A Look at Shell's Q1 in the Face of Tumultuous Geopolitics

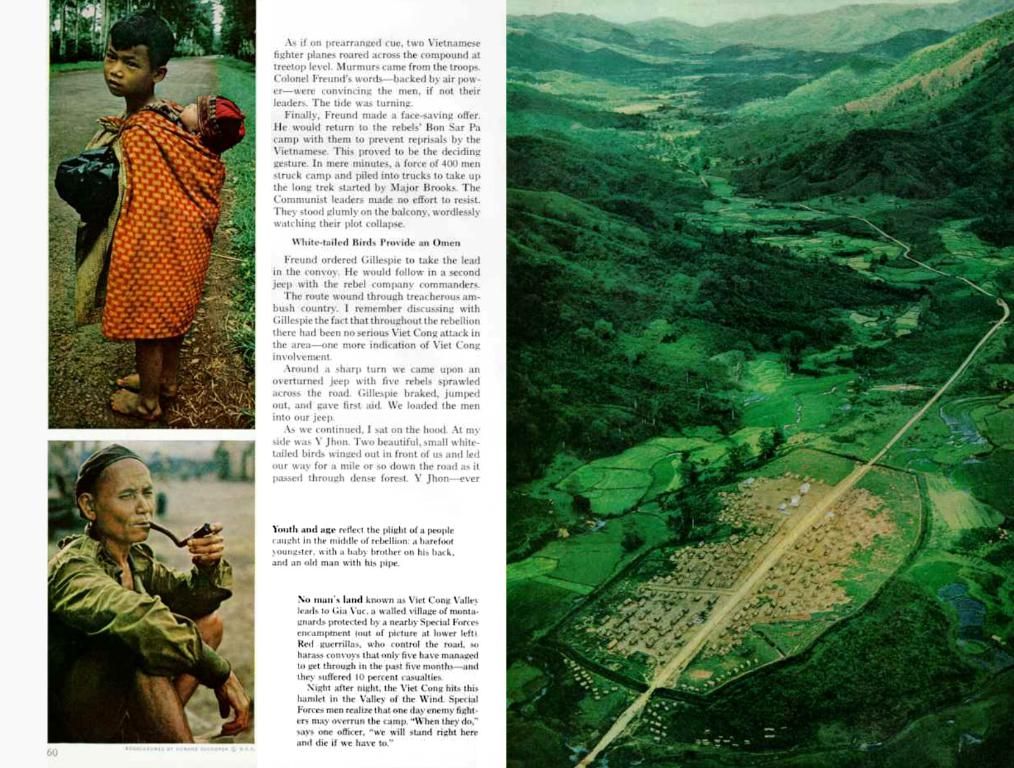

Stock prices of a major FTSE 100 company increase following announcement of share buyback and earnings surpassing expectations

Let's dive into the rollercoaster ride that was Shell's first quarter, set against the backdrop of oil price woes and geopolitical turmoil.

Shell reported a dip in its Q1 profits, recording an adjusted earnings of $5.58bn. Although this beat analyst expectations of $4.96, it represented a significant fall from the $7.73bn recorded in the same period last year. The profits dropped despite the positive early-year surge, with crude oil reaching a high of $82 per barrel on January 15, before plummeting to around $75 by the end of Q1.

This downturn came just as Trump's 'Liberation Day' tariffs on trading partners sent oil prices spiraling. Prices slumped below $60 following the fallout of Trump's erratic trade policy. Fortunately for Shell, the reporting period narrowly missed this whirlwind, allowing the company to tast success.

The company's cash flow from operations dipped to $9.28bn in the first quarter, down from $13.6bn in the prior period. However, net debt climbed to $41.52bn, up from $38.81bn in the fourth quarter. Despite these setbacks, Shell managed to outperform analyst expectations by over $1bn in the first quarter.

Mark Crouch, market analyst for eToro, attributes Shell's impressive Q1 results to its "strict capital discipline," a hallmark of Shell that delivers consistent shareholder returns. While the oil and gas prices, OPEC production increases, and tariff volatility weighed heavily on producers, Shell continues to stand tall, according to Crouch.

Shell announced a $3.5bn share buyback program, marking its 14th consecutive quarter of at least $3bn in buybacks. The firm aims to complete the program over the next three months. Shell's Q1 performance highlighted strong showings in integrated gas with earnings of $2.4bn, and upstream at $2.34bn. However, the company recorded a loss of $42m on renewables and energy solutions.

In the broader context, President Trump's tariffs have brought about significant economic shifts, leading to increased U.S. tariff revenue, market volatility, and fears of a recession[1][4]. As companies respond by considering price increases, shifting manufacturing, or bracing for market losses, Shell demonstrates resilience in the face of adversity.

While specific details on the direct impact of Trump's trade policies on Shell's Q1 profits and oil prices are lacking, the broader economic instability and volatility caused by these policies can indirectly affect both Shell's profitability and oil market dynamics. The overall economic instability caused by trade tensions can lead to reduced oil consumption, affecting oil prices, though specific impacts would depend on a range of factors.

In sum, Shell's Q1 results serve as an example of a company that can navigate challenging times with strategic execution and a clear identity. As the world watches with bated breath, we eagerly await the unfolding chapters of this evolving story.

- Despite the oil price woes and geopolitical turmoil, Shell's Q1 profits, though dipped, managed to beat analyst expectations, recording an adjusted earnings of $5.58bn.

- The downturn in Shell's earnings, which dropped significantly from the same period last year, can partially be attributed to Trump's 'Liberation Day' tariffs that sent oil prices spiraling, causing them to slump below $60.

- In a bid to continue rewarding shareholders, Shell announced a $3.5bn share buyback program, marking its 14th consecutive quarter of at least $3bn in buybacks.

- Market volatility, caused in part by Trump's tariffs, can indirectly affect Shell's profitability and oil market dynamics, leading to reduced oil consumption and potential impacts on oil prices.

- Market analyst, Mark Crouch, attributes Shell's impressive Q1 results to its "strict capital discipline," which delivers consistent shareholder returns, enabling the company to stand tall amidst challenges in the oil and finance industry.