Real estate market in UK homes: Transitioning from prosperity to decline

**British Homes Hitting Record Highs: What's the Deal with the Real Estate Boom?

By Andreas Hippin, London

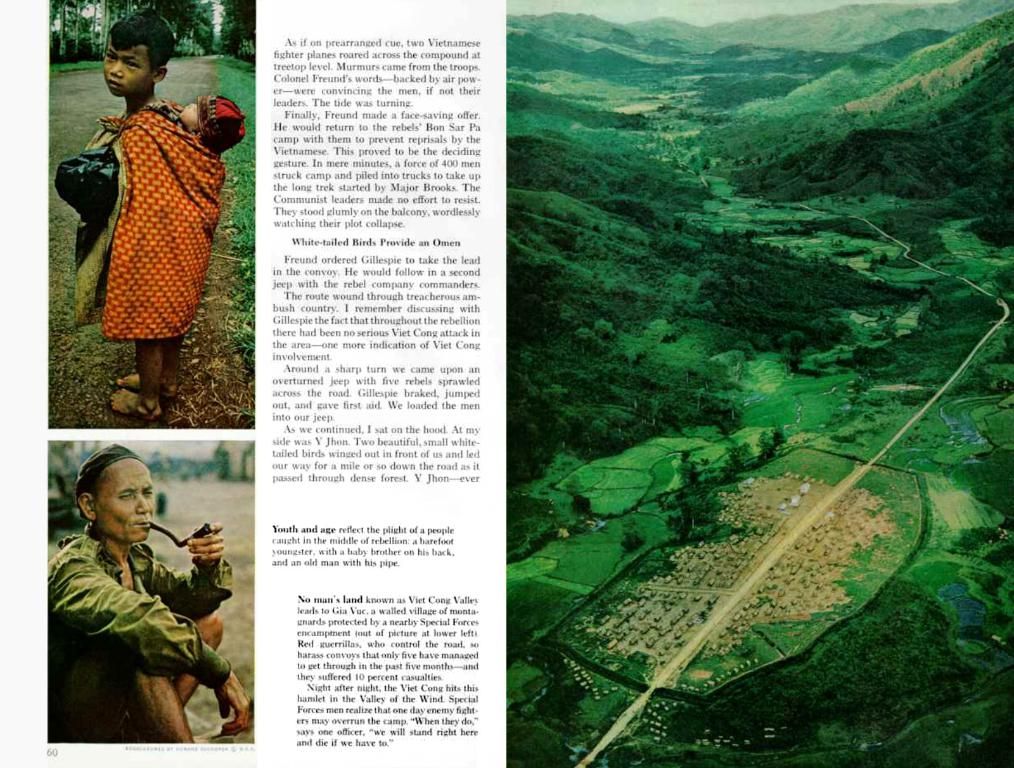

Talk about a hot topic, and it's all about UK residential property. With homes being a major part of many McEwan's savings, the news of prices creeping up to near-record levels back in 2022 sent the nation into a frenzy. Now, it seems we're revisiting those heights!

Now, what gives? Well, let's take a gander at the current trends and recent developments that've got the property market booming.

First off, let's talk figures, shall we? Over the past year, house prices have shot up an impressive 6.4% as of March 2025. That's from a revised estimate of 5.5% growth in the 12 months to February 2025. Alright, mind blown? It gets better. The North East region saw the highest jump, with prices skyrocketing a staggering 14.3%!

Average house prices in England were sitting pretty at £296,000, while Wales and Scotland came in at an affordable £208,000 and £186,000 respectively. But, just when you thought things couldn't get any crazier, between February and March 2025, prices increased by a breath-taking 1.1% nationwide!

But why this sudden surge in demand? We can attribute it to some easing credit rules and a better interest rate environment. Mortgage lenders have been playing nice, implementing less stringent affordability testing and fostering strong competition in the mortgage market. All of this has been encouraging more couples, first-time buyers, and buy-to-let investors to jump on the property ladder.

Additionally, a more optimistic economic outlook is fueling the market. Experts predict a 3.5% increase in prices by the end of 2025, with even higher growth on the horizon for subsequent years.

Of course, it ain't all roses. The property market can be a fickle beast, and there's always the possibility of a downturn. However, with the long-term outlook remaining positive, many are optimistic about continued growth. Experts are even forecasting annual price increases of 4% in 2026, 4% in 2027, 4.5% in 2028, and 5% in 2029.

As ever, the property market remains a rollercoaster ride, but it's one that's looking pretty attractive right now. So, maybe it's time to start saving up for that dream home, eh? Now, who wants to grab a pint and discuss the current state of the housing market? Cheers!

- The surge in demand for UK residential properties can be linked to easing credit rules and a better interest rate environment, encouraging more couples, first-time buyers, and even buy-to-let investors to invest in the property market.

- considering the predicted 3.5% increase in property prices by the end of 2025, one might find it tempting to consider investing in real estate for personal finance growth.

- With the national average house price of £296,000 and an optimistic outlook for future growth in the housing market, many are optimistic about the potential for continued personal financial gains through investing in real estate.