FirstGroup's revenues escalate following transportation cost alterations

FirstGroup Outperforms Amid Industry-Wide Inflation

In a triumphant financial year, the travel operator, FirstGroup, posted an adjusted operating profit of £222.8 million, exceeding analyst estimates of around £220 million. Their success was achieved in the face of industry-wide inflation pressures, which they tackled with strategic cost-cutting and price hikes.

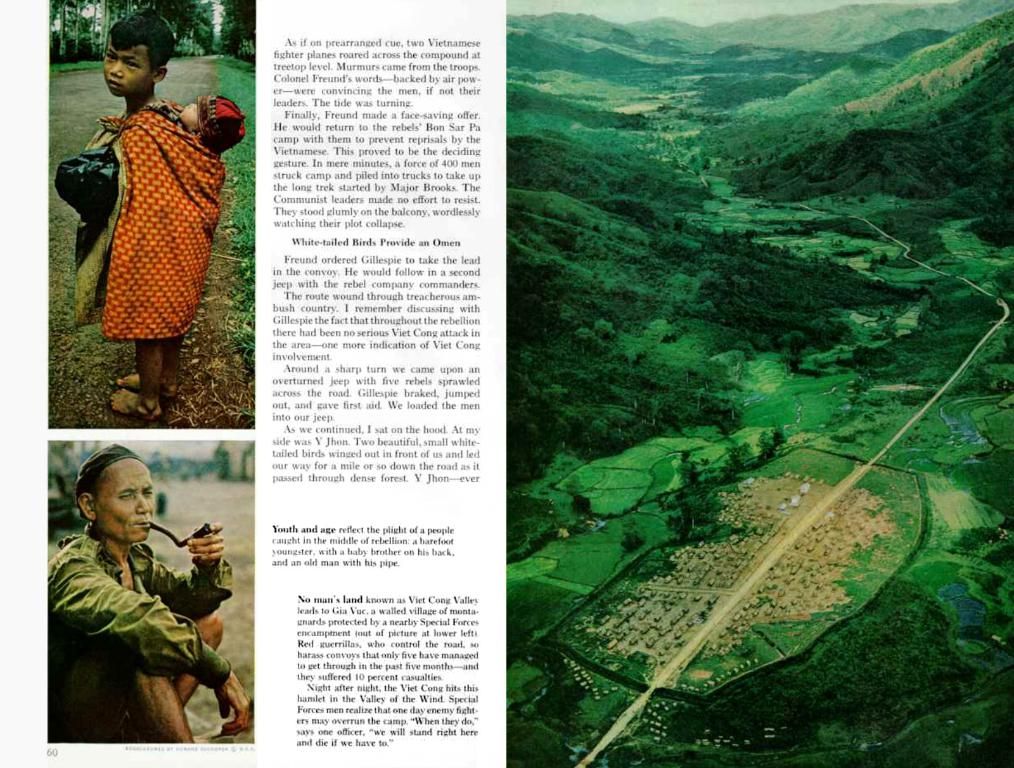

The London bus operator and Avanti West Coast giant saw its costs base rise due to higher wages, but its revenue increased 7% YoY to £1.37 billion, with the bus arm being the primary driver of growth. This prosperous performance came despite cost inflation of 3.5%, mainly driven by a 5% average driver pay hike.

FirstGroup adapted to these inflationary pressures through various strategic measures:

- Pricing Dance: Customizing its ticket pricing to accommodate the increased costs led to approximately £41 million in revenue adjustments.

- Efficiency Symphony: The company realized network and operational efficiencies of around £10 million, reducing the impact of inflation on their bottom line.

- Multi-year Tune-ups: FirstGroup focuses on multi-year pay award settlements with employees. In FY 2026, it managed to agree upon 16% of driver pay awards at an average increase of 3%. Negotiations for further pay awards are underway.

- Fuel and Electricity Foxtrot: The group uses hedging programs for fuel and electricity costs to manage volatility and lessen the effects of energy price spikes. These programs are periodically reviewed and fine-tuned as the company transitions its bus fleet to zero-emission vehicles.

These tactics have enabled FirstGroup to endure the financial strain of cost inflation, maintain operational stability, and prepare for future growth. Despite ongoing inflationary pressures, these measures contributed to a remarkable financial performance, with revenue growth and improved portfolio diversification.

FirstGroup’s First Rail business, which also hosts Hull Trains and GWR on its roster, reported a better-than-expected adjusted operating profit of £148.8 million. South Western Railway, previously a FirstGroup joint venture with MTR, returned to public ownership as part of the Government’s renationalisation drive. SWR contributed revenue of around £1.18 billion and an adjusted operating profit of £25.2 million to FirstGroup in the last financial year.

FirstGroup's shares surged 6.3% or 12.20p to 206.00p on Tuesday, following an impressive 21% increase in the previous year. Analysts at Panmure Liberum rated FirstGroup a 'Buy', with a target price of 250p.

- In the face of industry-wide inflation, FirstGroup augmented its savings through strategic cost-cutting and price hikes in the finance sector, generating approximately £41 million in revenue adjustments, known as the 'Pricing Dance'.

- To further combat inflation in the transportation industry, FirstGroup focuses on long-term pay agreement negotiations with employees, such as the 16% driver pay awards settled for FY 2026, averaging a 3% increase.

- Recognizing the impact of inflation on both fuel and electricity costs within the business sector, FirstGroup utilizes hedging programs to manage volatility and lessen the effects of energy price spikes, with an ongoing transition to zero-emission vehicles.