Standing Patient: Economists Alert ECB on Potential Pitfalls of Lower Rates Amid Inflation Persistence

mpi Frankfurt

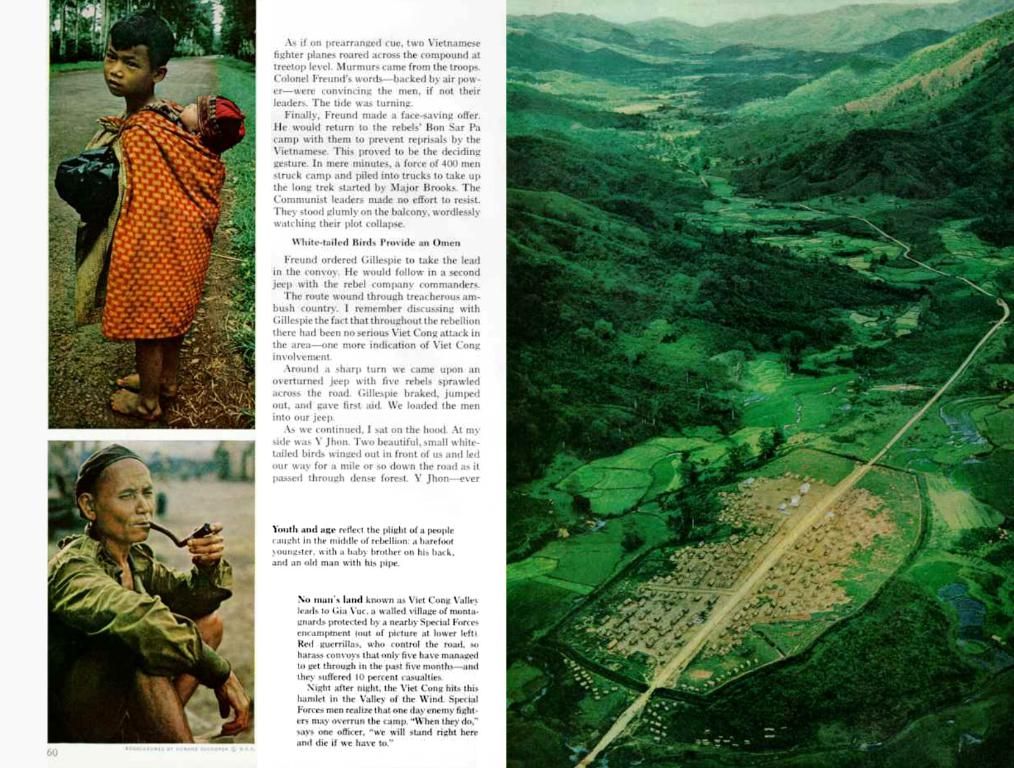

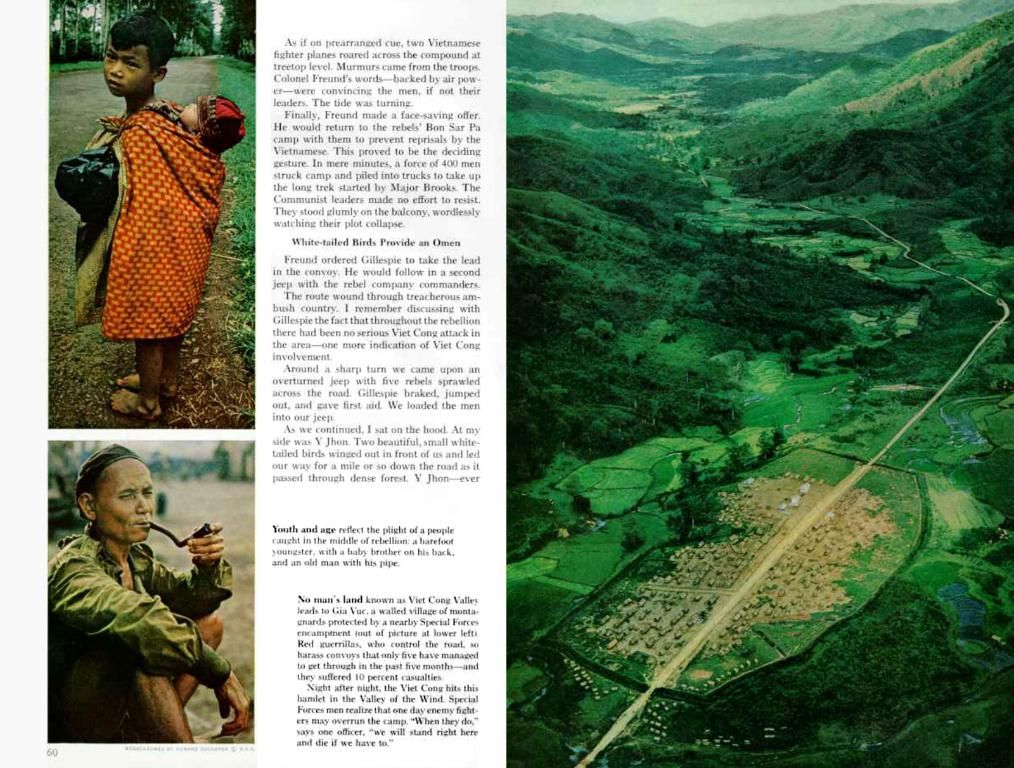

Prices Increase More Than Anticipated in Significant Surge

Recent numbers indicate a surprising turn in inflation rates, with consumer prices in Germany showing a 2.1% hike in May, contrary to the anticipated decrease to 2.0%. According to a preliminary estimation by the Federal Statistical Office using the European calculation method HVPI, this follows a 2.2% increase in April.

Here's a quick look at the broader economic context:- Inflation Management: The European Central Bank (ECB) has been working tirelessly to control inflation. Projected forecasts hint at inflation approaching the target of 2% by mid-2025, with factors like diminishing energy prices and wage moderation contributing to this trend[3][5].- Interest Rate Adjustments: The ECB has been exploring interest rate cuts to stimulate economic growth amidst global uncertainty. Recent discussions suggest another cut could be in the pipeline[1][2]. The central bank has reduced rates seven times since June 2024, and another cut is likely on June 5, 2025[3][4].

Now, let's discuss the possible concerns about these rate cuts:- Core Inflation: Despite not having a direct mention, persistently high core inflation (excluding volatile components like food and energy) could raise eyebrows among policymakers. Core inflation is a crucial indicator of underlying price pressures in the economy.- Economic Flux: The ECB is tackling a intricate economic landscape, with global trade policies shaping growth expectations. Lower interest rates are viewed as a necessity to buffer risks to economic growth, but they need to be carefully balanced against inflation concerns[4].

Economists might issue a heads-up to the ECB, cautioning against overly aggressive interest rate cuts if core inflation persists. Reducing rates too deeply could potentially reignite inflationary pressures if underlying demand remains robust. However, the ECB's decision-making process depends heavily on the overall economic outlook and its faith in meeting the target inflation rate[3][4].

In brief, while there's no news of a 2.1% rise in German consumer prices or direct warnings based on core inflation, the ECB's cautious stance on interest rate cuts can be associated with broader economic considerations, and the necessity to balance growth stimulus with inflation management.

- The European Central Bank (ECB) may face warnings from economists regarding overly aggressive interest rate cuts, considering the potential for persistently high core inflation to reignite inflationary pressures.

- As the ECB navigates a complex economic landscape, balanced decision-making on interest rate cuts is imperative, taking into account the need for growth stimulus while managing core inflation amidst global trade policies.