Medicare and workers' comp coordination: Crucial insights

Notifying Medicare about your workers' compensation arrangement is crucial to prevent claim denials and reimbursements. Here's the rundown.

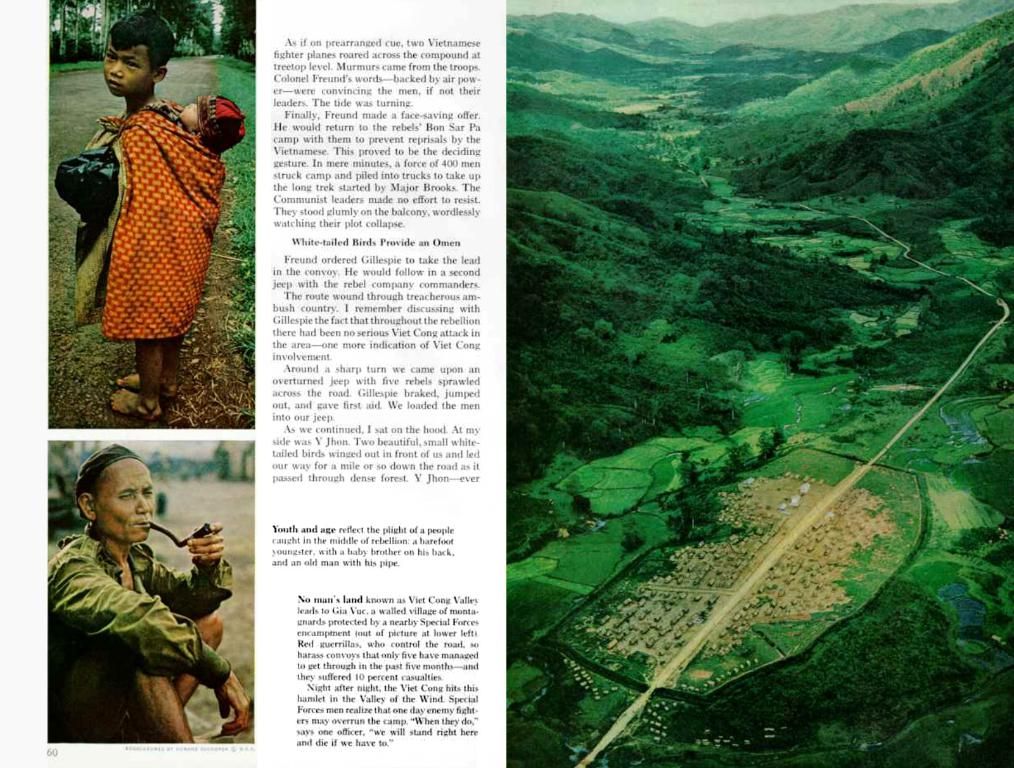

Workers' compensation is insurance for employees who suffer job-related injuries or illnesses, managed by the Office of Workers' Compensation Programs (OWCP) under the Department of Labor. Whether you're a federal employee, family member, or part of a covered entity, know how your workers' compensation benefits could affect your Medicare coverage. It's essential to avoid conflicts with medical costs related to work injuries.

Now, let's talk about workers' comp settlements and Medicare:

Under Medicare's secondary payer policy, workers' compensation should cover all treatment for a work-related injury before Medicare kicks in. But if urgent medical expenses pop up before you get your workers' compensation settlement, Medicare may pay first and start the Benefits Coordination & Recovery Center (BCRC) recovery process.

To avoid this recovery process and protect your funds, the Centers for Medicare & Medicaid Services (CMS) generally keeps tabs on the amount you receive from workers' compensation for your injury-related medical care. In some cases, Medicare may request a workers' compensation Medicare set-aside arrangement (WCMSA) for these funds, covering your care only after the WCMSA funds are depleted.

So, which settlements should you report to Medicare? Workers' compensation must submit a total payment obligation to the claimant (TPOC) to CMS if you're already enrolled in Medicare based on age or Social Security Disability Insurance, and the settlement is $25,000 or more. If you're not yet eligible for Medicare but will within 30 months of the settlement date and the amount is $250,000 or more, you'll also need to submit a TPOC.

Additionally, if you file a liability or no-fault insurance claim, you must also report it to Medicare.

Need help? Contact Medicare directly at 800-MEDICARE (800-633-4227, TTY 877-486-2048); they offer live chat on Medicare.gov during certain hours. If you have questions about the Medicare recovery process, reach out to the BCRC at 855-798-2627 (TTY 855-797-2627).

A Medicare set-aside is voluntary, but the amount must exceed $25,000 if you're already enrolled in Medicare or if you're eligible within 30 months. Using set-aside funds for other purposes is prohibited and could lead to claim denials and reimbursement obligations.

Here's the takeaway: Educate yourself about workers' compensation and Medicare, inform Medicare about your workers' compensation agreements to avoid claim rejections, and comply with all reporting requirements to avoid penalties and ensure Medicare's interests are protected.

For more resources to help navigate the intricate world of medical insurance, check out our Medicare hub.

- If you're already enrolled in Medicare due to age or Social Security Disability Insurance, and your workers' compensation settlement is $25,000 or more, it's necessary to submit a total payment obligation to the Centers for Medicare & Medicaid Services (CMS).

- If you're not yet eligible for Medicare but will within 30 months of the settlement date and the amount is $250,000 or more, you'll also need to submit a total payment obligation to CMS.

- Workers' compensation settlements may impact your health-and-wellness and finance as they could influence your Medicare coverage, particularly in cases requiring medical care for workplace injuries or medical conditions.

- Healthsystems should be aware of the intricacies of Medicare and workers' compensation to ensure the workplace wellness of their employees and to protect themselves from claim denials and reimbursement obligations.