"Relief for our sector announced": NAMM President responds to reduced tariffs on Chinese products and assesses the effects on the musical instrument industry

It looks like President Trump just declared a "total reset" in U.S.-China relations, as both countries have agreed to a 90-day trade war ceasefire and initiate new negotiations. This is some good news for the musical instrument industry, as tariffs on Chinese goods will dip from a crushing 145% to a more manageable 30%.

John Mlynczak, head honcho of NAMM (National Association of Music Merchants), welcomes the relief, acknowledging the previous 145% tariff was a death sentence for small businesses. Yet, Mlynczak raises concerns about the 30% levy on imports from China, as well as the 10% tariff on imports from all other countries. This remains a substantial burden for manufacturers and retailers across the nation, making it particularly hard to prepare for the high-demand back-to-school and holiday seasons looming on the horizon.

Mlynczak insists that the 90-day tariff pause serves as a short-term fix, but ongoing uncertainty makes long-term planning difficult for businesses. For fair trade and stability, he advocates for a robust tariff strategy that provides clarity and enables the industry to adapt and thrive.

Mylnczak stresses that despite U.S. manufacturing being 'very strong' in the musical products sector, they continue to advocate for U.S. manufacturers relying on unavailable domestic materials by. They've submitted comments during the federal review process for Section 232 investigations and worked on global tariff exceptions, even making a trip to D.C. with guitar industry heavyweights to plead their case.

Meanwhile, the government has also slashed tariffs on small parcels sent from both mainland China and Hong Kong, leading to a reduction of 'de minimis' parcels tariffs from 120% to 54%. This, however, could potentially be bad news for U.S. retailers stocking lower-value Chinese goods, as they've been outgunned by firms going direct-to-consumers on cheaper items for years now.

Trump's statements suggest that some levies have been suspended, not canceled altogether. However, they may resume in three months, with the President stating he doesn't intend to harm China and doesn't anticipate the tariffs reaching their previous 145% peak.

There's still plenty of uncertainty on tariff policy, but manufacturers and retailers now have a 90-day window to react and adjust their strategies. Prices for consumers may still be elevated due to the reduction in shipping, with gaps and product shortages possible as manufacturers seek to re-stock their shelves.

Stay tuned for an exclusive interview with Mlynczak regarding tariffs in the coming weeks on our website.

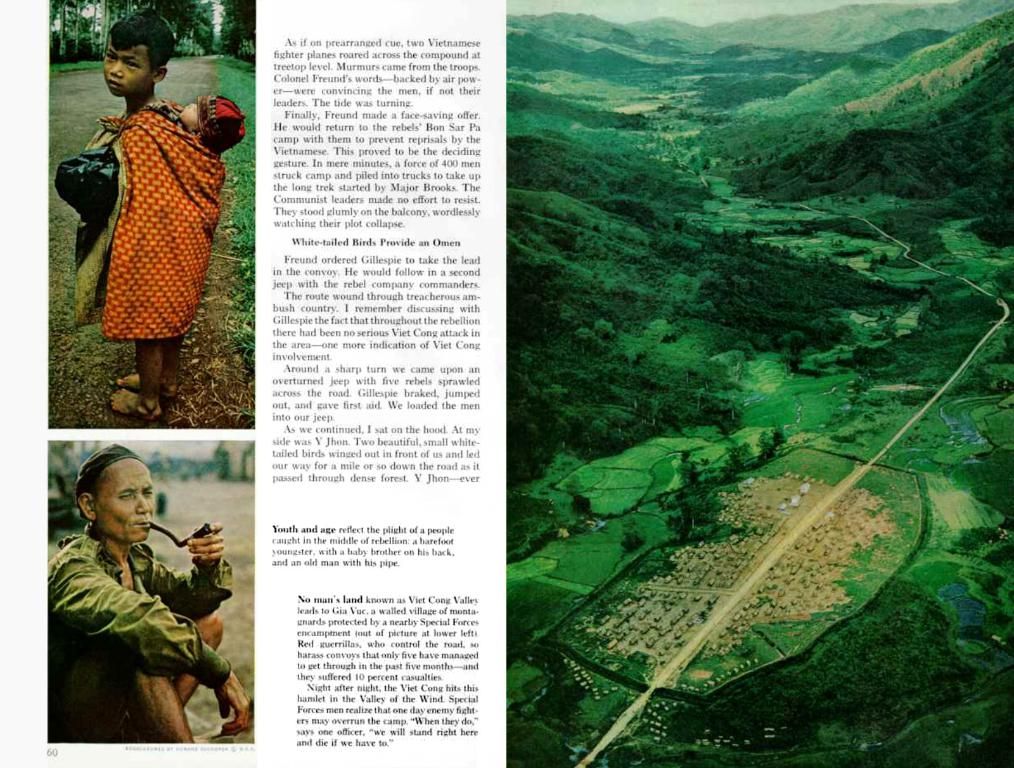

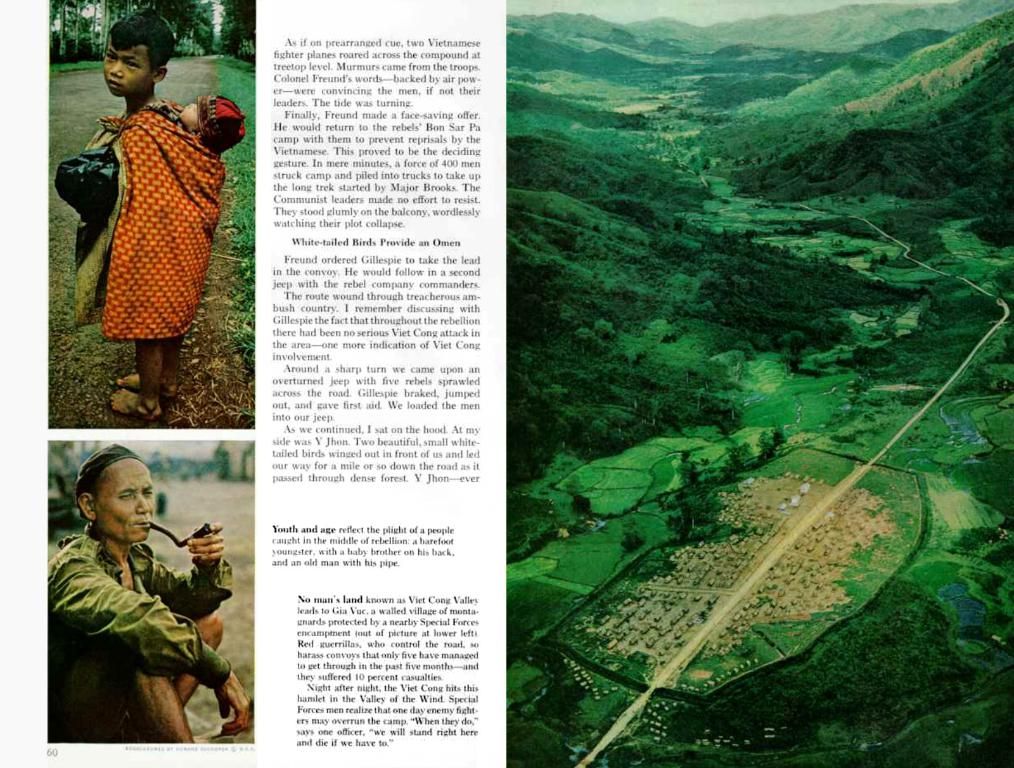

Sources: [1][2][3][4] // (Optional) In case you're interested, here's some interesting facts about the current tariff situation:

- Industry Alarm: The initial 145% tariff on Chinese-made musical instruments created a major stir within the industry, as it put a significant strain on entry-level instrument imports and components.

- Price Impacts: Even with the reduced 30% tariff, the financial strain on importers and retailers is substantial, with as much as 50-75% of the additional expenses expected to be passed on to consumers, making entry-level instruments more expensive for students and families.

- Illegal Tariffs? In recent court rulings, aspects of Trump’s tariffs have been deemed "illegal." While this doesn't automatically roll back the tariffs or provide refunds, it does cast doubt on the longevity of the current tariff situation.

- Long-term Concerns: The trade war and high tariffs have raised concerns about the long-term effect on music education and access, particularly for beginners. If costs remain high, there may be a decrease in students entering music programs, impacting the future of the industry.

- John Mlynczak, the head of NAMM, acknowledges the relief brought by the reduced tariffs on Chinese-made musical instruments, but expresses concerns about the 30% levy, as well as the 10% tariff on imports from all other countries, making it difficult for businesses to prepare for high-demand seasons like back-to-school and holidays.

- Mlynczak advocates for a robust tariff strategy that provides clarity and enables the industry to adapt and thrive, citing U.S. manufacturing's strength in the musical products sector.

- Mlynczak's organization, NAMM, has submitted comments during the federal review process and worked on global tariff exceptions, even making a trip to D.C. with guitar industry heavyweights to plead their case.

- The government has also slashed tariffs on small parcels from both mainland China and Hong Kong, potentially causing problems for U.S. retailers stocking lower-value Chinese goods.

- Despite the tariff reduction, manufacturers and retailers now face uncertainty, with prices for consumers potentially remaining elevated due to the reduction in shipping and possible gaps and product shortages as manufacturers seek to re-stock their shelves during the 90-day tariff pause.