Methods for Determining Interest Rates in Capital Lease Contracts

Sometimes, a business may opt to rent a permanent asset rather than buying it directly. This choice could be inspired by appealing lease financing conditions, financial statement management, or other factors. If a company decides to finance an asset using a capital lease, it's possible to calculate the effective interest rate on the lease utilizing a basic spreadsheet formula, provided we have the financing amount and the payment amount. We'll neglect any residual value or asset buyout for the sake of simplicity in this explanation.

Prepare your spreadsheet

Step 1: Prepare your spreadsheet

To perform this calculation effortlessly, we'll employ a spreadsheet. First, let's organize the data.

Input the financing amount in the spreadsheet's top cell in a designated column. Subsequently, input the first payment amount as a negative number in the cell below it. Since the company receives the asset, the financing amount is positive, while the regular payments are recorded as negatives because the company is paying out the cash.

Enter the remaining payment amounts as negatives in successive cells for all scheduled payments.

Compute a capital lease interest rate

Step 2: Utilize the internal rate of return function to compute a capital lease interest rate

If the payments are made annually, the next step is straightforward. Utilize the =IRR() spreadsheet function to determine the interest rate of the capital lease. Choose the payment data you set up in step one, beginning with the financing amount and concluding with the final payment amount. We'll supply a sample in the following section to clarify this process further.

If the payments are paid monthly or quarterly, our formula should be slightly adjusted to accommodate the non-annual payment schedule. Since the internal rate of return calculation is by definition annual, we simply need to tweak the formula to account for the non-annual payment schedule.

For a monthly payment schedule, use the following formula: =(IRR()+1) ^ 12-1.

For a quarterly payment schedule, use this formula: =(IRR()+1) ^ 4-1.

Upon examining each formula, you shall observe that we've inserted the number of payments per year in the exponent, thus adjusting the internal rate of return calculation for each respective non-annual payment schedule. The following section will provide a clear illustration of the process.

Example

A capital lease interest rate calculation example

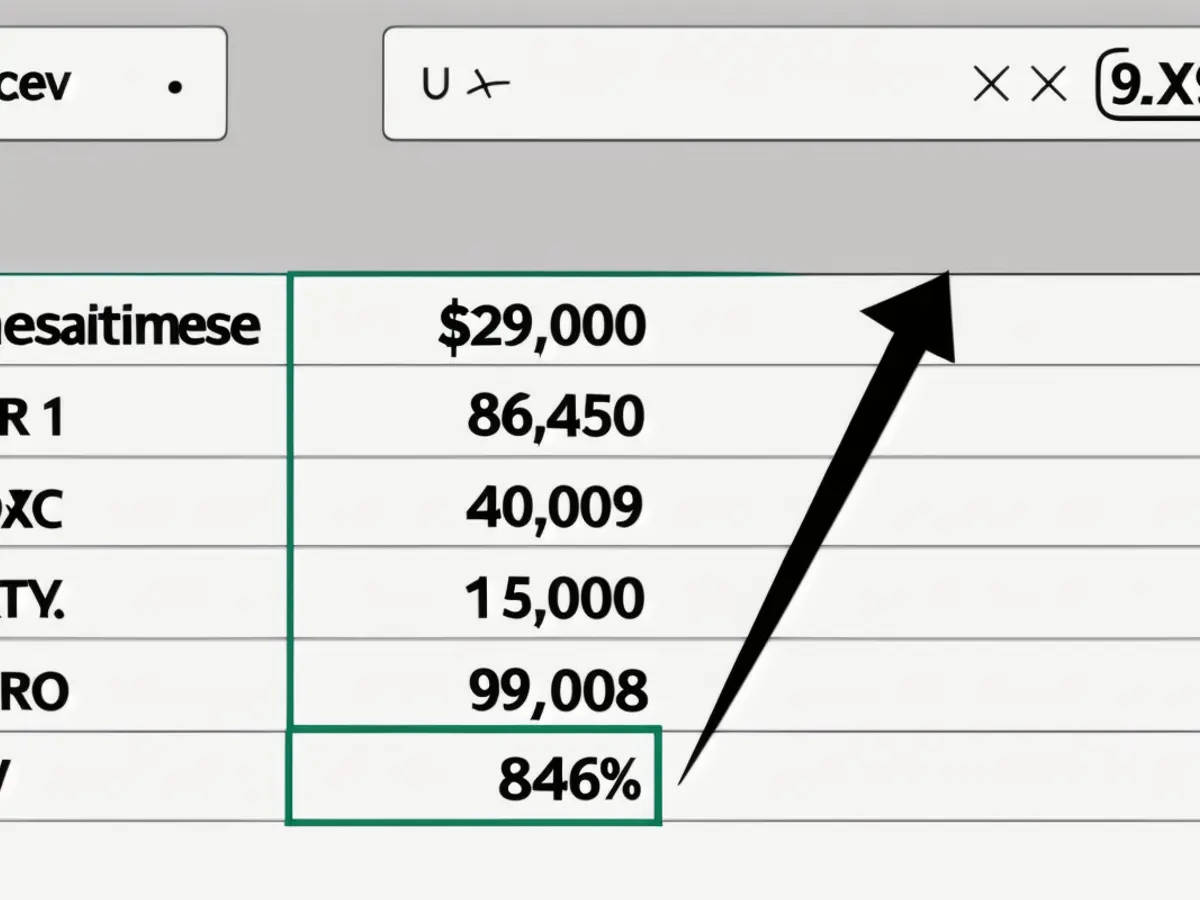

Suppose a company is leasing a vehicle. The company is financing $19,000 and will make annual payments of $6,000 for four years. To calculate the lease interest rate, simply set up your spreadsheet with the $19,000 loan amount as a positive number, each of the four annual payments (as negatives), and then calculate the internal rate of return using the built-in spreadsheet function. Your spreadsheet should resemble this (the arrow points to the formula for demonstrative purposes), and the calculated interest rate will be 10.05%.

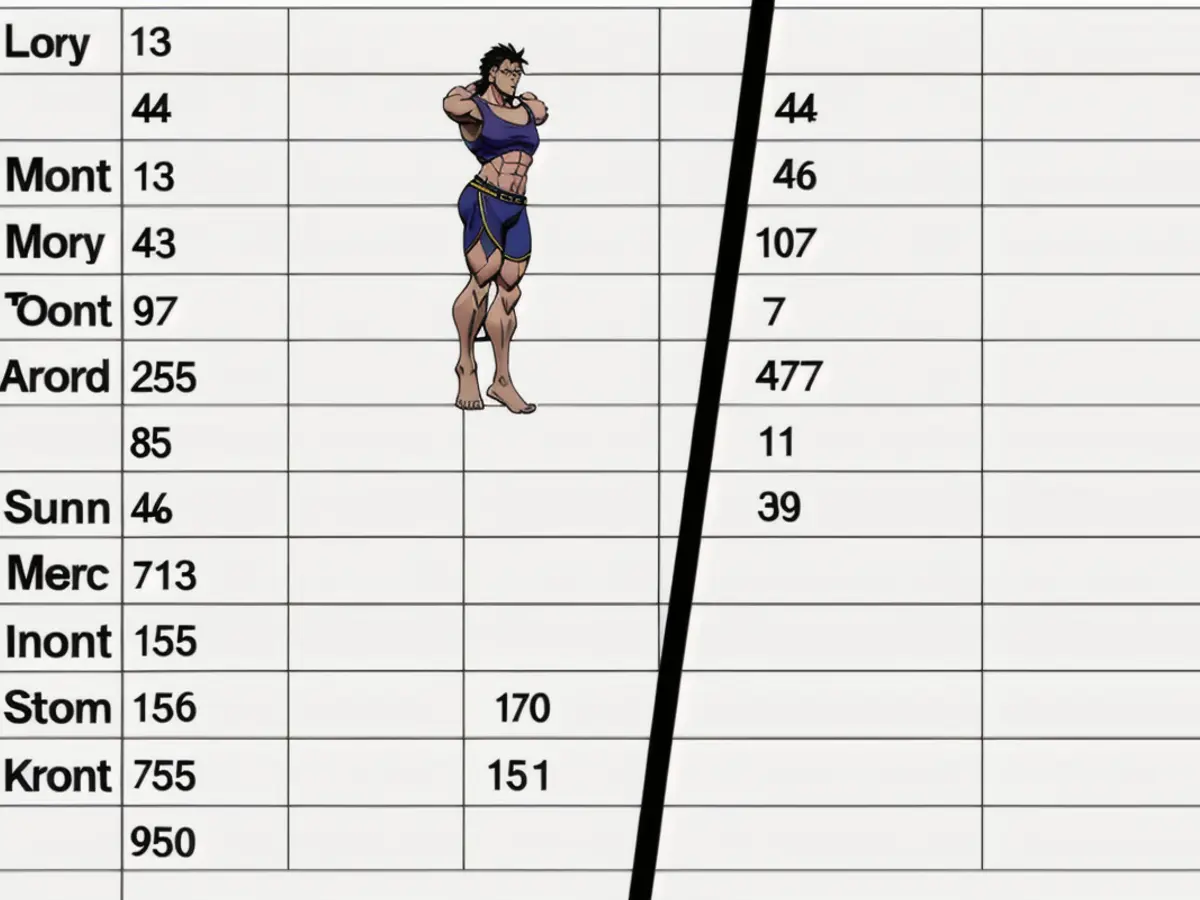

Let's assume a company is financing a $9,000 computer system with a two-year lease through monthly payments of $400. You should now set up your spreadsheet with each payment and the financed amount but use the aforementioned formula that adjusts the interest rate for monthly payments instead of annual payments. Once completed, your spreadsheet will appear like this and deliver an interest rate of 6.46%.

Related investing topics

Convert Daily Returns to Annual Returns Formula, Process, and Example

Understanding how to transform daily returns into annual returns can aid in evaluating investments more fairly.

What is a Ground Lease?

With a ground lease, tenants only hold the property, not the land it's on.

Anticipated Return on Your 401(k)

What kind of returns do investors typically expect from 401(k)s?

Deferred Rent

Deferred rent refers to scenarios where the average lease expense exceeds the actual lease payment.

If you're an ambitious and dedicated investor, you might be interested in visiting our broker center to discover a broker that meets your specific needs.

Our Website features a disclosure policy.

In the world of finance and investing, companies may consider leasing an asset instead of outright purchase due to favorable lease financing conditions or financial statement management. If a company decides to finance an asset using a capital lease, they can calculate the effective interest rate using a spreadsheet formula, taking into account the financing amount and the payment amount. By employing a spreadsheet and following a step-by-step process, investors can efficiently calculate the capital lease interest rate, even when payments are made monthly or quarterly.