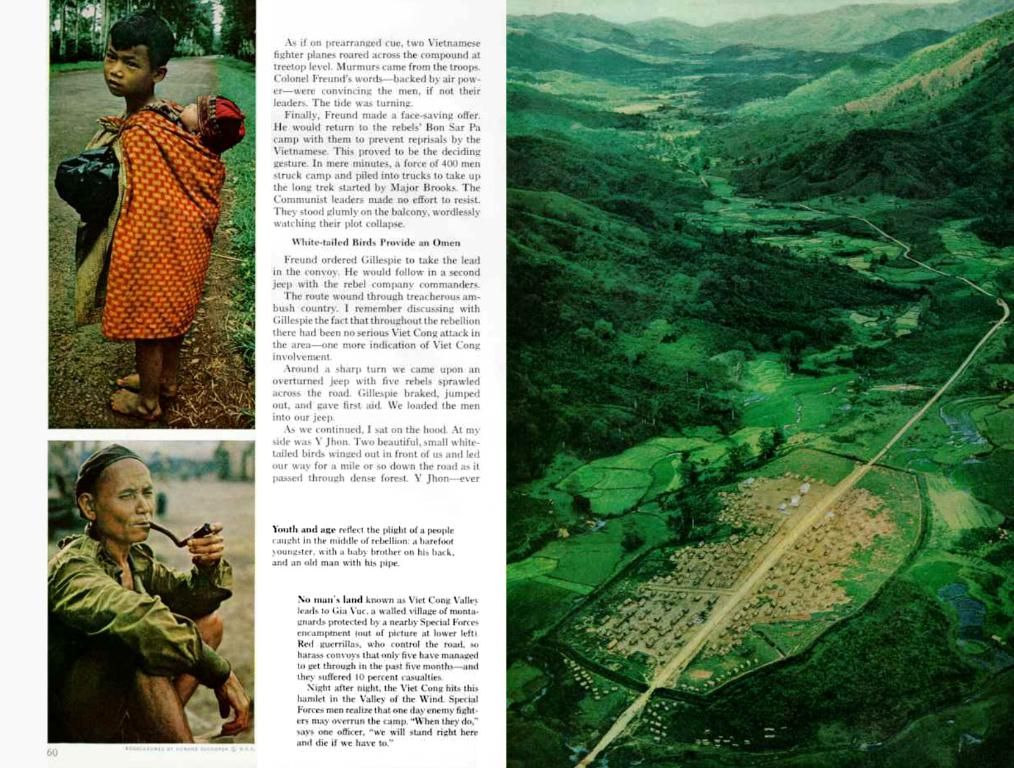

Palmers has already implemented harsh measures to stay afloat:

- Closing of 47 branches

- Termination of 8 domestic and 4 international franchise contracts

- Completely abandoning the location in Hong Kong

Further closures of struggling foreign subsidiaries (except for Croatia and Germany) are in the pipeline.

Yet, Palmers remains present in Austria with 70 own branches and 46 franchise locations. The workforce has been pared down to a lean 393 employees—a difficult but vital step, Palmers management contends. If the investor puts pen to paper by May 20th, and the creditors sign off on it, Palmers' rescue just got one big step closer.

- The international textile titan, planning to acquire Palmers, has expressed intentions to keep the business in the premium segment and support its global expansion, thereby potentially injecting much-needed capital and expertise into the company.

- The revised rehabilitation plan, drafted by Palmers Textil AG and the rehabilitation manager Mag. Maria-Christina Nau, aims to minimize the requirements for the rehabilitation plan, allowing for more investment in the business. This plan will be presented for a vote at the upcoming creditors' meeting on May 20th, signifying an important step towards Palmers' potential rescue.