Elimination of Double Taxation on Pensions: Which Individuals Are Impacted? - Elimination of dual taxation on pension payments: which individuals are affected?

Switching to the new pension tax system led some individuals to incur double taxation. Here's how to identify if you're affected and potential steps to tackle it:

Initially, both employees and the government contributed to pensions from taxed income, receiving tax-free pension payments. However, the government needed to equalize tax treatment across employees and civil servants leading to a transition to post-payment taxation. Since 2005, pension contributions began to lose their taxable aspect (initially 60% tax-free), while pension payments gradually became taxable (50% since 2005). Originally, pensions were planned to be fully taxable by 2040, but the deadline was extended to 2058. As of 2023, pension contributions have been fully tax-free.

The transition to post-payment taxation resulted from lawsuits brought forth by pensioners bearing double taxation: they were paying from already-taxed income and also facing tax deductions. The government chose an extended transition period to prevent such double taxation. However, in 2021, the Federal Finance Court confirmed double taxation could occur too early, prompting the government to make necessary amendments.

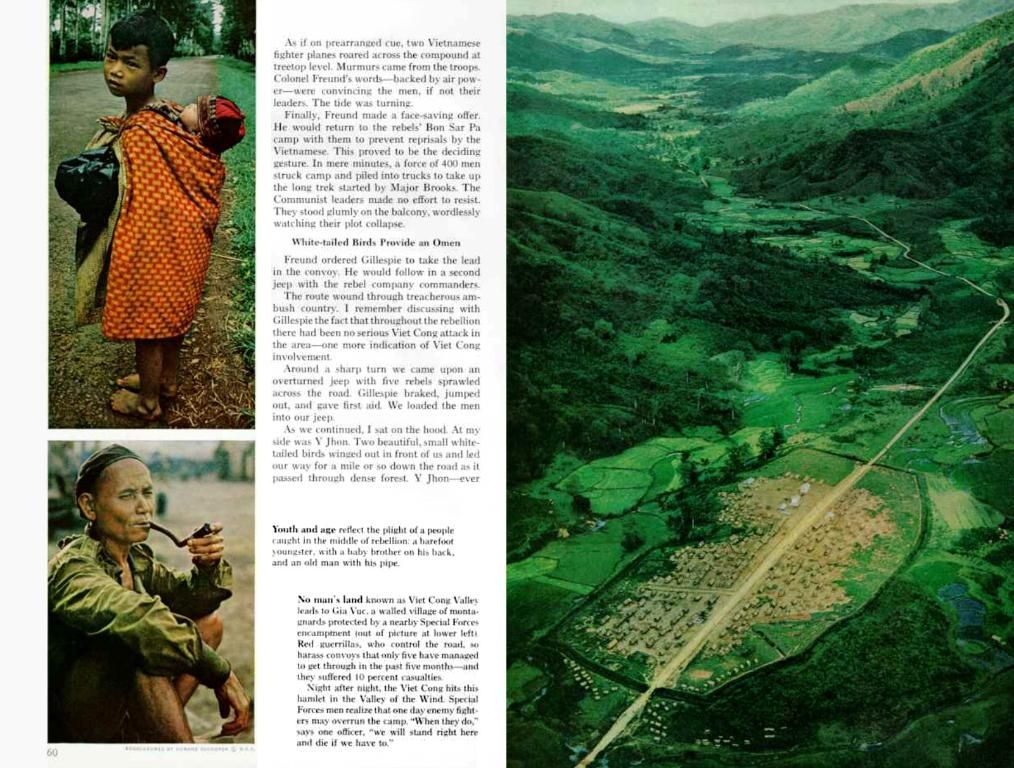

Whom does it affect? The new law acknowledges the need for further regulations to avoid double taxation in existing and future pension cases. Although currently, the effect is limited to a select group, for those approaching retirement, double taxation could be significant. The extent depends on factors such as income, retirement age, duration of contributions, and personal contributions. Single men aged 50 or above are often the most affected.

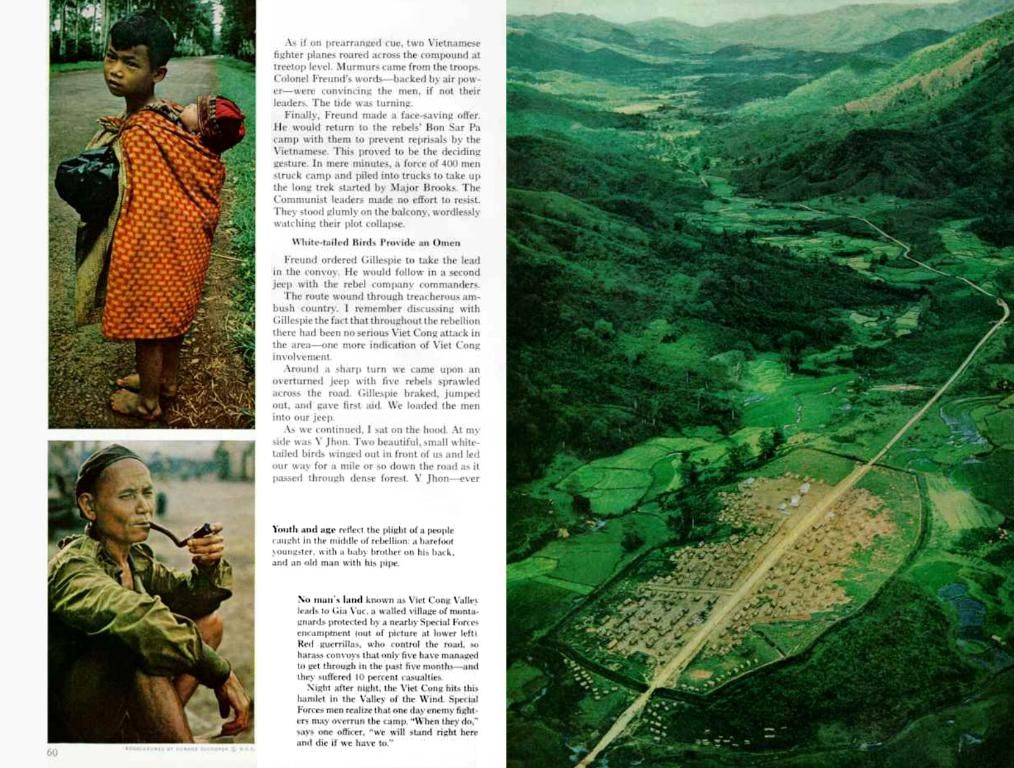

Double taxation is calculated based on taxed incomes against the pension's tax-free portion. Income levels, residency status, international tax agreements, and pension structures should all be considered. All tax notices since 2005 contain preliminary notes on pension contribution and taxation. Those suspecting double taxation should maintain pension payment notices and tax records, limiting appeal for older payments.

To mitigate double taxation, one must comprehend German pension tax system nuances, applicable international tax agreements, and residency status. Tax treaties should be reviewed, fiscal credits claimed, and professional advice sought. Some treaties offer specific pension income tax relief, so it's essential to recognize available exemptions or deductions. Lastly, keep track of double taxation risk factors to minimize its impact.

During this transition, understanding the laws, your situation, and potential relief mechanisms can help prevent and mitigate the risk of double taxation.

- The government's decision to make pension contributions fully tax-free in 2023 was a response to prevent future cases of double taxation, as individuals should no longer face tax deductions on their pension contributions.

- Despite the government's efforts to prevent double taxation, some pensioners may still encounter it due to gradual changes in the pension tax system implemented since 2005, which led to the loss of the taxable aspect of contributions and the gradual taxation of pension payments.

- In the coming years, as the pension tax system continues to evolve and regulations are introduced to avoid double taxation, it's crucial for individuals approaching retirement to stay informed and consult with financial or tax advisors to ensure they fully understand the impact on their pensions and potential tax relief options.