Economic Crisis, Financial Instability, Impending Danger Likelihood for Markets

Take a Dive into the Rotten Core of the U.S. Financial System

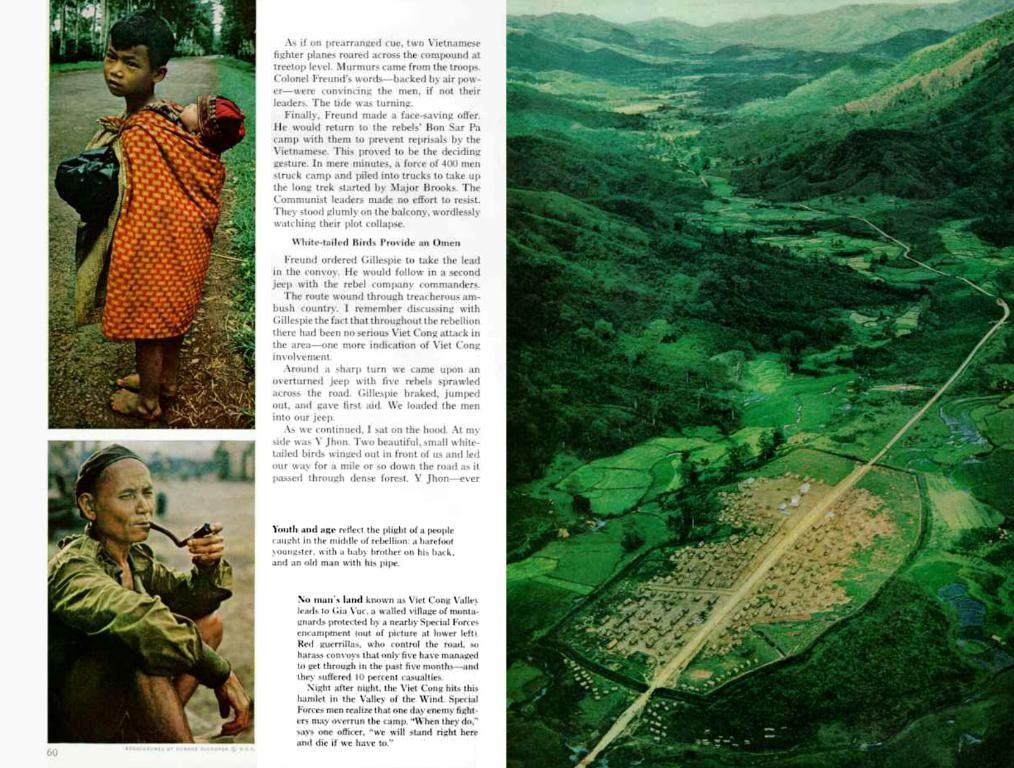

Let's face the harsh reality - Al Capone was spot on! Today's financial scene is a seething den of deceit, manipulation, and worse. From Wall Street moguls to bankers, hedge fund managers, large corporations, the Federal Reserve, you name it, they're all playing dirty. If you still can't see the rot, you probably never will.

This nation, from an economic standpoint, is a swamp of corruption, extortion, crushing debt, and thievery at every level. It's a cesspool that's devouring our economy, with nary a chance of recovery. But there's a high chance of total collapse, bank failures, and market implosions that will usher in a digital financial system run by extreme monetary control and government surveillance.

First, consider the staggering mountain of debt that's choking our nation. Without a central bank, this wouldn't have happened, but we're not here to discuss the abolition of the Federal Reserve. The big picture demands we tackle the major underlying problem that allows for all this tyranny, and that's the presence of any ruling system claiming national or state sovereignty.

Any form of governing system can only mean the destruction of freedom and is always grounded in force. The moment force by the state is present, freedom disappears, and liberty becomes a mere fantasy. With the state only being able to survive through extreme force, liberty is nothing more than a pipe dream, and the enslavement of society is guaranteed.

Here's a glimpse into the depths of our debt: Official national debt is reported to be $36 trillion, but this is a drop in the ocean compared to the real debt and government obligations. Personal debt is estimated to be around $26 trillion, while the actual total U.S. debt is reported to be $103 trillion. It's mind-boggling, but that's still not the whole story. Unfunded liabilities currently stand at a whopping $222 trillion!

If we add the $1,500 to $2,000 trillion in worthless derivatives world wide (financial products with no intrinsic value), it becomes crystal clear that America's debt will be the death knell of our economy. These financial "weapons of mass destruction," as warned by Warren Buffett, will lead to the calamitous collapse intended by the ruling class and sold to the masses as a necessary "reset."

Trump's sanctions, protectionist measures, tariffs, support of wars, and proxy wars, and the unending debt creation will accelerate the fall of this country. This will usher in a new monetary system based on Central Bank Digital Currencies (CBDCs), digital dollars, some level of Bitcoin (government-controlled crypto), or other options to allow for total surveillance of every transaction in the country.

It's crucial to remember the banking system in the U.S is bankrupt. Many banks stand on the brink of default and failure. When these giants teeter, any bail-outs will become bail-ins, marking the final grab for private property and the assets of Americans. When the world financial system collapses, only token amounts will be returned, and all will be locked up while the new, fully digitized, fully controlled system takes form.

As an aside, forget about so-called federal insurance called FDIC protection. This protective buffer is minimal, so any major banking problem would turn into a bail-in situation where your deposits would be claimed by the State to bail out the banks.

Image Source: New York Stock Exchange 1950s [Edited]

- The rampant deceit and manipulation in today's financial system, reminiscent of Al Capone's era, is a hurdle to true liberty and financial freedom.

- As the national debt soars, with the real debt and obligations far exceeding the reported figures, the truth behind our economic situation seems to evade transparency and accountability.

- The looming threat of Central Bank Digital Currencies (CBDCs) and digital government surveillance in the wake of America's financial collapse could erode the freedom of personal financial investing in politics and general news.