Lowering Rates Again: ECB drops key interest rate to 2% in another Zinssenkung

Central Bank lowers principal rate to 2%

Facebook Twitter Whatsapp E-Mail Print Copy Link Interest Rates Dive Again: ECB Cuts Main Deposit Rate to 2% Amid Global Uncertainty

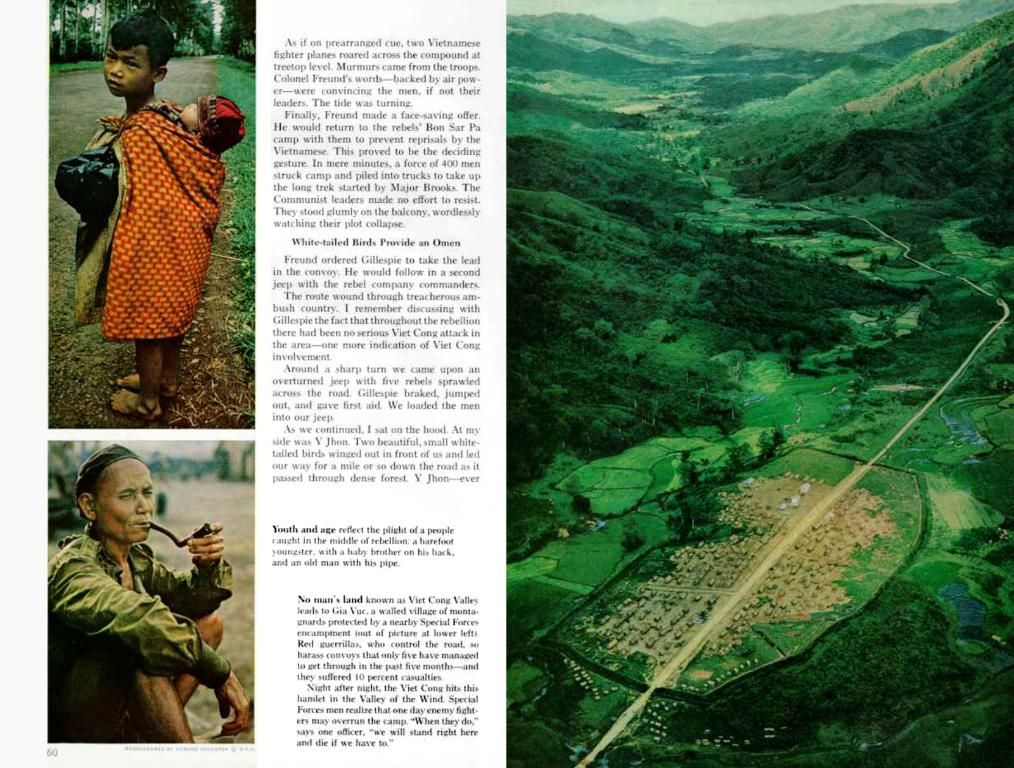

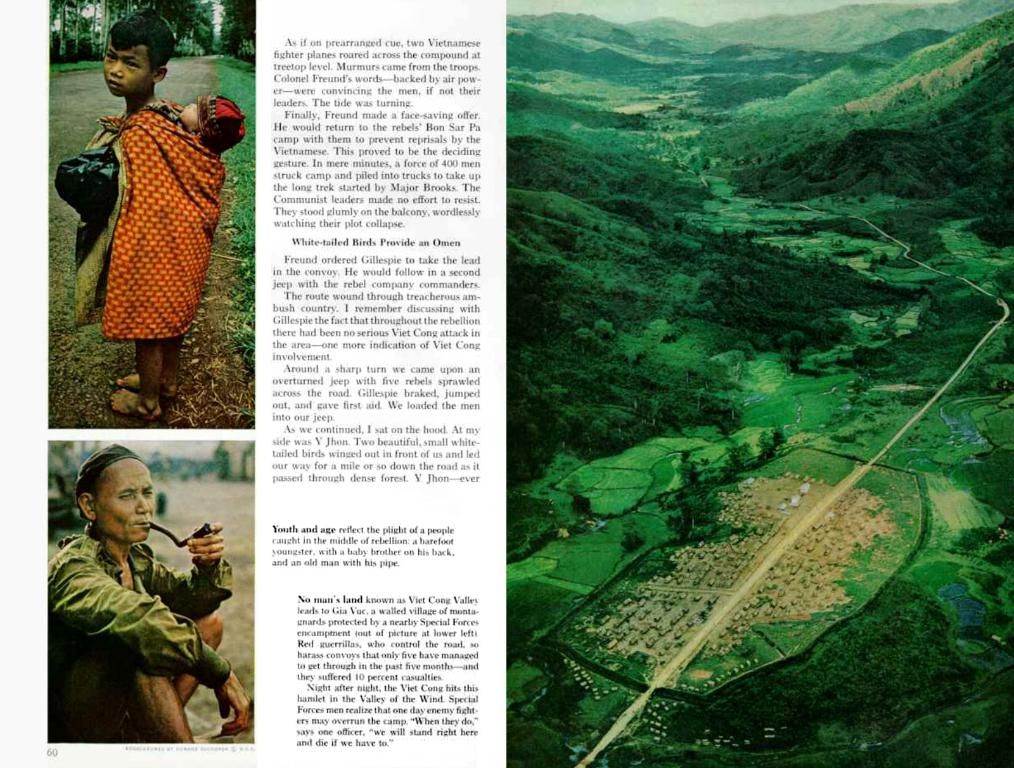

In response to falling inflation and weak economic growth in the eurozone, the European Central Bank (ECB) has taken another step in easing monetary policy. President Christine Lagarde and her council voted to lower the key interest rate by a quarter of a percentage point, bringing it down to 2.0 percent.

Banks will now pay less to park excess liquidity with the central bank. This rate cut marks the eighth consecutive decrease in the eurozone's interest rates since mid-2024 when the ECB switched to an easing course.

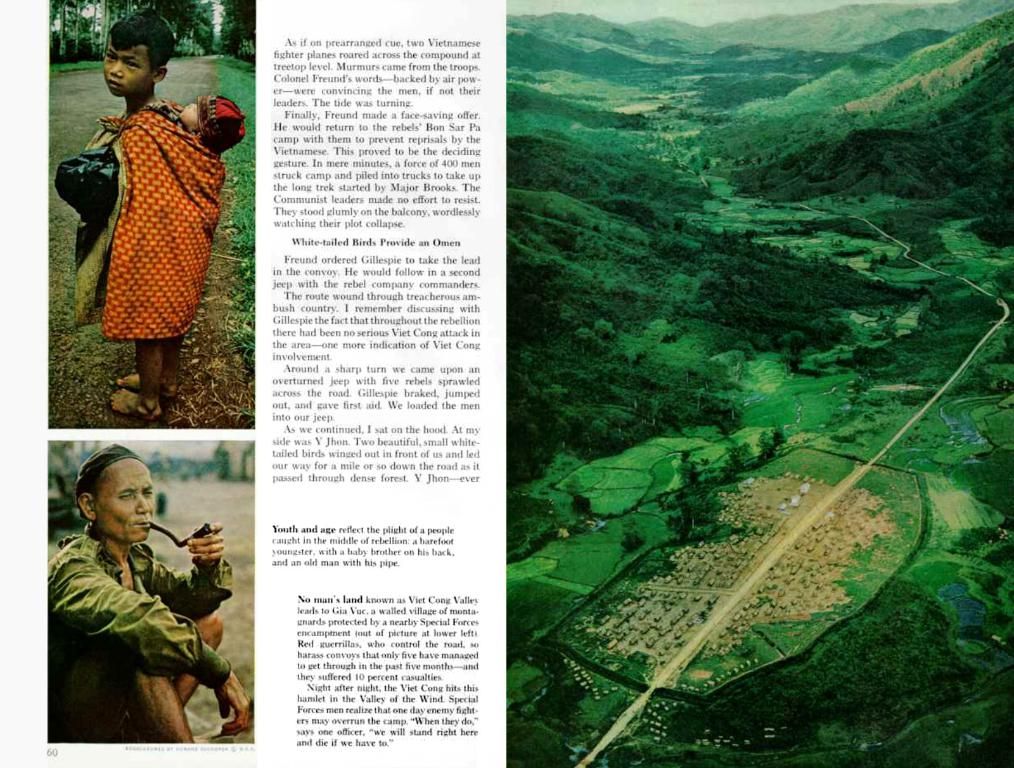

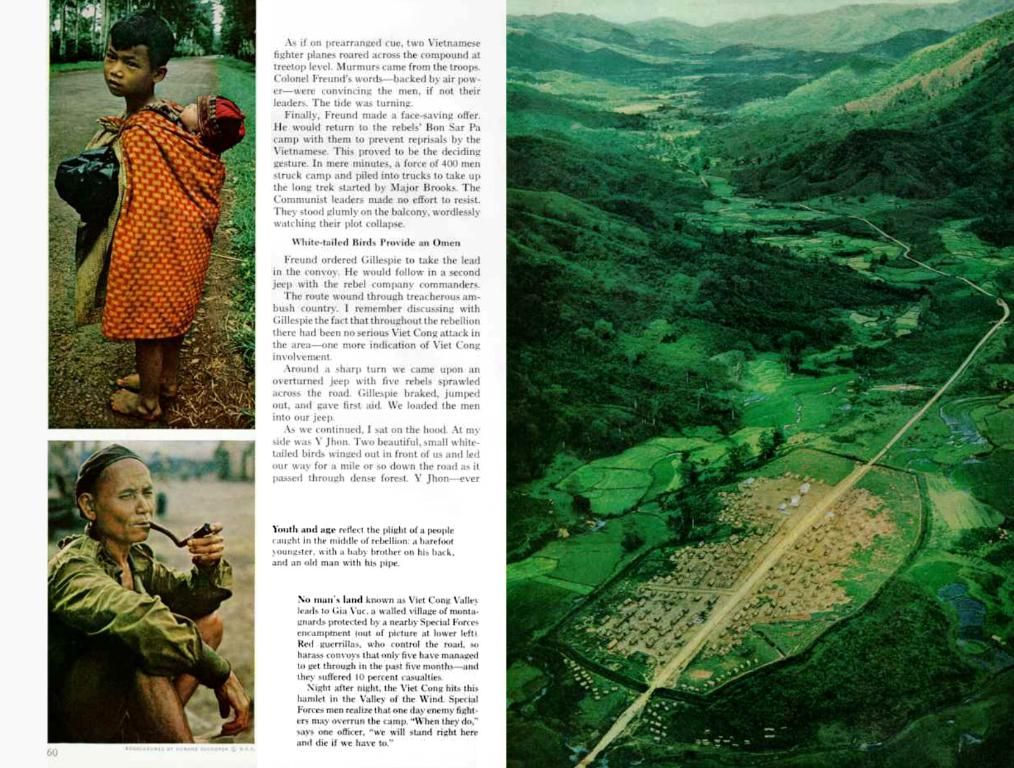

One council member didn't join the vote, with the ECB Council newspaper expressing that the rate level is well-positioned for the uncertain conditions. The bank, however, stopped short of committing itself to a specific interest rate path in the future.

"In the midst of rising geopolitical tensions and dwindling investment readiness, the central bank is taking a clear, stabilizing course," says Ulrich Reuter, President of the German Savings and Giro Association. Heiner Herkenhoff, CEO of the German Banking Association, warns against further easing, asserting that it could push inflation higher, posing unforeseen risks.

A Tumultuous Economic Scenario: Inflation Falls Below Target, Growth Slows

Inflation, which had surged due to consequences from the Ukraine war, has now fallen below the ECB's target of 2.0 percent. The inflation rate in May came in at 1.9 percent, down from 2.2 percent in April.

Global trade wars ignited by US President Donald Trump are causing economic woes in the eurozone. According to the EU Commission's May forecast, GDP in the eurozone will only expand by 0.9 percent this year. The initial projection for 2025 held growth at 1.3 percent. One of the significant drag factors is the ongoing weakness in the German economy, the biggest economy in the 20-member bloc. The German Industry and Commerce Chamber predicts the third consecutive year of recession.

The ECB remains uneasy about what lies ahead. Companies are restricting large investments amid questions surrounding the trade spat with the US. A potential bright spot for growth is the planned military buildup and the substantial financial package earmarked for Germany.

ECB President Christine Lagarde cautions about disrupting the world order and sees new opportunities for the euro. "Instead of multilateral cooperation, we now see zero-sum thinking and bilateral power plays," Lagarde said in Berlin, though she neglected to cite Trump explicitly.

Mixed Scenario Ahead: Trade Tensions and Global Risks

While the weak economy is currently suppressing inflation, trade tensions and supply chain disruptions could boost inflation in the long run. The ECB has been taking monetary policy decisions on a case-by-case basis, making adjustments in response to new data and emerging risks. The likelihood of the ECB pausing rate cuts in July stands at around 70 percent, according to financial market projections.

Sources: ntv.de, mpa/rts, Reuters, Bloomberg, Deutsche Welle

- ECB

- Key Interest Rate

- Policy Rate

- Interest Rate Decision

- Global Economy

- Growth

- Inflation

Enrichment Data:

The European Central Bank (ECB) has continued to cut interest rates due to persistently low inflation and weak economic growth in the eurozone. The latest rate cut occurred in June 2025, lowering the main deposit rate to 2%, and the deposit rate had been halved from its peak the previous year. The ECB's decision was influenced by trade tensions, particularly those with the US, and the potential impact on business investment and exports. The bank's cautious approach regarding future interest rates reflects their balance between combating inflation and supporting economic growth as the Eurozone navigates volatile global markets.

In light of the persistent low inflation and weak economic growth in the eurozone, the European Central Bank (ECB) has repeatedly adjusted its employment policy and community policy by reducing its key interest rate. In an effort to aid businesses, banks will now pay less to park excess liquidity with the central bank due to these cuts. Finance continues to play a crucial role in the ECB's decision-making process, as they seek to balance inflation rates and support sustainable economic growth amidst global economic uncertainty.