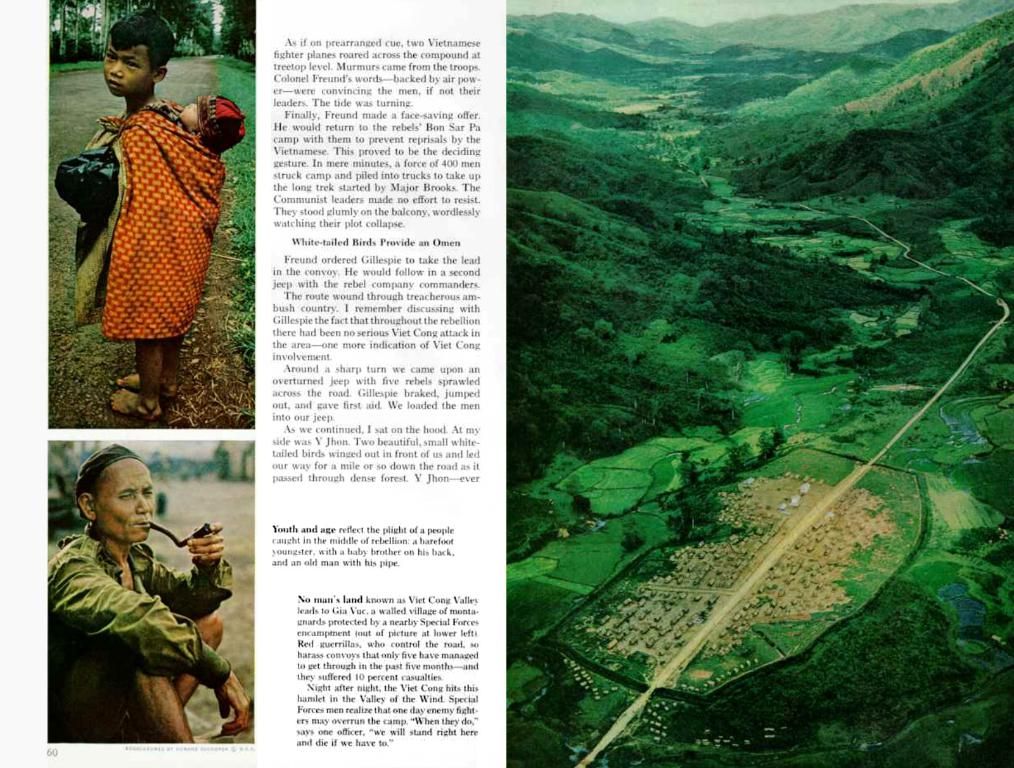

Shares of KEI Industries Decrease by 6% amid Stock Market Volatility

Plunging Stock Price of KEI Industries:

KEI Industries, a pioneer in the manufacturing of electrical cables and wires, took a beating today as its share price dipped by 6%, trading at ₹3,073.0.

This swift descent can be traced back to market volatility - a common culprit for rattling investor sentiment. Despite a modest 0.4% gain displayed by the BSE POWER Index during the same time frame, KEI Industries couldn't escape the ripples of the uncertain market.

Over the past year, the share price has tumbled 3.4%, falling from a staggering ₹3,181.6 to its current level. This downturn contrasts sharply with the BSE POWER Index, which has managed to eke out a 1.6% gain over the same period.

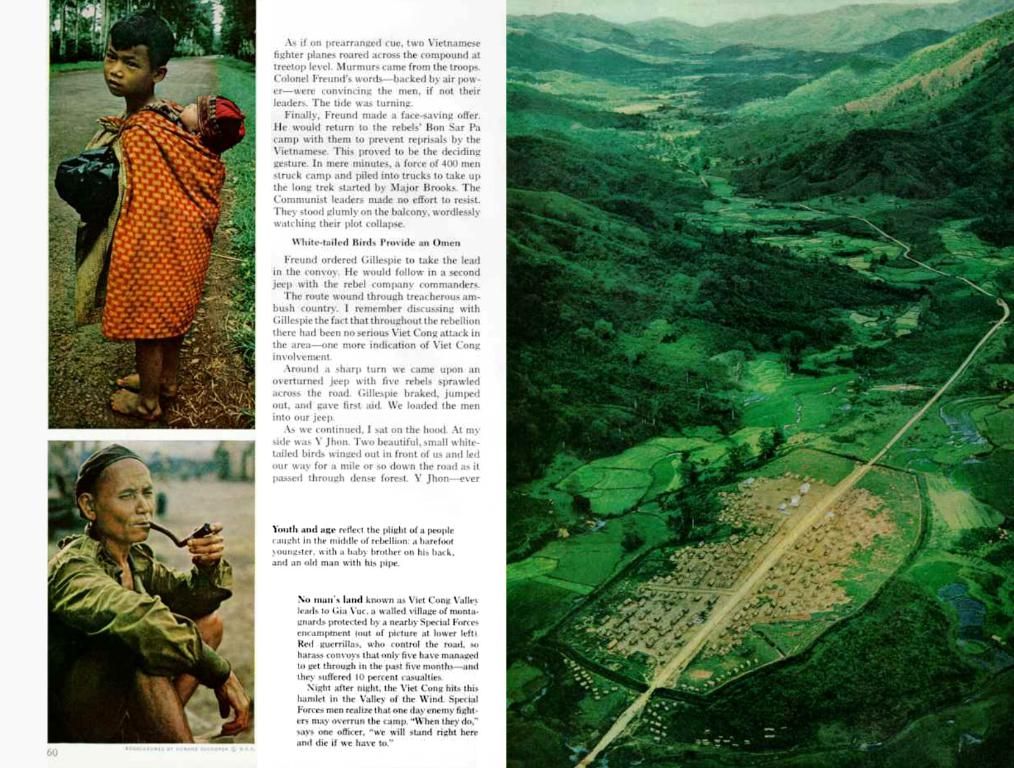

KEI Industries, renowned for its Extra-High Voltage, Medium Voltage, and Low Voltage power cables, caters to both retail and institutional markets. The company also offers Engineering, Procurement, and Construction (EPC) services, making it a significant player in India's power infrastructure sector.

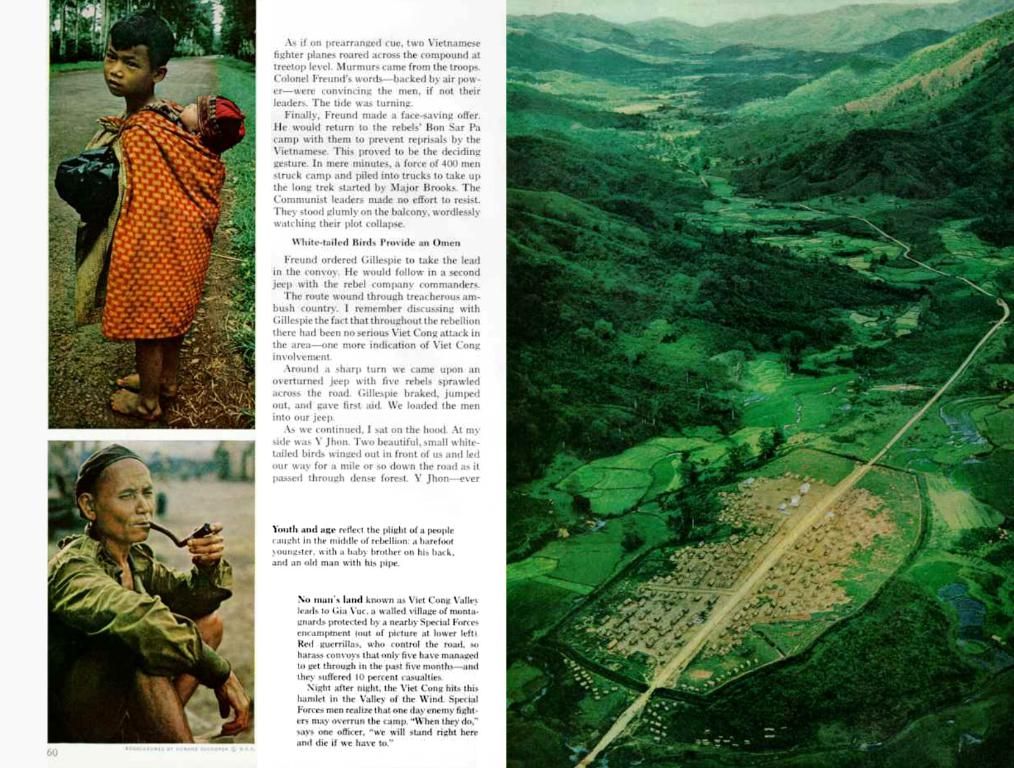

Although today's decline may paint a grim picture, market analysts remain hopeful about the company's long-term growth trajectory. They point to its solid industry standing and expansion plans as reasons for their optimism. However, short-term market pressures and broader economic factors are anticipated to significantly impact investor confidence.

Experts advise investors to keep a close eye on KEI Industries' performance and take market trends into consideration when making investment decisions. Upcoming financial reports are expected to shed light on the company's future direction.

For a deeper understanding of KEI Industries' financial performance, growth potential, market position, and valuation, take a look at the insights below:

Financial Performance and Growth:

- Profit Growth: Over the last five years, KEI Industries has posted a significant profit growth of 22.1% CAGR.

- Revenue Growth: The company has recently witnessed a quarterly surge in revenue of 18.99%.

Market Metrics:

- Market Capitalization: KEI Industries boasts a substantial market capitalization of approximately ₹34,000 crore.

- Return on Equity (ROE) and Return on Capital Employed (ROCE): With an ROE of 20.26% and ROCE of 27.04%, KEI Industries demonstrates an efficient use of equity and capital.

Market Position:

- Sectoral Positioning: As the industry leader by market capitalization, KEI Industries claims a strong position in the sector.

Growth Forecasts:

- Share Price Target: Analysts have predicted a slight upside in the share price, with a potential target price of ₹3960.45.

- Revenue Growth Forecast: The company's projected revenue growth for Q1 FY2027 stands at 68.85%.

Valuation Metrics:

- Price-to-Earnings (PE) Ratio: With a PE ratio of around 48.51, KEI Industries presents itself as relatively fairly valued, considering the industry's average PE ratio of 54.57.

Overall, KEI Industries Limited appears to possess strong long-term growth prospects, fueled by its financial performance, market position, and favorable growth forecasts. However, specific Q1 2023 performance data remains unavailable.

**More to Explore:

*Alphabet's $500 Billion Market Cap Decline: A Tech Titan at a Crossroads**

*Can Gen Z Afford Homes? The Challenges and Opportunities of Buying a House in the Gen Z Years*

- KEI Industries, with its operations in Africa and robust infrastructure, is expanding its market reach, aiming to import necessary logistics for its electrical cable business.

- Despite the current financial loss, astute investors may perceive the dipping stock price of KEI Industries as a potential opportunity for long-term investing.

- Keen on observing the business strategies of KEI Industries, analysts are closely monitoring the company's engineering, procurement, and construction (EPC) services contracts, expecting significant projects in the power sector.

- The company's impressive financial performance and growth, coupled with a favorable market position, reinforce KEI Industries' potential for future business expansion and infrastructure development.