Stock Market Adjustments, Trade Taxes, and Shopper Trust Levels

Amidst the recent market turbulence, the S&P 500 plunged into correction territory, marking a whopping 10% slide from its previous peak. Although stocks regained some ground on Friday, the market still hovers over 8% below its mid-February high. The tech behemoths, dubbed the Magnificent 7 (MSFT, META, AMZN, AAPL, NVDA, GOOGL, TSLA), have taken an even tougher hit, plummeting a staggering 18% since mid-December. The significant pressure on stocks appears rooted in an economic growth scare and policy uncertainty over tariffs.

The Slumping Consumer Confidence

While some hard data points have revealed chinks in the armor, the eerie economic data mainly stems from soft indicators, such as consumer confidence data. The University of Michigan's consumer sentiment index tumbled to its record low since November 2023 last week. Caution is warranted with survey data, as people often act differently than they claim. For instance, in 2023, the reading dove far below current levels without triggering a recession.

Researching past periods with suppressed consumer sentiment, buying the S&P 500 every time the index dipped below 65 conjured average returns of 8.4% over the next 12 months. If it were magically possible to forecast the rock-bottom for each cycle accurately, the exciting returns averaged 19%, with no losses for a holding period of 12 months. Employing 2023 as an example, the consumer sentiment index dropped beneath 65 in February, yet investing then would have been premature as the S&P 500 tumbled another 9.2% in the following 12 months. However, the economy avoided contracting, and consumer sentiment hit its lowest ebb in June, catapulting the S&P 500 to a 17.6% increase over the subsequent 12 months.

Ground Tactics of Russia's Nasty Drone Swarm Attacks

The White Lotus: Season 3, Episode 5 Recap and Review: Fear and Hatred

NYT Wordle Hints, Spangram, and Answers for Monday, March 20th

Of note, political persuasion has significantly impacted the consumer sentiment index. Democratic consumer confidence has plummeted since the election of President Trump. This trend is far from abnormal because consumer confidence amongst Republicans was even worse during some of President Biden's tenure. Last week's findings showed a decline in Republican sentiment, hinting that this may resemble 2023.

Churning Tariff-Infused Policy Uncertainty

President Trump's tariff shenanigans have escalated the policy uncertainty to unprecedented levels. Predicting the magnitude, duration, and cost of any future tariffs is practically impossible. Furthermore, potential retaliation, and secondary ripple effects must be carefully considered.

Ordinarily speaking, tariffs represent a headwind to economic growth, since higher prices produce a tax-like impact on consumer spending. They tend to inflate inflation readings on the margin, although the added expenses might not get passed onto consumers, and a strong U.S. dollar might provide additional offsets. In the end, the administration could withdraw or focus the tariffs more precisely if the costs heighten recession risks excessively. Within a general context, uncertainty decreases the valuation investors are prepared to pay for risk assets like stocks.

Assessing the Baker, Bloom, and Davis composite index of economic policy uncertainty, it is unsurprising that the U.S. policy uncertainty index is elevated given the tariff and DOGE headlines.

According to an analysis by Strategas, stocks often do exceptionally well following periods of policy uncertainty. Specifically, the average return of the S&P 500 over the subsequent 12 months has been over 20% in instances where the policy uncertainty index is currently elevated. This outcome is perfectly in line with the consumer sentiment data discussed previously, indicating that negative data typically compresses the market expectations as readings worsen. As pessimism gradually dissipates, the market eventually rebound.

The S&P 500 closed over 10% below its February 19 high last week, officially entering a correction. This leaves investors pondering whether things will deteriorate further before improvement. A peek into the past can offer a glimpse of the risks.

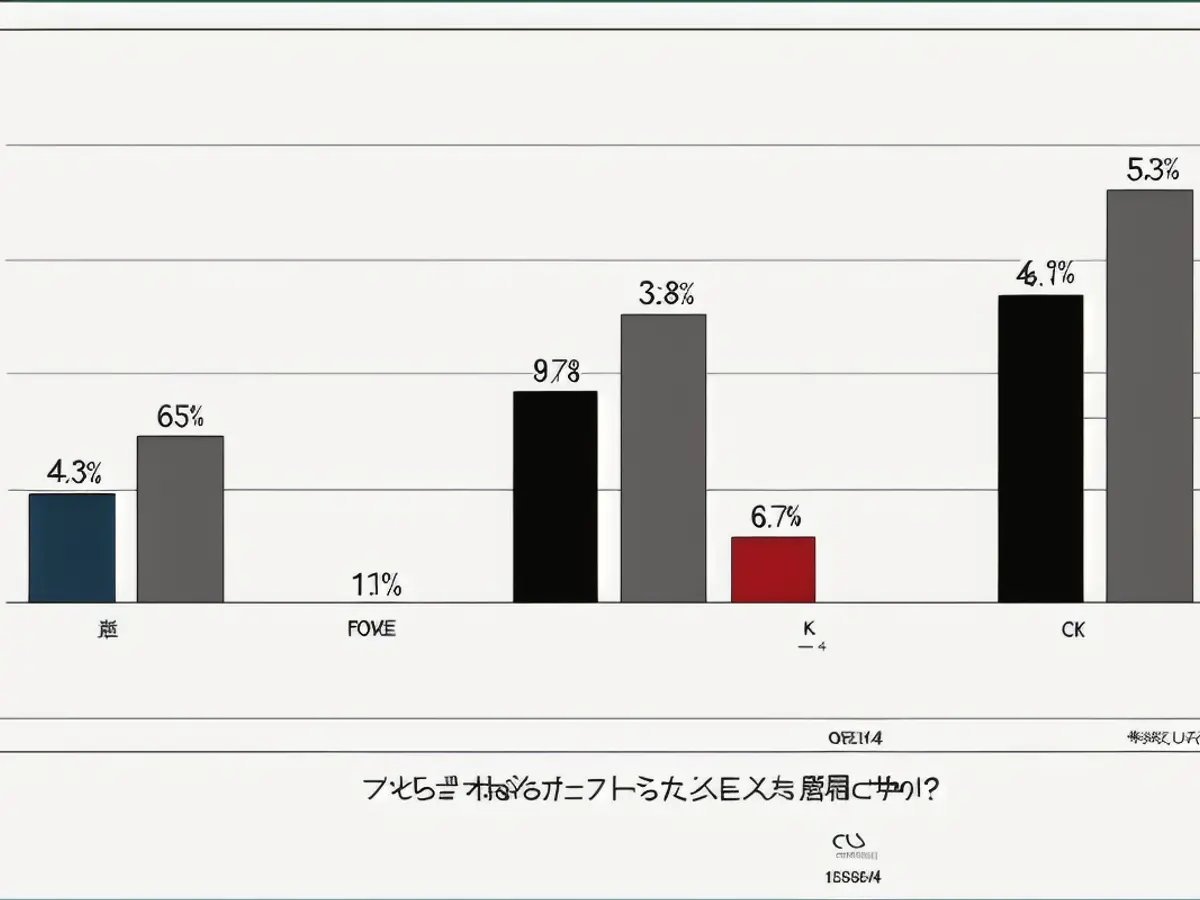

Gazing at the assortment of 21 U.S. stock market corrections since 1980, the average return in the 12 months that followed was 13.4%, which certainly fosters optimism from the current position. When sorting the results between periods when the U.S. economy entered a recession within the 12 months after the correction, the outcomes lose some luster, standing at an average gain of 1.9%. If an economic downturn is avoided, results have historically been spectacular, averaging 19.1%.

Analyzing the outcome through a batting average perspective, stocks have gone up in the 12 months following a correction 81% of the time. If there was no recession, the success rate surges to 93% of the instances. As one might expect, a recession around the time of the correction engenders inferior results, with a positive outcome only 57% of the time.

It can also be enlightening to scrutinize the spectrum of outcomes when evaluating the risks after a correction. Recall that this data encompasses two brutal bear markets—2000 and 2007. The tech bubble burst in 2000, driving the S&P 500 down nearly 50%. The 2007 global financial crisis wasn’t to be outdone, with stock prices plunging over 56%.

Not surprisingly, the worst outcome in the 12 months following a correction was during the 2007 bear market, in which the S&P 500 plummeted another 34.8% post-correction and featured a recession kicking off in December 2007. The best outcome was relatively recent in 2024. It followed a 2024 correction, which emerged on the heels of a growth scare and bear market in 2023, so when the recession was sidestepped, and earnings rebounded, stocks skyrocketed.

What's on the Horizon

Since some of the market turbulence stems from economic concerns, the February retail sales figures on Monday promise to be an essential barometer. Consumer spending is crucial to U.S. economic growth, and January retail sales declined month-over-month.

As acknowledged earlier, the vast majority of the weaker economic data have been of the soft variety, like consumer sentiment. Two months of tepid retail sales consecutively would raise worries about the sturdiness of the consumer. Retail sales need to demonstrate an increase month-over-month in February to quell such concerns.

Fed Rate Cuts: Not Quite Yet

With the economic growth scare unfolding and policy uncertainty escalating, investors have started expecting more cuts from the Federal Reserve (Fed) in 2025. Initially, expectations for Fed cuts fell to only one for the year but have since increased to between two and three cuts, with the first cut expected in mid-June.

On Wednesday, the Fed will gather for their meeting, with no shifts to monetary policy expected. Nonetheless, Chair Powell's statements will be carefully scrutinized. Market participants will be eager to gauge the timing of the next cut and the committee's views on inflation and the state of the U.S. economy.

Concluding Remarks

While there are no guarantees when predicting the short-term movements of stocks, historical data offers precious insights into the risks. Dreadful consumer confidence, high policy uncertainty, and stock market corrections don't automatically portend a doomed future for stock returns. Historically, the U.S. economy and stock market have managed to regain strength, often rebounding from downturns.

Investors may want to keep sufficient safe assets on hand to meet short-term expenses. While stocks can compound wealth over long periods, they are susceptible to the whims of sentiment and animal spirits, making them unreliable for short-term liability needs. Unlike in recent years with ultra-low bond yields, high-quality bonds have resurfaced as dependable providers of income and a safe haven when stocks and other risk assets have declined. Stockpiling a portfolio with enough cash and bonds to cover short-term expenses can lessen the impact of any stock declines on a portfolio, enabling investors to stay resilient and overcome stock declines for the benefits of long-term ownership.

- Amid the rising policy uncertainty due to tariffs and the impact of President Trump's administration, investors are increasingly anticipating more Federal Reserve rate cuts in 2025.

- Economic data such as the chinks in the armor, the soft consumer confidence indicators, and the plunge in the University of Michigan's consumer sentiment index down to a record low, weigh heavily on the expectation for recession.

- Historically, stocks have shown promising returns following periods of economic turbulence, policy uncertainty, and even significant declines like during the 2000 tech bubble burst and the 2007 global financial crisis. However, given the current market landscape, investors should exercise caution and prepare for short-term uncertainties, such as the upcoming retail sales figures and Federal Reserve meetings, that may impact the economic trajectory.