Gold vs. Bitcoin: Safety vs. Revolution

In the world of digital versus traditional finance, gold takes the lead as the veteran market player. Bitcoin may share similarities with gold, serving various purposes, but it's not the same as the timeless yellow metal. Walking around in Bitcoin socks might garner attention at tech events, but it doesn't have the same impact as flaunting a Vacheron Constantine gold watch or indulging in a gold-coated steak at Salt Bae's. Gold's deep-rooted presence in human history, from nightclubs in Monaco to everyday jewelry, is undeniable.

Bitcoin, however, finds its place as a flight vehicle for the wealthy, a refuge for those fleeing dire circumstances. Bitcoin's security, often praised, is not as robust as it may seem. The misconception of cold wallets as ultimate secure storage misunderstands their vulnerabilities. While Bitcoin may offer advantages over physical gold, it struggles to replace the latter as a secure storage of wealth.

The cryptocurrency sphere is currently in a state of equilibrium. Though there’s a considerable amount of noise, Bitcoin's value remains relatively unchanged. Traders watch with bated breath, anticipating the breakout, the moment when volatility drops and the market takes a decisive turn. Bitcoin's history consistently shows this pattern, and skilled traders rely on predicting these breakouts.

However, the current state of Bitcoin is neither bullish nor bearish. The market is finely balanced, like a seesaw that's barely touching the ground. The frothy AI token bubble serves as a warning, signaling instability that may ultimately cause it to collapse. Therefore, the cautious advice is to wait and observe.

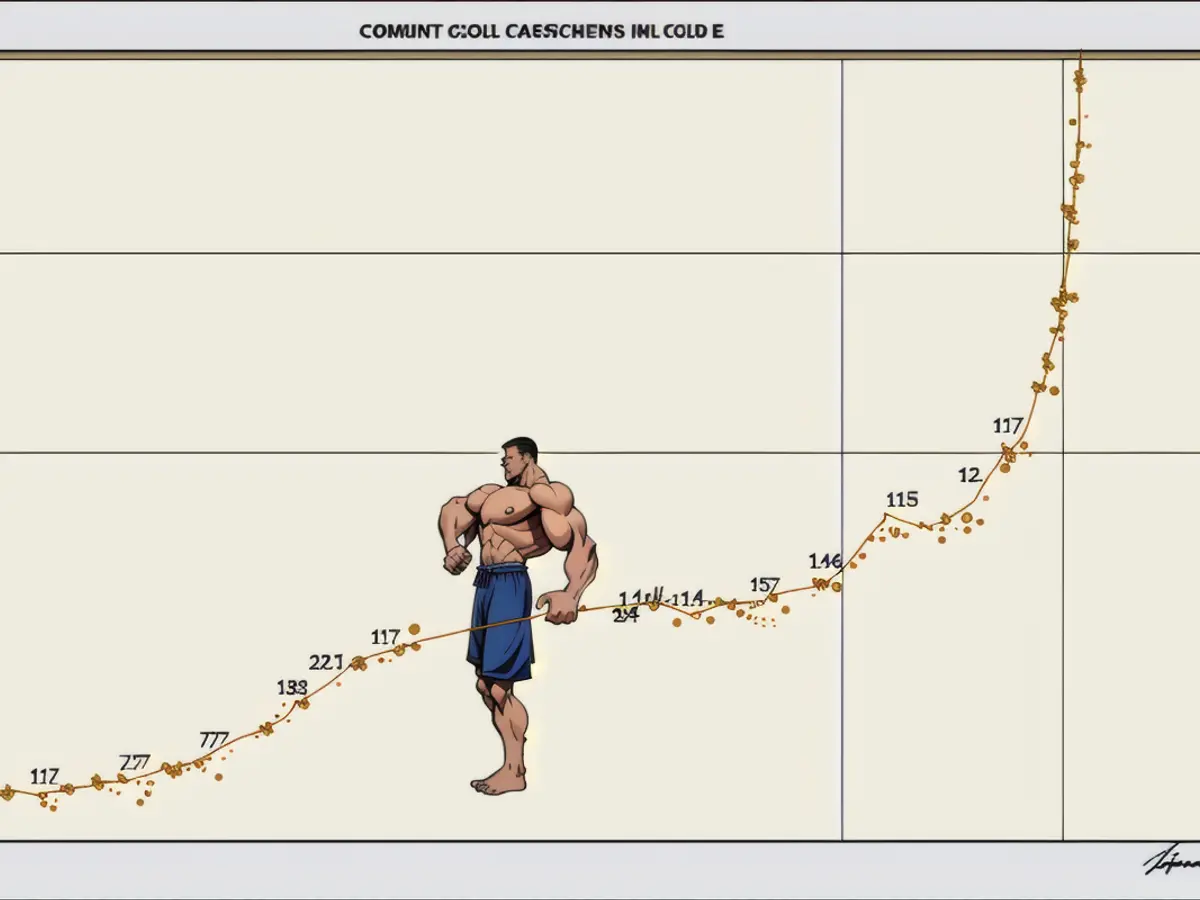

On the other hand, gold is on a trajectory, hitting new all-time highs and capturing the attention of investors seeking safety during times of economic uncertainty. The recent gold price surge, with spot gold reaching $2,896.55 and COMEX futures hitting $2,968 per ounce, speaks volumes of its reliability as a secure investment option.

The investment landscape highlights the differences between Bitcoin and gold. Gold, with its historical consensus, physical properties, and established utility, retains a practical advantage over the young Bitcoin, which is still evolving and faces complicated security concerns.

While both assets may not compete directly, they serve distinct purposes, with gold being a dependable store of value and safe-haven asset, and Bitcoin offering the potential for significant growth and innovation as a digital currency. Investors must weigh their tolerance for risk and align their financial objectives to make educated decisions.

Ultimately, the choice between Bitcoin and gold comes down to individual preferences and investment strategies. Gold, as a time-honored asset, maintains its value regardless of external factors, while Bitcoin, as a new-age asset, provides opportunities for growth and transformation in modern finance.

Digital investments, such as cryptocurrencies like Bitcoin, often benefit from developments in technology. However, Gold's digital assets, like its reputation and historical significance, hardly require such enhancements to maintain their value. C1806cdcd30cfda98820b6d41f8f70f7

Cryptocurrencies, including Bitcoin, might offer potential for significant growth, but their security, despite such advancements, isn't as resilient as Gold's. In contrast, Gold's cryptographic security, in the form of its physical existence and social trust, has stood the test of time for centuries.

As the market for digital assets, like cryptocurrencies, continues to evolve, traditional investments, like Gold, remain a dependable safe haven for wealth, especially during periods of economic uncertainty. Despite the allure of Bitcoin and other cryptocurrencies, the enduring value of Gold, from its role in technology to its status as a luxurious commodity, continues to distinguish it in the investment landscape.