Comparing Trump Accounts with $1,000 for Babies to 529 Savings Plans and Custodial Roth IRAs: An Analysis of Their Financial Implications

Welcome to the Future: Baby 401(k)s and the Path to Success

Donald Trump and some of America's top business leaders recently celebrated a provision in the tax bill that will create investment accounts for babies born in the next few years. Known as "Trump accounts," these accounts are designed to set children up for a prosperous future.

The accounts will work like this:

- The government will contribute $1,000 to a Trump account for every baby born between 2025 and 2028.

- Parents, employers, or other private entities can add up to $5,000 more each year.

- The funds will be invested in a mix that tracks the overall US stock market.

- The account will be controlled by guardians until the child turns 18, and qualifying withdrawals will be taxed at the long-term capital gains rate.

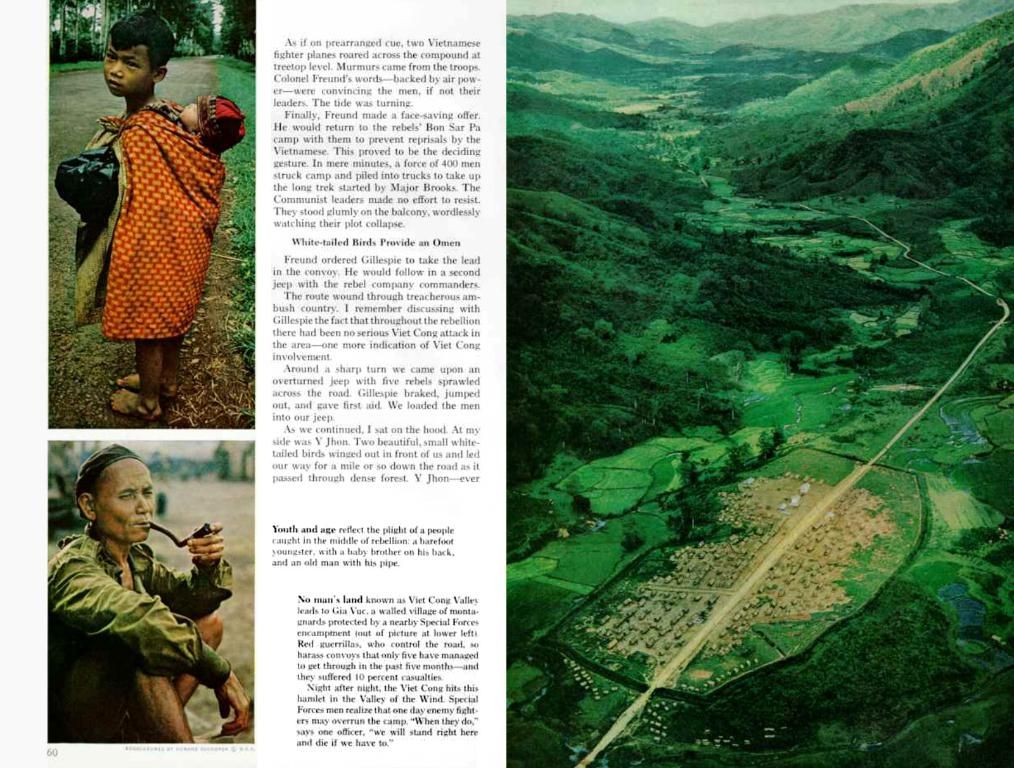

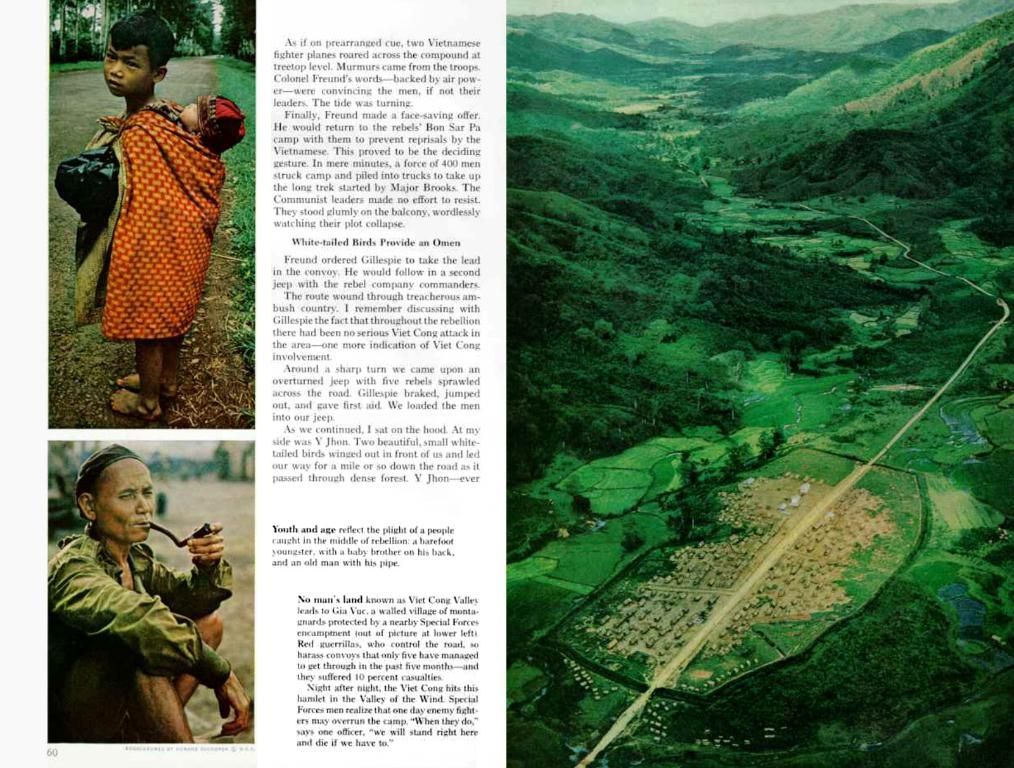

Extensive research demonstrates that children with savings accounts are more likely to succeed in life, with a reduced risk of incarceration, higher rates of college graduation, and increased chances of owning a home and starting a business.

While Trump accounts share some similarities with 529 savings plans and custodial Roth IRAs, they have significant differences that make them a unique opportunity for children's financial growth.

Trump Accounts vs 529 Savings Plans

While both plans allow savings for children's future, some key differences set Trump accounts apart:

- Funding: Trump accounts will be initially funded by the government, while 529 plans are usually funded by parents or family members.

- Withdrawals: Withdrawals from 529 plans are only tax-free when used for educational purposes, while Trump accounts have fewer restrictions on use.

- Contribution limits: The annual contribution limit for Trump accounts is $5,000, while 529 plans typically have higher contribution limits, depending on the sponsoring state.

Trump Accounts vs Custodial Roth IRAs

Custodial Roth IRAs provide children with the opportunity to invest and grow their funds. Here's how they compare:

- Earned Income Requirement: Unlike Trump accounts, custodial Roth IRAs only allow contributions if the child earns income during the year.

- Contribution Limits: Custodial Roth IRA contributions are limited to $7,000 per year, or the child's earned income, whichever is less. Trump accounts allow an annual $5,000 contribution.

- Taxes on Withdrawals: Retirement withdrawals from Roth IRAs are tax-free, but withdrawals from Trump accounts will be taxed at the long-term capital gains rate.

In conclusion, the proposed Trump Accounts offer an exciting opportunity for early and flexible savings for American babies, providing them with a solid foundation for future success. As the legislation continues to evolve, it's essential to stay informed and consider your options for your child's financial future.

The 'Trump accounts' are different from traditional 529 savings plans as they are initially funded by the government, while 529 plans are usually funded by parents or family members. Additionally, withdrawals from 529 plans have restrictions for educational purposes, whereas Trump accounts have fewer restrictions on use.

In contrast to custodial Roth IRAs, contributions to Trump accounts do not require the child to have earned income during the year, and the annual contribution limit is $5,000, lower than the $7,000 limit for custodial Roth IRAs. Furthermore, retirement withdrawals from Roth IRAs are tax-free, while withdrawals from Trump accounts will be taxed at the long-term capital gains rate.