A Potential 2025 Recession: What's the Scoop? 🌟

Future Economic Forecasts for 2025: Is a Recession looming on the Horizon?

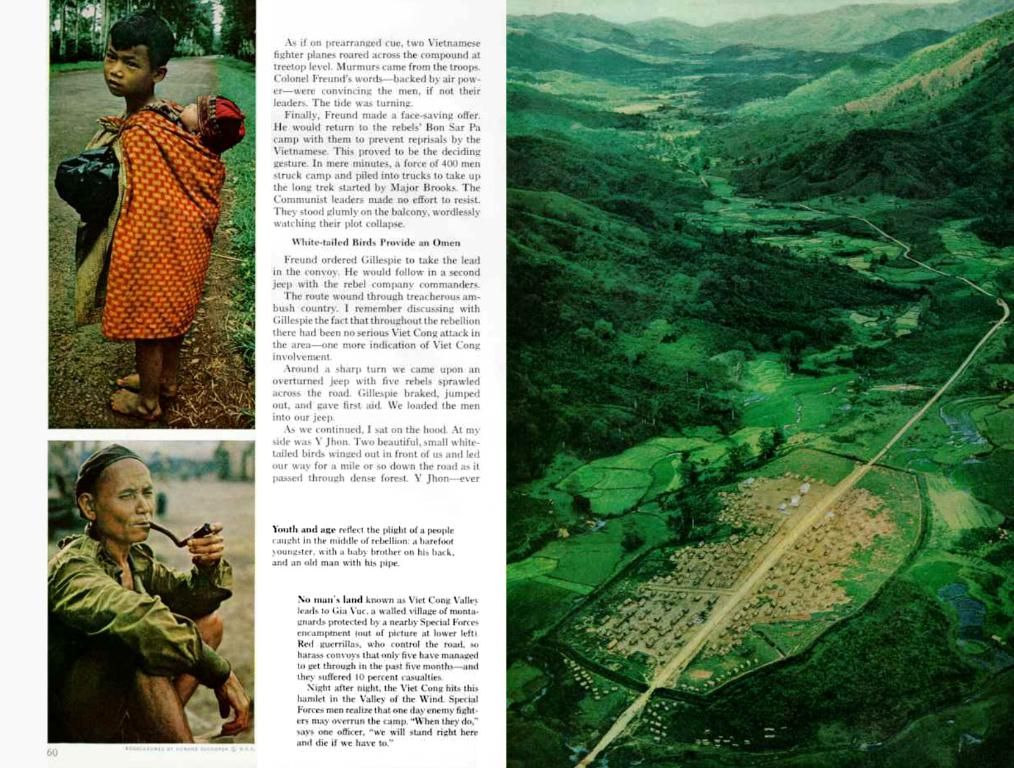

With whispers of a looming recession in 2025, economists and investors are more alert than ever, scrutinizing key financial indicators and stock market trends. 📊

The volatility in major indices like the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average (DJIA) has sparked lively discussions about the future of the U.S. economy.

Assessing the Economic LandscapeRecent data suggests that a financial downturn isn't far-fetched. The Atlanta Federal Reserve's model forecasts a negative GDP growth for the first quarter of 2025, while consumer confidence levels have started to dip. Prediction market platform Kalshi estimates a 40% chance of a recession happening in the near future.

Trade policies and their impacts are significant factors that are causing concern.

Tariffs introduced during the Trump administration have raised red flags regarding inflation and consumer purchasing power. Analysts at BCA Research believe there's a 75% chance of a recession within three months, citing the negative effects of tariffs on real wages and overall economic activity.

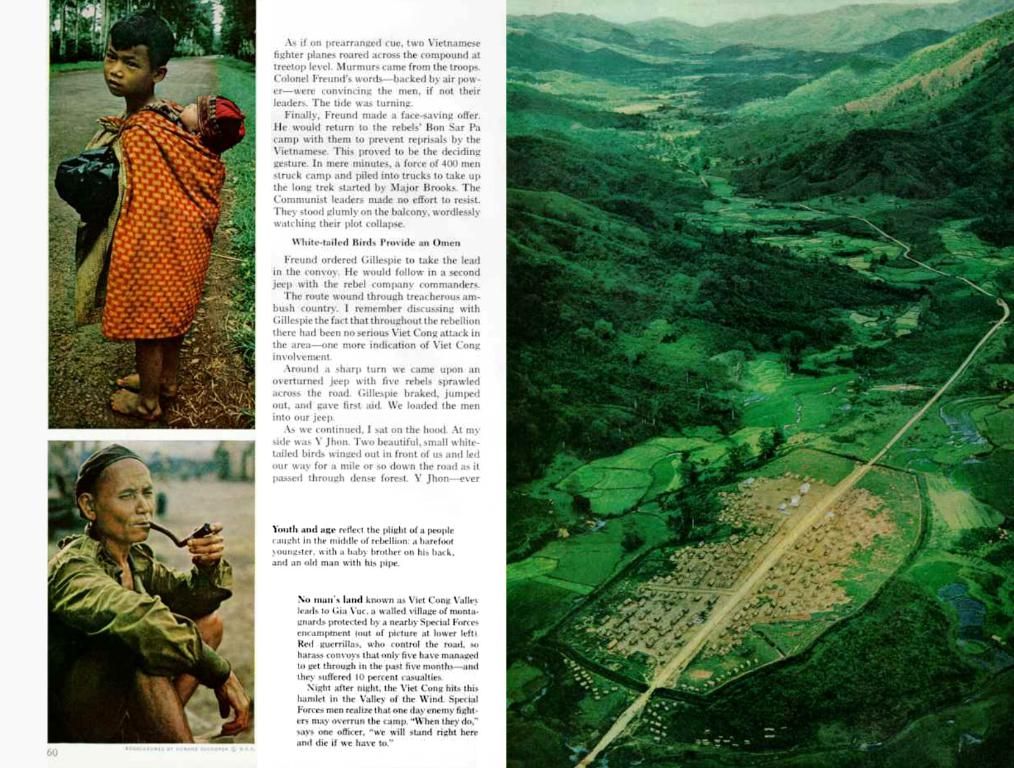

Stock Market RollercoasterTurbulence in the stock market is evident as investors react to economic uncertainties. On March 10, 2025, the Dow Jones plummeted by over 1,000 points, marking one of its steepest drops in recent years.

The tech-heavy Nasdaq Composite saw a 4% plunge, adding fuel to the fire amongst investors.

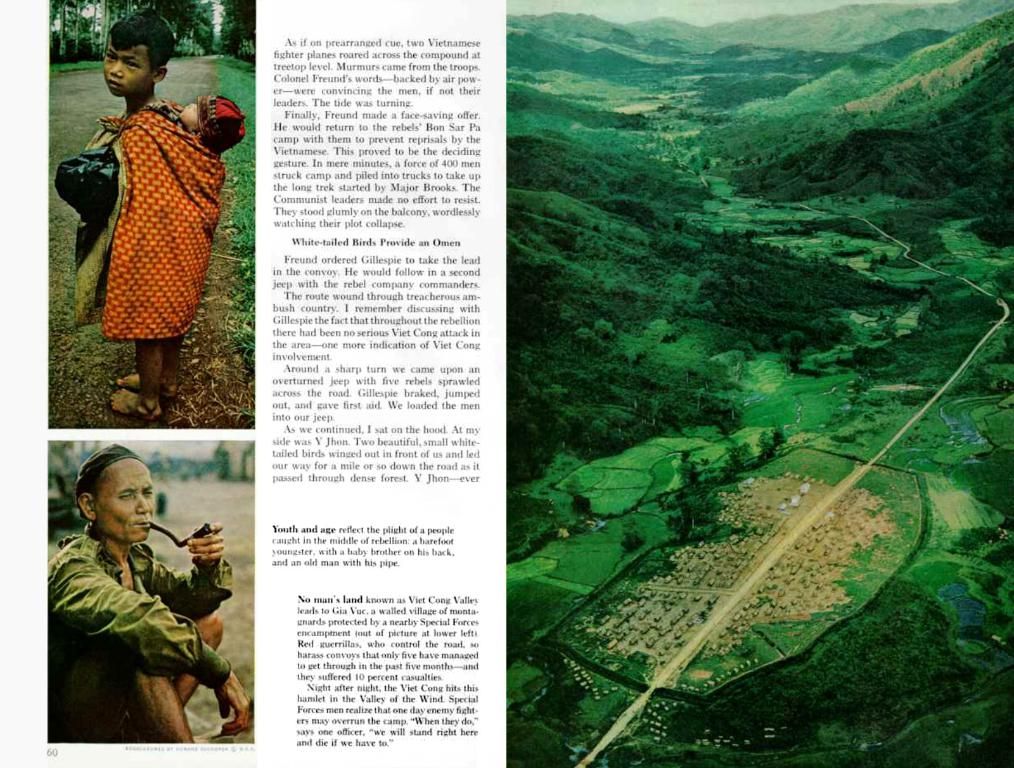

Key index performances include:

- S&P 500: Ended the day down 2.7%, hitting its lowest level since mid-September.

- Dow Jones Industrial Average (DJIA): Dropped approximately 890 points during the same period.

- Nasdaq Composite: Fell into correction territory, shedding more than 12% from its February peak.

The stock market selloff resulted in significant losses, wiping out an estimated $1.75 trillion following President Trump's comments on potential economic headwinds.

Shifting Investor ConfidenceConfidence among investors has taken a nosedive in light of these developments. The CNN Fear & Greed Index currently indicates "extreme fear," a stark contrast to the optimism expressed in previous months.

This turn of events is reflected in trading patterns, with investors gravitating toward safer sectors like utilities and healthcare, while avoiding high-risk investments.

Interest Rates and Economic ImpactsLong-term interest rates have potential to mold market conditions significantly.

The 10-year Treasury yield has shown notable fluctuations, affecting borrowing costs and investment decisions across industries. Increasing interest rates could augment expenses for businesses, potentially leading to cutbacks in spending and hiring, increasing recession risks.

The Big Question: Recession or Resilience?As 2025 unfolds, the question on everyone's minds is: Is a recession imminent? Although economic signals indicate an increased risk, history shows that recession fears can sometimes be overblown. The dynamics of the global economy mean changes can happen swiftly.

Investors should stay vigilant and stay updated on economic trends, especially movements in major indices like the S&P 500, Dow Jones, and Nasdaq. Whether the current downturn escalates into a full-blown recession depends on a range of factors such as policy decisions from the Trump administration and broader global economic shifts.

While recession concerns grab headlines, the evolving landscape of trade policies and market dynamics will play a decisive role in shaping the U.S. economic outlook for the rest of 2025.

Also Read

- Amazon's Stock Plunge: Unraveling the Recent Market Shakeup 🚀

- Geoffrey Odundo's Appointment: A Fresh Start at Nation Media Group 📰

- Economists and investors worldwide are closely monitoring stock market trends and financial indicators, especially those in the U.S. economy.

- Analysts are scrutinizing trade policies and their impacts as significant factors raising concerns about a potential recession.

- The Atlanta Federal Reserve's model predicts a negative GDP growth for the first quarter of 2025, while consumer confidence levels have started to dwindle.

- Tariffs introduced by the Trump administration and the subsequent negative effects on real wages and economic activity have sparked debate among analysts.

- Prediction market platform Kalshi estimates a 40% chance of a recession happening in the near future.

- Amidst the volatile economic landscape, a shift in investment trends is noticeable as investors fled from risky assets and gravitated towards safer sectors like utilities and healthcare.