Solar Giant Meyer Burger's German Subsidiaries Facing Insolvency but Continuing Operations

In Spite of Financial Troubles, Meyer Burger Plans to Carry on with Operations - Despite financial distress, Meyer Burger persists in its active operations

Despite undergoing insolvency proceedings, the German branches of solar pioneer Meyer Burger are carrying on their operations for the interim. Lucas Floether, temporary insolvency administrator for tech hub Meyer Burger (Germany) GmbH in Hohenstein-Ernstthal near Chemnitz, stated emphatically, "Our goal is to keep both companies up and running throughout the entire preliminary procedure." His counterpart, Reinhard Klose, manages the operations at Meyer Burger (Industries) GmbH, the solar cell manufacturer based in Bitterfeld-Wolfen and Hohenstein-Ernstthal.

Salaries secured for three months

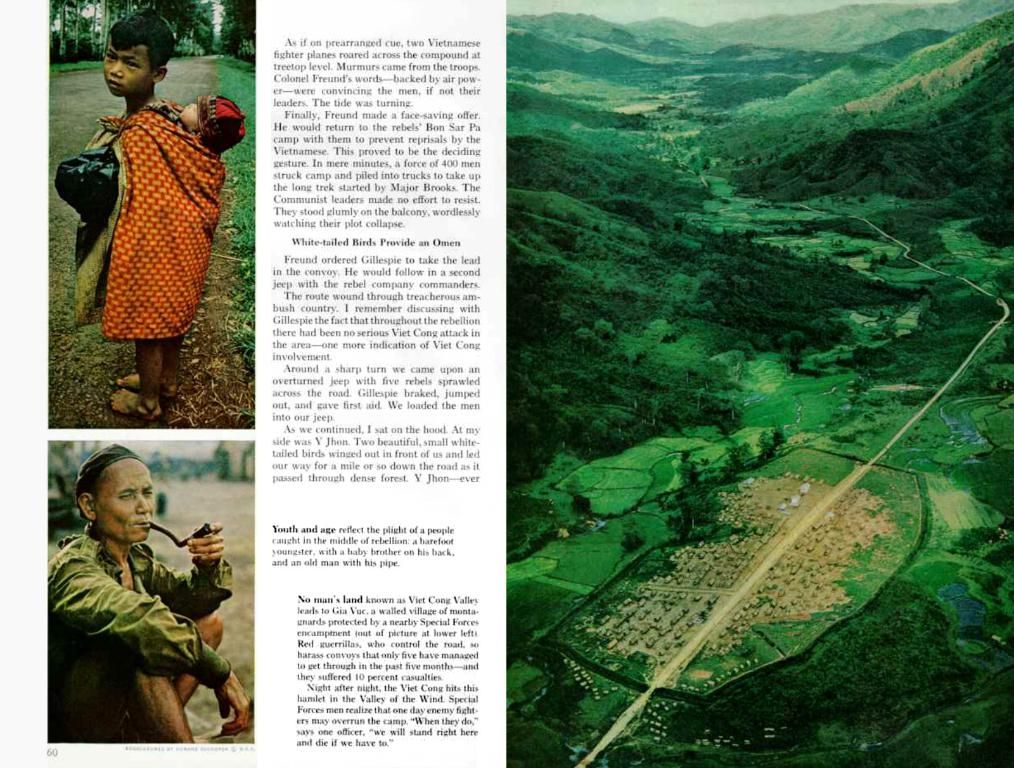

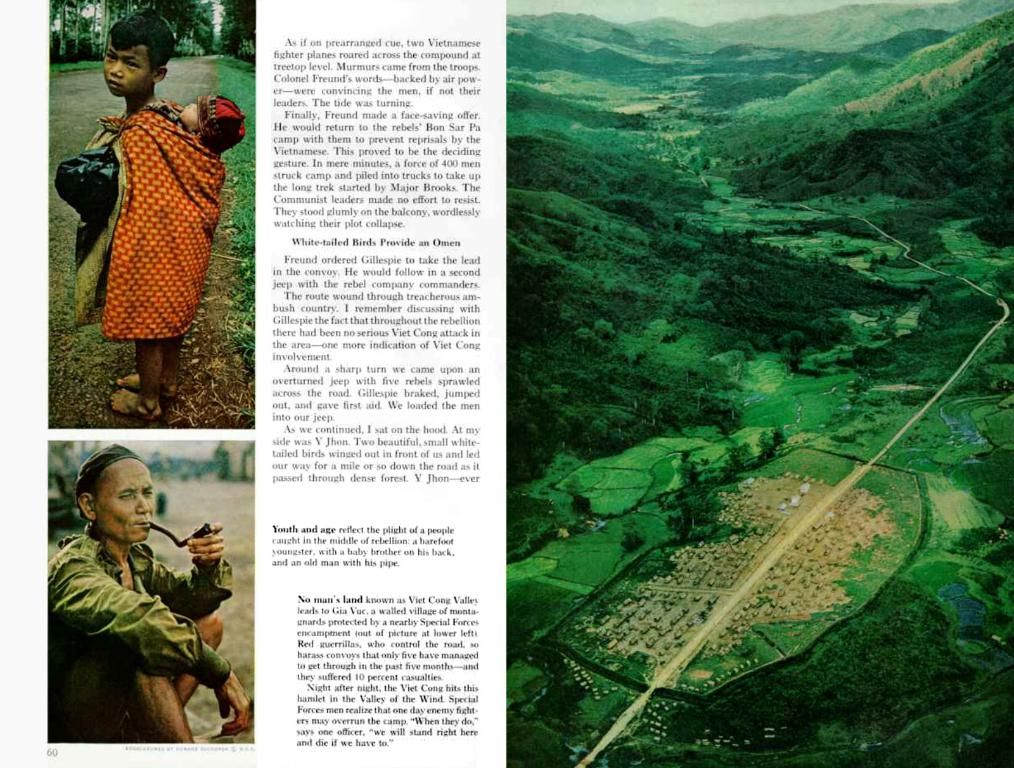

Employees at the approximately 600-strong workforce can breathe a sigh of relief, as their wages and salaries will be guaranteed for three months due to insolvency benefits, the administrators revealed. In Hohenstein-Ernstthal, 289 employees are affected, while the rest, totaling 332, work in Bitterfeld-Wolfen.

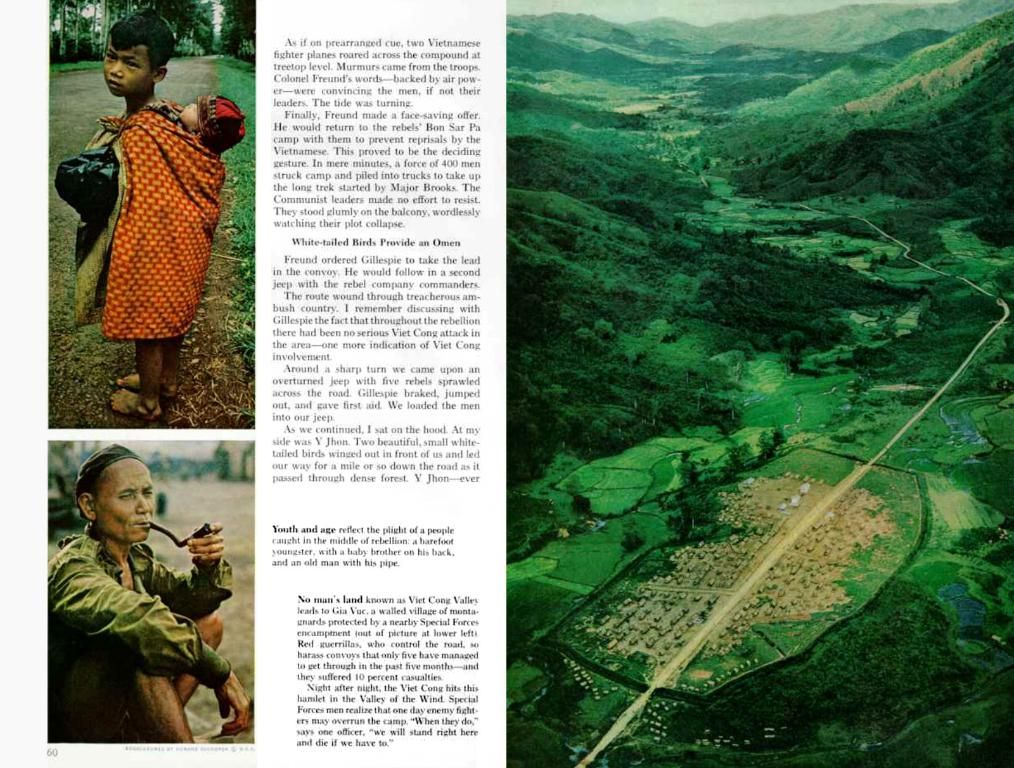

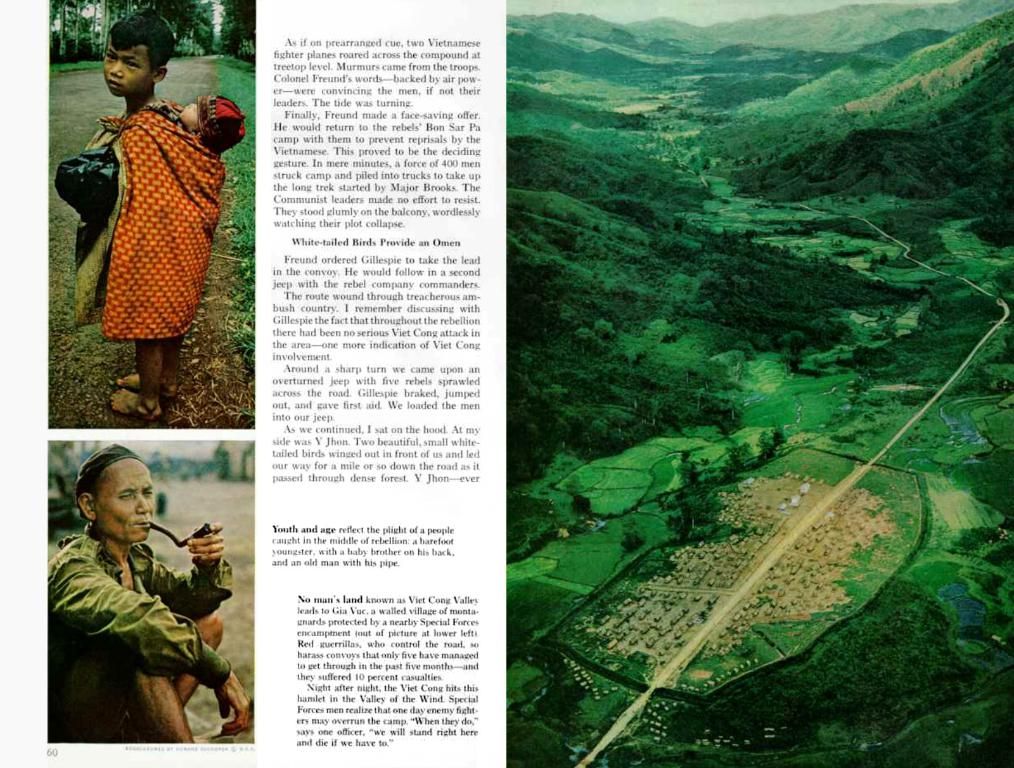

Discussions with management to explore solutions

According to Floether & Wissing Insolvenzverwaltung, managers of the two firms were engaged in talks to assess the economic situation and scrutinize potential restructuring strategies over the coming weeks. Klose, the administrator of Meyer Burger (Industries) GmbH, underscored the company's significance as, "one of the European technological and innovative leaders in the industry." He expressed a hope that both sites and as many jobs as possible could be retained.

Path forward through investment and asset sales

A potential resolution to the insolvency crisis lies in an investor approach. Although past endeavors were unsuccessful, administrators are optimistic about the prospects of the insolvency proceedings. A key advantage is that acquirers could acquire the business operations "without burdensome liabilities."

Meyer Burger has struggled with a deteriorating market environment, especially from intense competition from Chinese manufacturers. With no imminent investor solution on the horizon, managers of the two German companies filed for insolvency at the Chemnitz court.

- Meyer Burger

- Insolvency

- Germany

- Insolvency application

- Business operations

- Chemnitz

Meyer Burger at a Glance

Despite its Swiss origins, Meyer Burger is grappling with closure of its Arizona (U.S.) facility and insolvency filings for its German subsidiaries due to financial difficulties. The insolvent German subsidiaries include Meyer Burger (Industries) GmbH, a solar cell manufacturer in Thalheim, Bitterfeld-Wolfen, and Meyer Burger (Germany) GmbH, a mechanical engineering and technology development company in Hohenstein-Ernstthal. [3][5]

Potential Strategies for Recovery

- Formal Insolvency Proceedings Both German subsidiaries are now in insolvency proceedings, where a provisional insolvency administrator will oversee efforts to restructure the companies.

- Negotiations with Creditors Meyer Burger is still in talks with bondholders regarding a broader restructuring plan that could potentially affect assets and debts across the company.

- Preservation of Key Entities Meyer Burger (Switzerland) AG and Meyer Burger (Americas) Ltd. will continue to exist, serving as potential vehicles for future restructuring or investment opportunities.

Potential Saviors

- No Announced Bidders As of now, there are no specific reports of bidders or buyers for the insolvent German subsidiaries or the company as a whole.

- Strategic or Industrial Partners Given the advanced technology and leveraging existing facilities, strategic partners in the solar or renewable energy sectors could emerge as interested parties.

- Financial Investors Private equity or venture capital firms specializing in distressed assets could consider involvement, particularly if a viable restructuring plan surfaces.

The Future for German Subsidiaries (Hohenstein-Ernstthal and Bitterfeld-Wolfen)

- Current Impact Both sites, employing 331 in Bitterfeld-Wolfen and 289 in Hohenstein-Ernstthal, are now underinsolvency proceedings, effectively halting their manufacturing and development operations temporarily.

- Possible Scenarios

- Sale of Assets The insolvency administrator may attempt to sell off viable business units or technology assets to other solar manufacturers or industrial firms.

- Restructuring and Continuation If negotiations with creditors or new investors prove successful, parts of the subsidiaries' operations could continue under new ownership or a changed business model.

- Closure and Liquidation If no viable interest or solution arises, the sites may face closure, and their assets may be liquidated.

- The Road Ahead Meyer Burger has underscored that restructuring efforts will continue under the administrative oversight, but the fate of the German subsidiaries relies on the outcome of the insolvency process and negotiations with potential interested parties. [3][5]

- The financial assistence from the government could be essential in supporting the restructuring of Meyer Burger's German subsidiaries, particularly in the steel industry, to aid their recovery and ensure the continued operations of both companies.

- The duration of the insolvency proceedings offers an opportunity for Meyer Burger to engage in discussions with potential investors, financial partners, and strategic or industrial partners who may provide the necessary finance and resources for the restructuring of the business operations, securing the future of the German subsidiaries and preserving jobs in the solar and renewable energy sectors.