Bending Rates, Setting the Eurozone's Pace: Eighth Interest Rate Slash by ECB

Central Bank Cuts Main Rate to 2% Level

Share Tweet Chat Mail Print Link

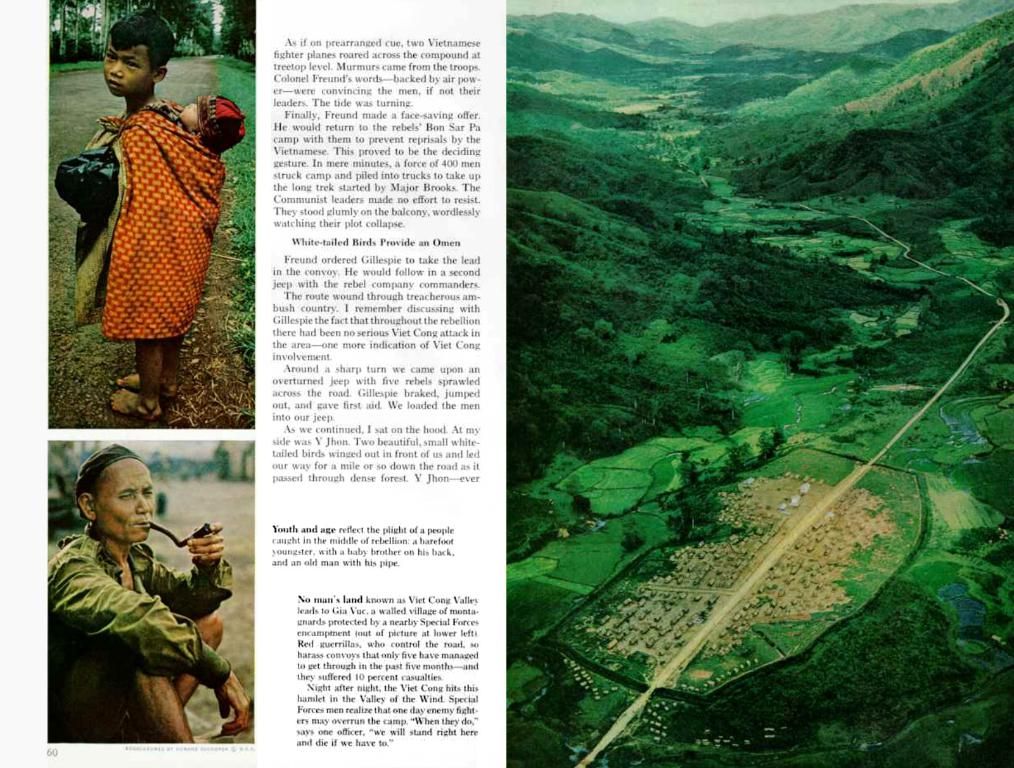

Inflation slips beneath ECB's target, growth falters: For the ECB, this calls for another interest rate adjustment. The key rate now stands at 2.0%. For now, the currency coordinators keep mum about what's next.

Steering the European Central Bank (ECB), led by the helm of central bank chief, Christine Lagarde, the ECB Council has decided to trim the eurozone's key interest rate, the deposit rate, by a quarter of a percentage point, down to 2.00%. This is the interest banks receive when they store excess funds at the central bank.

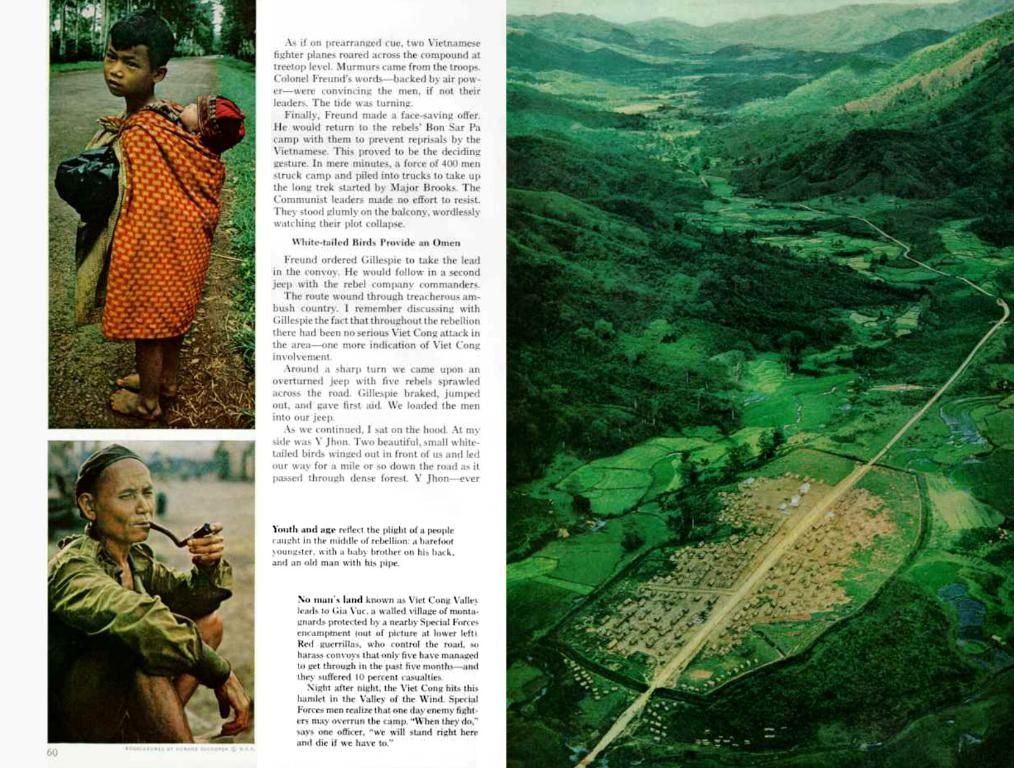

This is already the eighth time the ECB has eased its performing course since mid-2024. The decision didn't get unanimous nods, Lagarde confessed. One council member abstained from voting. "The ECB Council believes that the present interest rate level suits the tricky conditions," Lagarde declared. The ECB refrains from predicting their next moves: "The ECB Council doesn't commit to a specific path for interest rates in advance," the central bank stated in its announcement on the interest rate decision.

"With this, the central bank is doing exactly the right thing," opines Ulrich Reuter, President of the German Savings and Giro Association, about the ECB's decision. "During a phase of escalating geopolitical tensions and declining investment readiness, the central bank is maintaining a steady course and sending an essential stabilization signal."

Heiner Herkenhoff, CEO of the German Banking Association, warns against additional easing. He claims there are "strong reasons" to postpone further interest rate decisions over the summer. "Further interest rate reductions by the ECB would actively fuel inflation again," says Herkenhoff. "Such a move would not be without risks - especially now, when nobody can accurately foresee the exact affects of the trade and tariff wars."

ECB in a Rate-Cutting cycle: How it Impacts you

Inflation Loosing Grip

With inflation, which got a sharp boost due to the outcomes of the Ukraine war, the currency guardians have now reached their target. The inflation rate in the eurozone was 1.9% in May, down from 2.2% in April. Even the ECB's target of 2.0% was undershot. Lagarde still labeled the inflation outlook as "disconcertingly uncertain."

On one hand, the worldwide trade war instigated by US President Donald Trump is decelerating the economy in the eurozone. According to the EU Commission's prediction from May, the GDP in the eurozone will only swell by 0.9% this year. In the fall, a growth of 1.3% was still projected. One of the major constraints is the persistent weakness of the German economy, the biggest economy in the 20-member community. The German Chamber of Industry and Commerce expects the third consecutive year of recession.

Economy OECD's Third-to-last Ranked Economy The economy is growing much slower in comparison to other countries, due to concerns about growth and the volatile back-and-forth in the trade dispute with the US. The outlook for the ECB is marred by great unpredictability. Companies tends to postpone larger investments in such situations. Possible growth catalysts could be the planned military buildup in Europe, as well as the gigantic financial package spearheaded in Germany.

Christine Lagarde, ECB President, also perceives significant risks to the economy from the disruption of the global order that has been in place for decades, as she expressed in Berlin. "Rather than multilateral cooperation, we now have zero-sum thinking and bilateral power plays," Lagarde criticized, without mentioning Trump by name. However, fresh opportunities are on the horizon: "Given the current changes, the time for a greater international role of the Euro seems ripe."

While the weak economy is currently keeping inflation in check, in the long run, tariffs and disrupted supply chains could drastically ramp up inflation. The ECB has been relying on a gut feeling for its monetary policy for quite some time now, making decisions data-driven from meeting to meeting. Some currency guardians had recently suggested a rate pause in July. The probability of this is now estimated at around 70% on the financial market.

- ECB

- Interest Rate Decisions

- Monetary Policy

- Interest Rates

Insights from Enrichment Data:

- Long-term Ramifications: Although the weak economy is currently dampening inflation, persistent tariffs and supply chain disruptions could significantly boost inflation in the long term.

- ECB's Flexibility: The ECB is prepared to adapt its policy to accommodate changing economic conditions.

- Economic Challenges: The ECB faces several obstacles, including low inflation and trade conflicts. It is taking necessary steps to mitigate risks and maintain economic stability.

Community policy regarding the ECB's interest rate decisions may need to consider the potential long-term ramifications of tariffs and supply chain disruptions, which could significantly boost inflation in the future. The ECB's ongoing monetary policy, influenced by its adaptable approach to accommodate changing economic conditions, is aimed at mitigating risks and maintaining economic stability during this period of economic challenges, including low inflation and trade conflicts. Additionally, the impact of these interest rate decisions on business, particularly in the realm of finance, should be carefully considered in employment policy to ensure a stable economic climate for employers and employees.