Fresenius Shines Brighter Than Expected, Spain's Profitability Stands Out

Spain's Personal Savings Rate Adjustment

Get the lowdown on Fresenius's performance and its ambitions, delivered alongside a side of witty humor!

Healthcare powerhouse Fresenius kicked off the New Year on a high note, pouring champagne over positive growth in the Kabi division and the luminous performance of its Spanish subsidiary, Helios. CEO Michael Sen is all but cocky, confident that he'll hit his annual targets, even with the specter of US tariffs looming.

"We've got solid arguments to knock those high tariffs outta the park," proclaimed Sen, citing the company's extensive local production. "Take that, tariffs!"

Fresenius is tackling the looming US pharmaceuticals shortage head-on, engaging in talks to produce more domestically and alleviate the crisis. The US market accounts for around 10% of Fresenius's total sales.

Sen gleefully shared that the bolded adjusted operating profit (EBIT) popped up to 654 million euros, trumping analysts' projections. Sales soared by a whopping 7%, landing at 5.6 billion euros, with a concurrent 7% escalation in constant currency. Net income ballooned by a stout 12%, clocking in at an impressive 416 million euros.

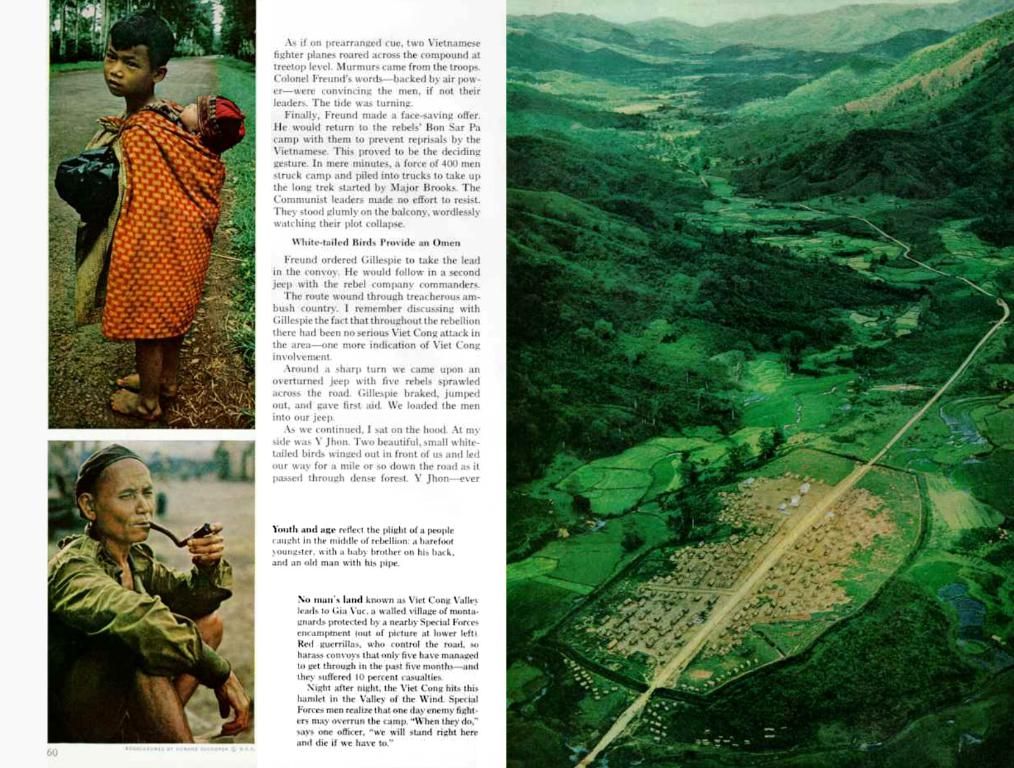

Helios' "special fever" in Spain helped offset losses in Germany following the conclusion of energy cost assistance. Revenue at Helios inched up by 8%, hitting nearly 3.4 billion euros, though the EBIT dropped by 4% to 333 million euros. German losses crippled the EBIT to 157 million euros, a 23% plummet.

Fresenius Kabi, the segment responsible for pharmaceuticals and medical devices like artificial nutrition, flexed its muscles with a 5% revenue increase, reaching 2.14 billion euros, and a significant 16% EBIT boost, landing at a hefty 360 million euros.

By 2025, Fresenius sets its sights, unwavering, on a 4-6% organic sales growth. Adjusted operating profit is projected to swell by a healthy 3-7% in constant currency.

Source: ntv.de, jwu/rts

- Takeaways: Fresenius continues to ride the crest of a wave of success, targeting its sights on dental tariffs with fighting words. The Spanish subsidiary stands out as a star performer, and Fresenius aims to maintain its revenue growth and enhance its profitability.

Did you know? Fresenius is composed of diverse segments, including Fresenius Kabi (pharmaceutical and medical devices) and Fresenius Helios (major European hospital operator). Fresenius Kabi offers crucial intravenous drugs, infusion therapy items, and medical devices needed by patients and healthcare systems around the world. Fresenius Helios runs lengthy hospital chains across Germany and Spain. Watch this space for Fresenius's strategic investments and operational improvements!

- Despite the looming threats of US tariffs, Fresenius CEO Michael Sen remains confident, ready to dispute them with solid arguments based on the company's extensive local production.

- In Q1'23, Fresenius's Kabi division, responsible for pharmaceuticals and medical devices like artificial nutrition, registered a 5% revenue increase and a significant 16% EBIT boost.

- Fresenius is ambitiously aiming for a 4-6% organic sales growth and a 3-7% enhancement in adjusted operating profit by 2025.

- The US market, accounting for around 10% of Fresenius's total sales, is under focus as the company engages in talks to produce more domestically to alleviate the US pharmaceuticals shortage.

- Fresenius's Spanish subsidiary, Helios, showcased impressive performance, with revenue inching up by 8% and the EBIT dropping by 4%, despite losses in Germany.