Business Confidence in Manufacturing Sectors Plunges in April

Manufacturing pessimism has skyrocketed in April as industrial producers grapple with fluctuating tariff plans and strive to foresee how global trade policy will affect their expenses and operations in the upcoming months.

A barrage of business surveys published this week reveal noticeable dips in confidence between January, when the majority of manufacturers expressed a rosy outlook for nearby conditions and the full year, and April, when optimism took a significant nosedive.

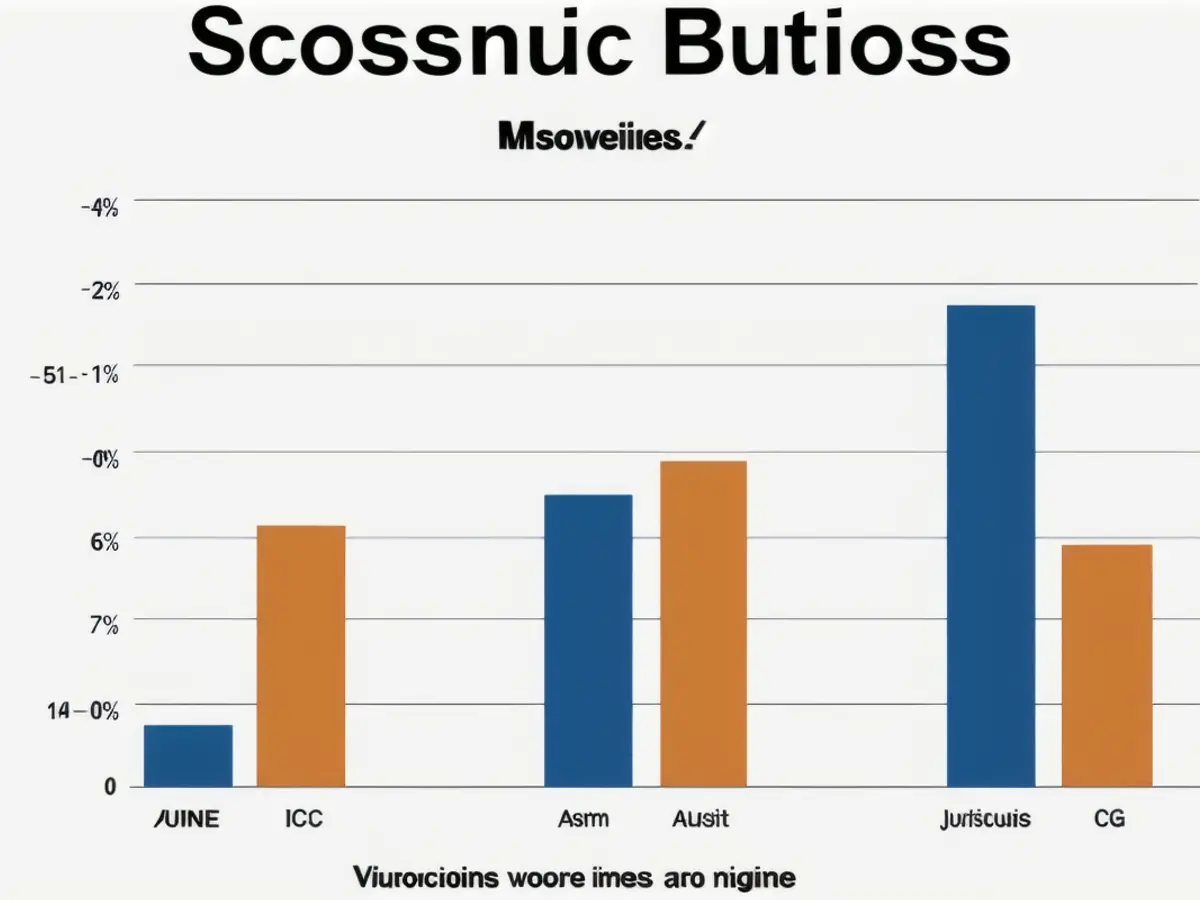

In the Federal Reserve Bank of Philadelphia's monthly "Manufacturing Business Outlook Survey," approximately 39% of businesses expressed intentions to boost capital spending this year to enhance operations in January – a figure comparable to peak points hit in 2017 and during the COVID recovery in 2021. By April, this number plummeted to a paltry 2%. For the sake of comparison, this metric slipped into the negative during inflation spikes in 2023 and during the financial crisis in 2009, but only reached a low of 9.7% during the gravest COVID declines.

New York's Fed survey, entitled the "Empire State Manufacturing Survey," followed a similar downward trajectory, plunging to just 1.6% of businesses with capital spending increase plans, down from 9.2% in March. The authors of this report pointed out, "Firms expect conditions to worsen in the months ahead, a level of pessimism that has only occurred a handful of times in the survey's history."

The most dramatic declines emerged from the Equipment Leasing Finance Foundation (ELFF), an organization representing lenders that provide manufacturers with new capital equipment for factories. In March, more than half of manufacturers surveyed by the group anticipated capital spending to increase or remain steady in the next four months. By April, this figure soared to 61% projecting a decline in spending.

The ELFA survey also noted a steep rise in pessimism regarding the overall health of the U.S. economy. When asked in March what they expected for the next six months, manufacturers were generally optimistic or neutral, with nearly one-third expecting improvements and about one-quarter predicting deterioration. Fast-forward to April, more than half (57.7%) anticipated conditions to worsen.

It's essential to note that survey data captures a snapshot in time, and much of the negative sentiment emanated from surveys conducted around President Donald Trump's announcements of colossal tariffs on virtually all U.S. trading partners, which included steep duties on incoming European, South American, and Asian goods. Although 145% tariffs on some Chinese goods remain in place, Trump later suspended most of the new import levies for 90 days. The upcoming May surveys, set to be released in about a month, will determine if this reprieve impacts sentiment.

James D. Jenks, CEO of Global Finance and Leasing Services LLC, informed the ELFA, "The uncertainty regarding whether tariffs will be implemented and when is not helping the economy in the near term."

Nonetheless, other respondents retained a more optimistic outlook. Charles Jones, senior vice president of 1st Equipment Finance Inc., told ELFA survey participants, "Turbulent times...doom and gloom mixed with increased opportunities. Tariffs might lead to higher prices for parts and equipment. They will also result in 'creative' financing opportunities to help borrowers protect cash flow and offset higher prices for goods. Once you get past the fear, it's an exciting time to be in equipment finance."

Slightly earlier data reveals some signs of growth in manufacturing capital spending. The Association for Manufacturing Technology's monthly U.S. Manufacturing Technology Orders report showed a 8.8% increase in capital equipment spending by U.S. manufacturers in January and February, in line with optimistic predictions for 2024.

Orders from electrical equipment producers were particularly robust. The proliferation of AI and data centers has spawned a massive demand for electrical grid improvements nationwide – transformers, switchgear, and other equipment.

Investments in Electrical Grid Improvements

- Hitachi Energy commits $70M to expand high-voltage manufacturing facilities in Pennsylvania (Plant Services)

- Google's AI-Powered Grid Revolution: How Data Centers Are Reshaping the U.S. Power Landscape (Data Center Frontier)

- DTE Electric Plan Approved to Expedite Innovation for Distributed Energy Resources and Grid Reliability (T&D World)

- America Needs More Electricity: Production Pulse

- Schneider Electric to Invest Over $700 Million in U.S. Operations Through 2027 to Support Energy and AI Sectors and Job Growth (T&D World)

[1] Deloitte.us

[2] Business Wire

[3] Bloomberg.com

[4] American Action Forum

[5] TSMC.comMicron.comSemiconductors.orgWhitehouse.gov

- The decline in business confidence, as reflected in the survey results from April, contrasts sharply with the optimistic outlook expressed by manufacturers in January regarding their near-term conditions and the full year.

- The Federal Reserve Bank of Philadelphia's survey indicated a dramatic drop in the number of businesses planning to boost capital spending this year, from 39% in January to a mere 2% in April.

- The Empire State Manufacturing Survey, conducted in New York, mirrored the downward trend, with only 1.6% of businesses planning capital spending increases in April, compared to 9.2% in March.

- The Equipment Leasing Finance Foundation (ELFF) survey saw a significant shift in sentiment, with 61% of manufacturers projecting a decline in capital spending in April, a stark contrast from more than half anticipating an increase or steady spending just a month prior.