Philippine Bank initiates sales of Mactan resort estate within recovery strategies of PH Resorts.

Cebu's Mactan Land: A Hot Commodity in the Philippines

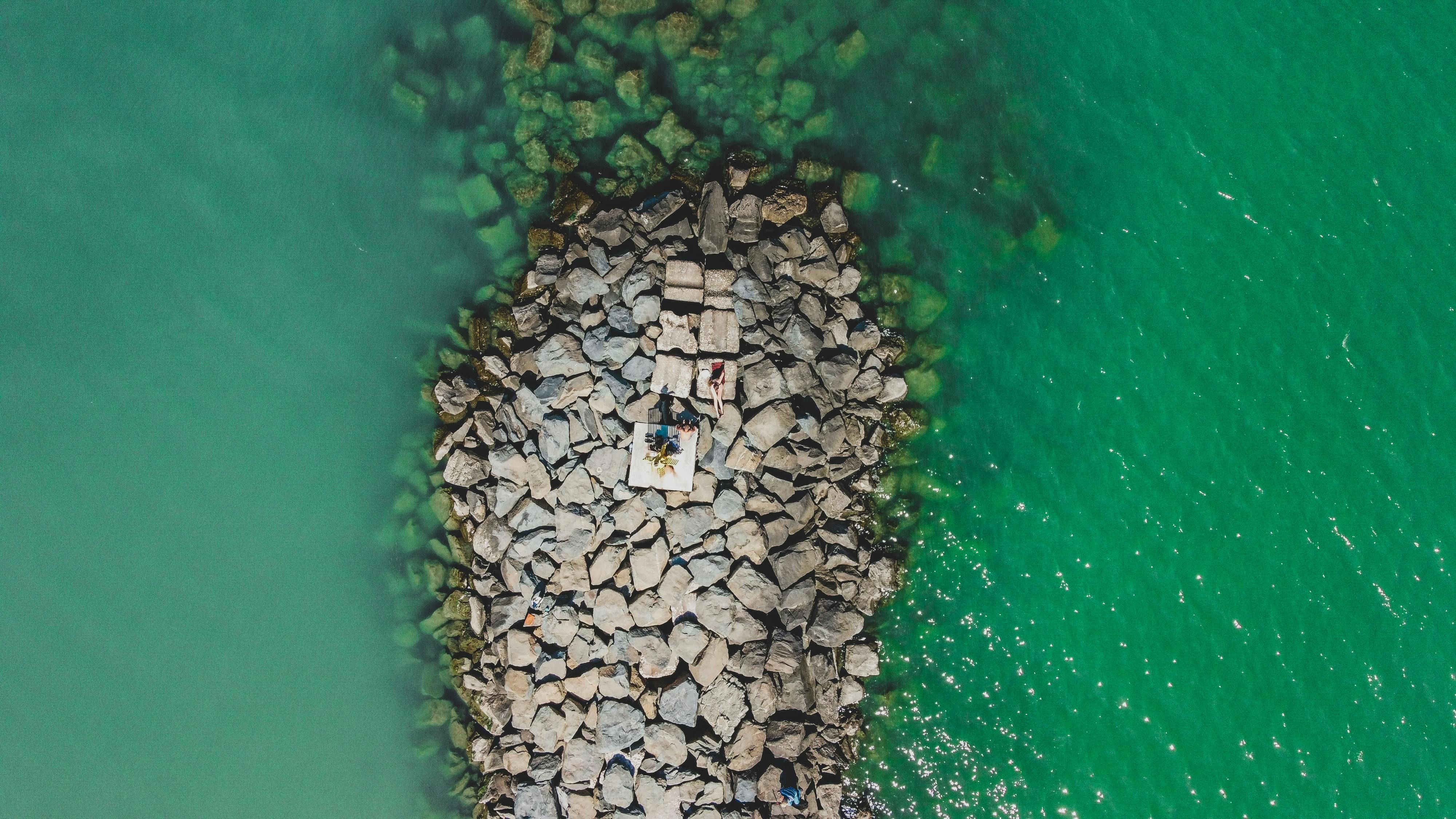

The hotly contested Mactan land, initially earmarked for the Emerald Bay casino project, is up for grabs! The China Banking Corporation, a local bank in the Philippines, has purchased the property from PH Resort Group Holdings Inc., a company owned by businessman Dennis Uy. The property is now fully in Chinabank's possession, with any previous leaseback agreements with PH Resorts having expired and will not be renewed.

Previously, PH Resorts had partnered with Chinabank in a sale-leaseback agreement to help restructure a PHP 3.1 billion (around US$ 55.8 million) debt. The leaseback period ended in March 2025, and Chinabank is now keen to cash in on this strategic location by putting the land up for sale.

Hans Sy, the president of Chinabank, confessed that PH Resorts was given enough time to repurchase or lease the land, but the bank ultimately chose to dispose of the asset. Sy also denied any plans of SM Prime Holdings Inc., another company under the Sy group, acquiring the land, as they are already involved in other large-scale projects, such as a land recovery project in Pasay City.

PH Resorts: Desperate to Regain Control

Despite Chinabank's intentions to sell the Mactan land, PH Resorts is holding onto hope. The company is currently in negotiations with EEI Corporation and the AppleOne Group in Cebu to raise funds for debt settlement and to exercise the option to repurchase the land. This option, held by PH Resorts' subsidiary Lapu-Lapu Leisure Inc., allows them to reacquire both the land and improvements made on it.

EEI Corporation has already advanced PHP 300 million (around US$ 5.4 million) through Udenna Corporation, the controlling company of PH Resorts. Some of these funds were used to meet lease obligations and interest payments to Chinabank.

Chelsea Logistics' Debt Settlement

In a related development, Chelsea Logistics and Infrastructure Holdings Corp., another company owned by Dennis Uy, transferred a land in Taguig to Chinabank as a form of debt payment through a debt-for-land swap. This land, originally acquired for a warehouse construction project, was used to settle a PHP 1.63 billion (around US$ 29.4 million) debt.

Financial Reshuffle Across Dennis Uy's Conglomerate

Across various fronts, Dennis Uy's conglomerate is making aggressive moves to clear financial obligations and attract new resources. PH Resorts has disclosed that it is in advanced negotiations with strategic investors and financial partners. Udenna Corporation, on the other hand, has pledged to defer receivables and assist with debt payments and the completion of group projects. These actions are part of a broader recovery strategy aimed at stabilizing Uy's operations and reviving the Cebu casino project.

Stay tuned for the latest iGaming headlines with SiGMA Top 10. Subscribe here to enjoy exclusive content and updates from the industry's leading news portal.

Follow the latest corporate news, including:

**Nazara's Absolute Sports acquires TJRWrestling.net and ITRWrestling.com for $1.25 million

**French gaming market hits €14 billion in 2024, becoming Europe's fourth largest

And more!

Southeast Asia:

**Thai Senate seeks clarification from prime minister on entertainment complex project

**Malaysia's casinos testing the limits of Indonesia's gaming regulation

And much more!

Sources:

- [1] Philippine Star

- [2] CNN Philippines

- [3] Manila Bulletin

- [4] Inquirer.net

- In a surprising turn of events, Chinabank has announced that it plans to sell the Mactan land, previously leased to PH Resorts, with the anticipated sale being highlighted in discussions about finance.

- Despite Chinabank's decision to sell the Mactan land, PH Resorts is actively negotiating with EEI Corporation and the AppleOne Group to secure funds for debt settlement and exercise their option to repurchase the land, potentially highlighting a future presence in the resort sector.

- The financial reshuffle across Dennis Uy's conglomerate, including the sale of the Mactan land by Chinabank, is part of a broader strategy aimed at clearing financial obligations and attracting new resources, thereby reinforcing Uy's commitment to the Cebu casino project.