BlackRock CEO Delivers Alarming Statement in Wake of Bitcoin and Cryptocurrency's $1 Trillion Market Crash

In a surprise move, Elon Musk has issued a crypto price warning, and the CEO of BlackRock has raised concerns about Trump's trade policies causing rising inflation. Bitcoin's price has dropped significantly, with the crypto market losing over a trillion dollars in value in a month.

03/13 update: Amidst fears of Trump's tariff trade war causing long-term inflation, the February U.S. inflation rate dropped to 2.8%, creating confusion in the market.

Goldman Sachs economists have increased their odds of a recession over the next 12 months from 15% to 20%, pointing to Trump's economic policies as the "key risk." Yardeni Research economists have also raised their recession odds, increasing them from 20% to 35% due to Trump's new executive orders, firings, and tariffs.

Last week, Federal Reserve chair Jerome Powell stated the Fed is in no hurry to cut rates, with the labor market still strong and inflation on an unsteady path toward its 2% goal. However, the CME FedWatch Tool shows the market is heavily betting the Fed will leave rates unchanged at its March meeting next week, but is split over whether rates will be cut in May.

With the crypto market already sluggish, this uncertainty isn't helping. Investors are waiting for clearer signals from the White House or Fed to boost market confidence. Last week's crypto summit failed to reassure markets.

Sean Dawson, head of research at Derive.xyz, suggests this market downturn is driven by broader economic concerns, including fears of a U.S. recession and persistent inflation. Dawson warns of the risk of stagflation - a slowing economy with high inflation.

As a result, traders are turning to downside hedging strategies, especially as volatility surges across both traditional and crypto markets. The coming weeks will be crucial in assessing how the economy affects digital asset prices and trading behavior.

In other news, the latest consumer price index (CPI) data will be released on Wednesday. Bloomberg predicts consumer prices have increased in February, potentially intensifying fears of stagflation.

iOS 18.3.2 Update Warning

Northern Lights Alert: These 10 States Could See Aurora Borealis Tonight

NYT Mini Hints, Clues And Answers For Thursday, March 13

Sources: Reuters, Bloomberg

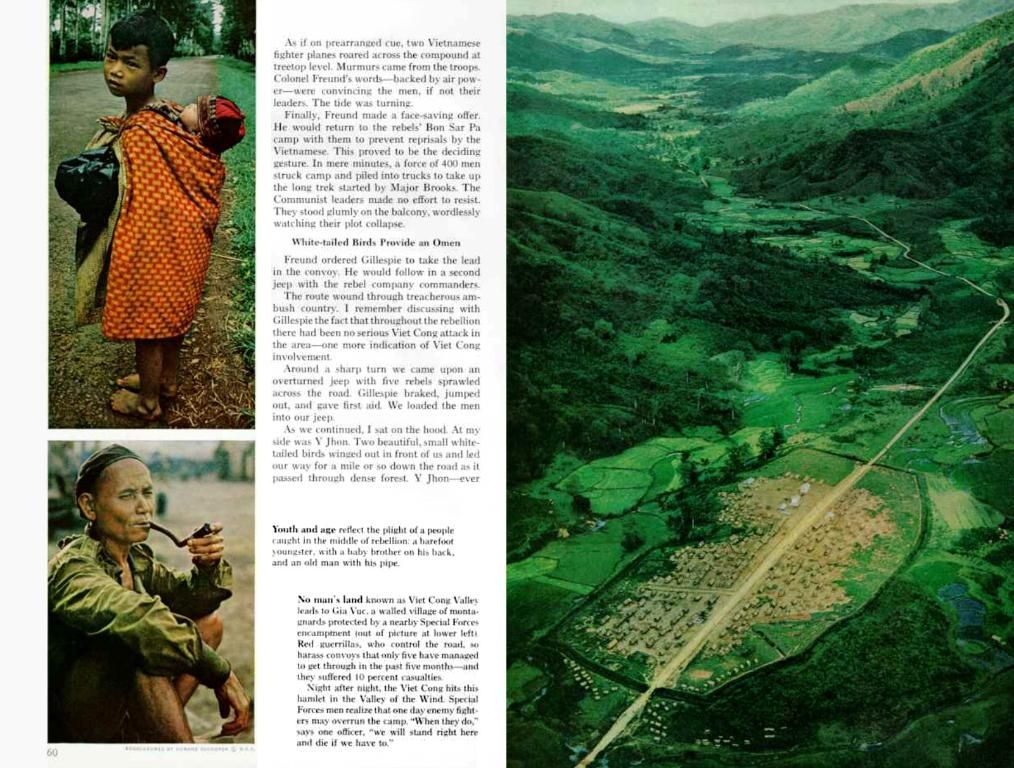

- Larry Fink, CEO of BlackRock, has expressed concerns about Trump's economic policies potentially causing rising inflation, adding to the worries surrounding the crypto market.

- Sooner rather than later, investors may need to assess the impact of potential layoffs on the crypto market, especially since the economy's overall health is a significant factor in determining digital asset prices.

- In the face of market uncertainty and surging volatility across both traditional and crypto markets, traders are increasingly adopting downside hedging strategies to prepare for potential Bitcoin price drops or a broader crypto crash.