"Tax Revenue Slash": Bundesrat Pushes Back Against Federal Government's Tax Cuts

- *

Encouraging Economic Growth: Federal Council Proposes Tax Compensation for Losses - "Federal Council Proposes Compensation": Council urges compensation for tax-related financial losses.

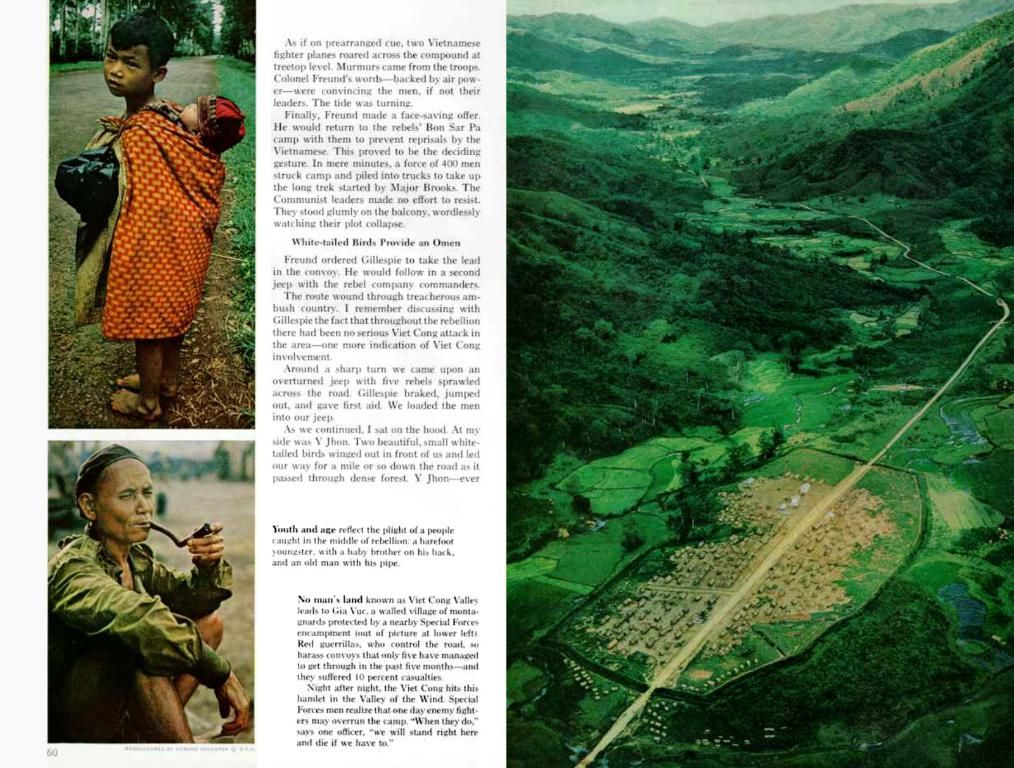

The proposed legislation, dubbed the "Investment Booster," could result in significant tax revenue losses for federal states and municipalities, totaling over 30 billion euros in the next five years. Two-thirds of this staggering sum would fall on these entities.

With *financial stability for federate states and municipalities* at risk due to these projected losses, the Bundesrat, Germany's upper house of parliament representing its federal states, wants a seat at the table with the federal government to discuss just how much burden these tax cuts can bear.

North Rhine-Westphalia's Minister President Hendrik Wüst (CDU) weighed in during the state chamber's session, urging relief for the economy, but emphasizing that the proposed measures translate to considerable tax losses for federal states and municipalities. Accordingly, a joint solution with the federal government needs to be reached.

Mecklenburg-Vorpommern’s Minister President Manuela Schwesig (SPD) highlighted support for the overall package, but underscored the necessity for the federal government to come forth with a reasonable offer for an agreement with the states.

State representatives are pushing for negotiations to occur before the parliamentary summer break (July), with references to the conference of minister presidents with Chancellor Friedrich Merz (CDU) next Wednesday.

The "Investment Booster" legislation, championed by Finance Minister Lars Klingbeil (SPD), brings forth a host of measures, including:

- Accelerated depreciation for movable economic goods like machinery, allowing for up to 30% annual deductions between 2025 and 2027.

- A progressive reduction of corporation tax from 15% to 10% between 2028 and 2032.

- Relief for acquisitions of electric company cars.

- An extension of the research allowance.

The federal government hopes these measures will boost the economy, grant companies a stronger investment incentive, and improve Germany’s overall business location attractiveness.

The state chamber plans to voice its opinion on the bill draft during Friday's session, with the Bundesautobahn (Bundestag) looking to decide on the draft on June 26th. The Bundesrat will then have a final say on the matter upon the Bundestag’s decision.

- Tax revenue losses

- Bundesrat

- Federal government

- CDU

- SPD

- Tax relief

- Finance Minister Lars Klingbeil

- Accelerated depreciation

- Corporation tax reduction

- Electric company car relief

- Research allowance extension

Insights

- The "Investment Booster" legislation in Germany introduces accelerated depreciation for movable assets and plans a gradual reduction of the corporate tax rate from 15% to 10%. These measures are intended to stimulate investment, strengthen the economy, and improve Germany's business location attractiveness.

- Reduced revenues for federal states and municipalities due to the measures' impact on corporate tax receipts, since corporate tax is a significant source of revenue for them.

- The Bundesrat is likely to demand direct compensation payments, adjustments to the financial equalization system, and funding for specific projects or sectors to offset the lost tax revenues.

- The Bundesrat is voicing concerns about potential "tax revenue losses" for federal states and municipalities, as a result of the proposed tax cuts in the "Investment Booster" legislation.

- With the "Bundesrat" pushing for a seat at the table, negotiations between the federal government and the states are necessary to address the "considerable tax losses" that federal states and municipalities would incur if the legislation is enacted.