Surveillance of Estate Agencies for Money Laundering Activities

In the world of real estate, adhering to regulations is as important as securing the perfect property deal. One such regulation is the mandatory registration of estate agency businesses with Her Majesty's Revenue and Customs (HMRC) for Anti-Money Laundering (AML) supervision. Here's a breakdown of the key requirements for estate agency businesses looking to register.

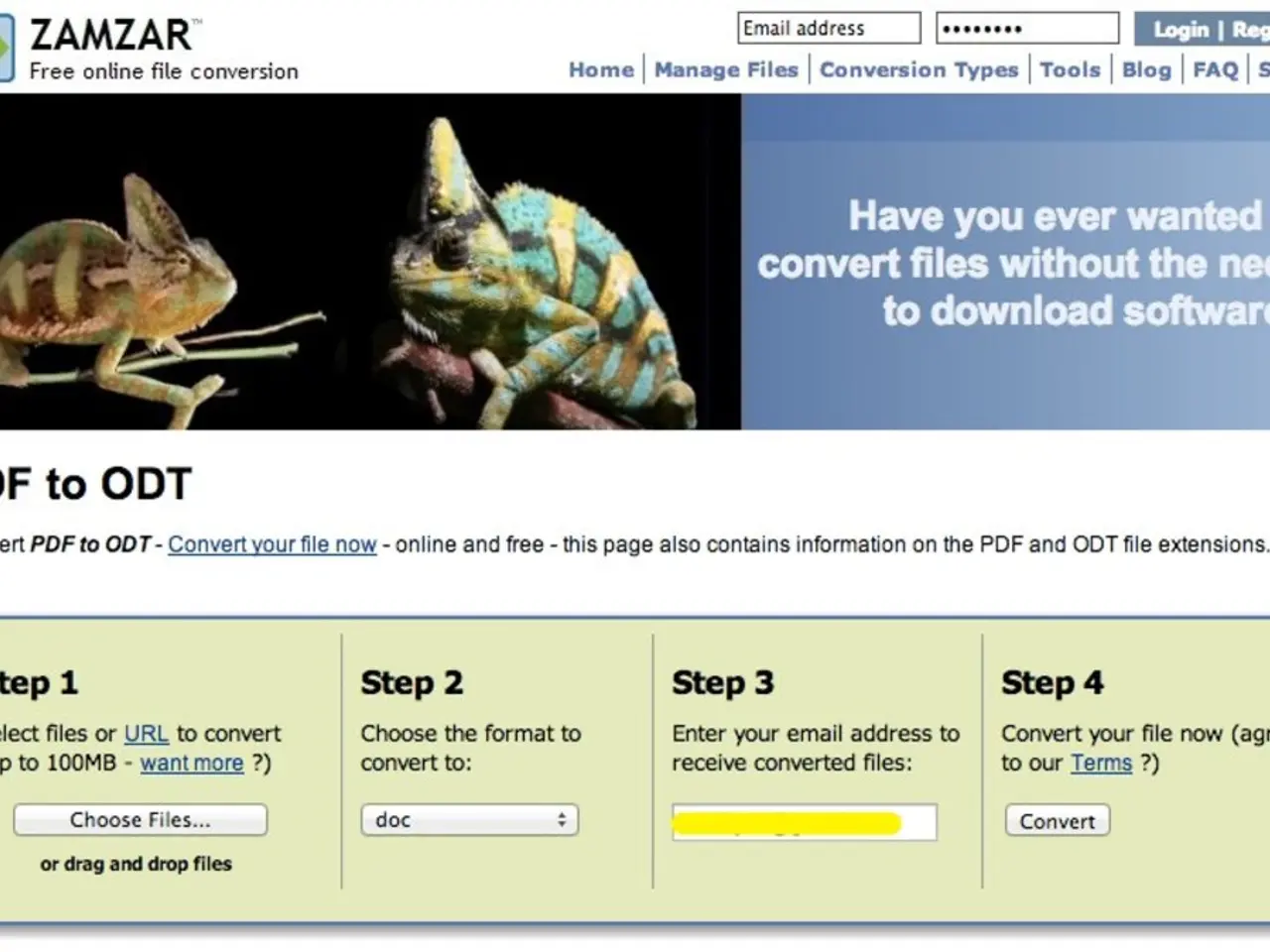

First and foremost, **if your business carries out estate agent activities as defined under section 1 of the Estate Agents Act 1979, you must register with HMRC for AML supervision.** The registration process is straightforward and can be completed online via the HMRC website. You will need to provide detailed information about your business, including premises details, and pay associated fees.

The registration process also includes a 'fit and proper' test for all responsible persons within the estate agency. This ensures that those operating the business meet required integrity and competence standards.

Once registered, estate agents must comply with various AML obligations. **Customer Due Diligence (CDD) is a crucial aspect, requiring estate agents to carry out identity verification checks on buyers and sellers using official documents.** Enhanced due diligence (EDD) must be performed for higher-risk clients or transactions.

Estate agents are also required to verify the source of funds involved in property transactions. This includes checking bank statements or other proof to ensure the legitimacy of clients’ financial resources.

A written AML policy statement outlining controls and procedures proportionate to the risks faced is another essential requirement. This policy should include the appointment of a Nominated Officer or Money Laundering Reporting Officer (MLRO) responsible for handling suspicious activity reports.

Lastly, staff training is vital to ensure ongoing compliance and awareness throughout the business. Employees must be trained to understand money laundering laws and their responsibilities under the AML regime.

In summary, the registration requirements with HMRC for estate agents include online registration with provision of business details, payment of fees, fit and proper approval of responsible persons, and ongoing compliance obligations such as customer due diligence, AML policies, and staff training. This framework aligns with the Money Laundering Regulations applicable to estate agency businesses in the UK.

It's important to note that separate business registration with HMRC or Companies House is generally needed to operate legally in the UK. Annual supervision requires paying the annual fee for each listed premise to update your registration.

Estate agency activities include sending out property details, arranging viewings, offering personal advice, answering questions, passing on details, providing energy performance certificates, property valuations, plans, photographs, 'for sale' boards, and additional estate agency services.

Businesses that must register include high street residential estate agencies, commercial estate agencies, online estate agencies, property or land auctioneers, land agents, relocation agents, property finders, private acquisitions specialists, sub-agents, asset management businesses, business brokers or transfer agents, social housing associations, letting or property management agents, construction companies with sales offices, and solicitor's property centers in Scotland.

For more information, visit the National Trading Standards website or attend recorded webinars to find out more about money laundering supervision. It's crucial to stay informed and compliant to maintain the integrity of the real estate industry.

Businesses engaged in estate agent activities, as stipulated in section 1 of the Estate Agents Act 1979, are mandated to register with Her Majesty's Revenue and Customs (HMRC) for Anti-Money Laundering (AML) supervision, before commencing operations in the UK. Compliance obligations for registered estate agents involve completing a 'fit and proper' test, formulating a written AML policy, performing customer due diligence checks, verifying the source of funds, and staff training to uphold awareness of money laundering laws.