Potential Surge Predicted for FedEx Shares, Reaching $150 Mark

Done Deal, pal:

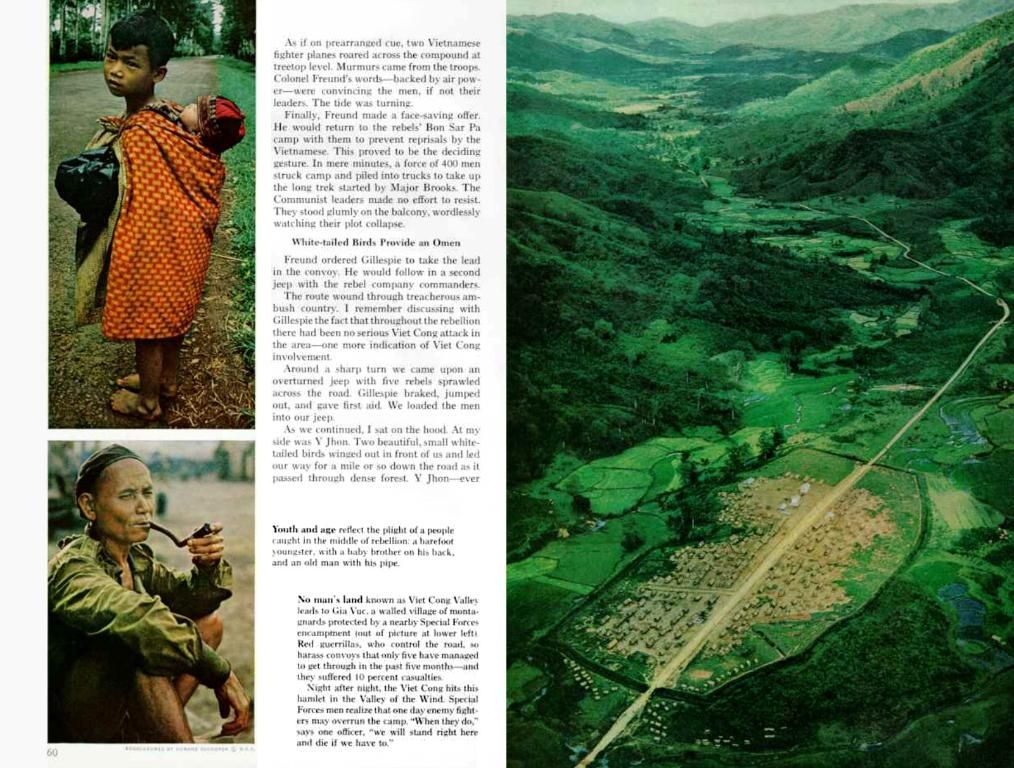

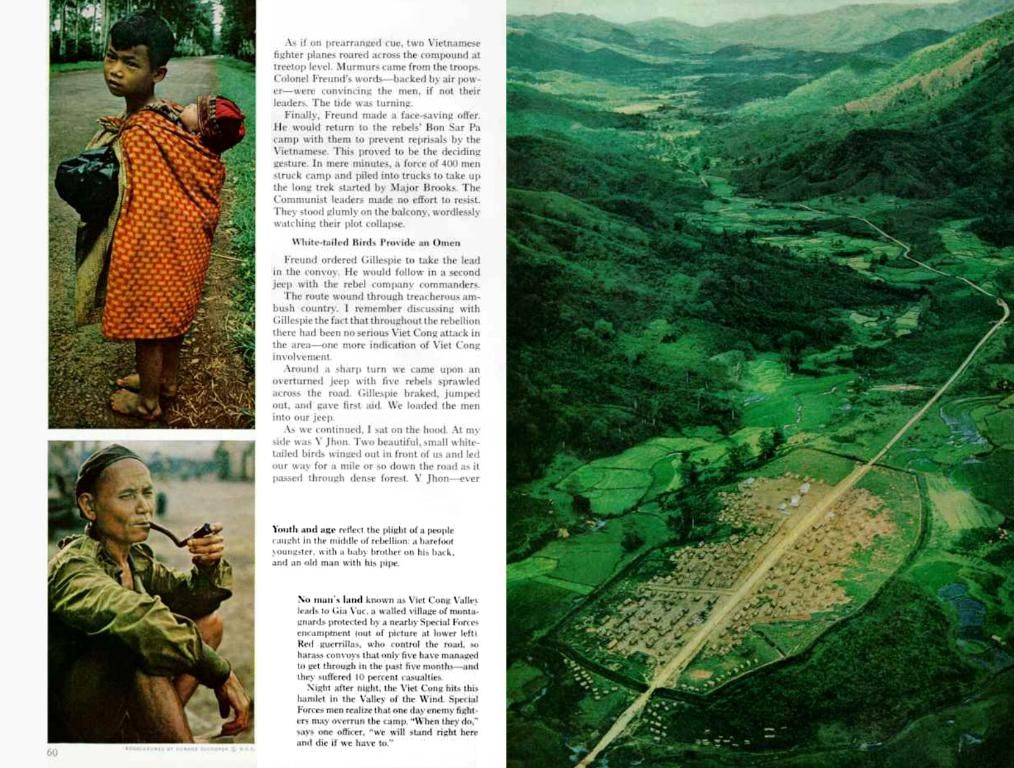

📜 FedEx down in the Dumps 🚀 (NYSE: FDX) recently drop-kicked its financials for the third quarter of fiscal year 2025, wrapping up in February. They reported earnings per share of $4.51 on revenues of $22.2 billion. Despite a year-over-year uptick of 2.3% in sales and 16.8% in earnings, these numbers fell short of Wall Street's predictions, which anticipated $4.57 in earnings per share on $21.9 billion in revenue. To top it off, FedEx slashed its full-year adjusted EPS forecast, moving from a $19.00-$20.00 range down to $18.00-$18.60. Needless to say, this wasn't great news for FDX stock post-earnings announcement.

But hey, let's take a gander beyond those lousy earnings and discuss the broader market atmosphere. Got any guesses what's causing a fuss for FedEx? economic jitters in the US, that's what! With all the chaos brewing, you can guessed that markets in general are gettin' a raw deal.

Now here's the kicker: we figure ol' FDX stock could tumble all the way to $150 per share in this mess. If you witnessed FedEx during past economic downturns, you'd remember that they took quite a beating, losing approximately 45% of their worth over just a few quarters! Now, granted, no two situations are ever identical, but hey, history does have a habit of repeating itself, right?

So what's an investor to do? Simple: give the High-Quality portfolio a spin, that's what. This puppy's been slayin' it, outperforming the S&P 500 and postin' returns greater than 91% since inception.

Why Bother Now?

Things were lookin' up for FedEx, what with sales meetin' or even exceedin' analyst's expectations due to increased volume. But worry not, macropolitical challenges remain a major concern, and inflation ain't exactly goin' away anytime soon. Whatzyamatta', Smokies?

You want a complete list of grievances? The current administration's aggressive tariff and immigration policies have stoked inflation anxieties, and trade uncertainties are a plenty. Add to that strained relationships with allies like Canada, Mexico, and Europe, and ya got yourself one complex risk landscape.

Risks at Risk

It ain't just blind luck, partner, that's keepin' us up at night. The new administration's ballsy policy moves make geopolitical tensions high as ever, and that ain't a good look for investors. Add to that conflicts in Ukraine-Russia, renewed tensions with Israel-Gaza, yo, and you got yourself one turmoil-filled existence.

FDX Stock: Playin' the Loser's Game?

Remember, when push comes to shove, FDX stock doesn't always fare so hot compared to the S&P 500 index during downturns, so let's reign in our risk tolerance in this boom-and-bust environment.

In fact, if the U.S. economy goes south, how ugly can things get? Our dashboard "How Low Can Stocks Go During a Market Crash" can fill you in on how historic market crashes have impacted major stocks, includin' FedEx.

How Tough Can FDX Take a Hit?

Inflation Shock (2022)

• During the inflation shock of 2022, FDX stock plunged a whopping 46.1% from its peak of $264.91 on 4 January 2022 to $142.90 on 26 September 2022, compared to the 25.4% decline for the S&P 500.• Speedy as a hare, FDX stock bounced back to its pre-Crisis peak by 26 July 2023.• From there, the stock continued to climb, peakin' at $313.52 on 16 July 2024 and currently restin' around $245.

Covid Pandemic (2020)

• FDX stock took a deep dive, plummeting 45.1% from its high of $164.91 on 20 February 2020 to $90.49 on 16 March 2020, compared to the 33.9% decline for the S&P 500.• It didn't take long for FDX stock to recover to its pre-Crisis peak, which happened as early as 16 July 2020.

Global Financial Crisis (2008)

• In the heat of the 2008 Global Financial Crisis, FDX stock nose-dived 68.1% from its peak of $107.51 on 14 October 2007 to $34.28 on 9 March 2009, compared to the 56.8% decline for the S&P 500.• FDX stock showed its resilience by comin' back to its pre-Crisis peak by 5 March 2013.

Preserve and Expand Yer Wealth with Risk-Focussed Quality Portfolios

FedEx's stock ain't exactly in the clear, sinkin' 12% year-to-date (as of March 2025), reflectin' investor concerns about declining e-commerce activity post-pandemic peak, inflationary pressures, and weakened international shipping demand. This streak ain't showin' any signs of lettin' up with the ongoing economic uncertainty.

FedEx's disappointin' revenue growth numbers have been a drag, averagein' just 1.7% annually over the past 3 years - a far cry from the S&P 500's 6.3% growth during the same period. To top it off, adjusted earnings have taken a dip by 15% since 2022. Despite this sluggish performance in both revenue and earnings, FDX stock still maintains a price-to-earnings (P/E) ratio of 14.0, slightly above its 3-year average of 13.0. So think long and hard, buddy: if yer holdin' on to your FDX stock, will you panic and bail if it drops to $200, $150, or even lower levels?

Hangin' On to a Fallin' Stock: Ain't Easy Trefis partners with Empirical Asset, a Boston-area wealth manager, whose asset allocation techniques yielded positive returns durin' the 2008/2009 timeframe, when the S&P 500 lost over 40%. Empirical's incorporated the Trefis HQ Portfolio in their asset allocation framework, offerin' clients better returns with less risk than the benchmark index, as evident from the HQ Portfolio performance metrics.

So there ya have it, partner. Even if the U.S. economy manages to make a soft landing, there's a decent chance that things could still turn south in a hurry. Stay informed, watch your investments, and don't forget some diversification! Don't say we never warned ya. 😉

*Invest with Trefis Market-Beating Portfolios | Rules-Based Wealth* 📈📉

Historical Performance and FedEx as a Bellwether:

Historically, FedEx has shown a high sensitivity to economic conditions due to its role in logistics and business-to-business services. In general, during market crashes, FedEx's stock might decline more sharply due to its dependence on industrial and shipping demand, reflecting broader economic contractions more directly than a diversified index like the S&P 500. While specific comparative historical data is not provided for every major market crash, FedEx, as a bellwether for the US economy, can provide insights into broader economic trends and resilience during market turmoil.

- Despite FedEx reporting earnings per share of $4.51 on revenues of $22.2 billion for the third quarter of fiscal year 2025, the numbers fell short of Wall Street's predictions, signaling potential troubles for FDX stock in the near future.

- With FedEx slashing its full-year adjusted EPS forecast and economic jitters in the US, the broader market atmosphere could pose significant challenges for FedEx and other stocks in the near term.

- If the U.S. economy experiences another downturn, FDX stock could potentially tumble all the way to $150 per share, following the company's historical performance during economic downturns.