BlackBerry's Shift in Strategy: Revising Revenue Forecasts and Embracing Change

BlackBerry Faces Cybersecurity Challenges: Reduced Revenue Predictions due to Decreasing Market Demand

In a unexpected turn of events, BlackBerry, the once renowned tech titan, has revised its fiscal year revenue projections, citing a drop in demand for its cybersecurity services. This adjustment is a stark reminder of the fierce competition in the cybersecurity sector, with competitors like CrowdStrike and Palo Alto Networks leading the charge.

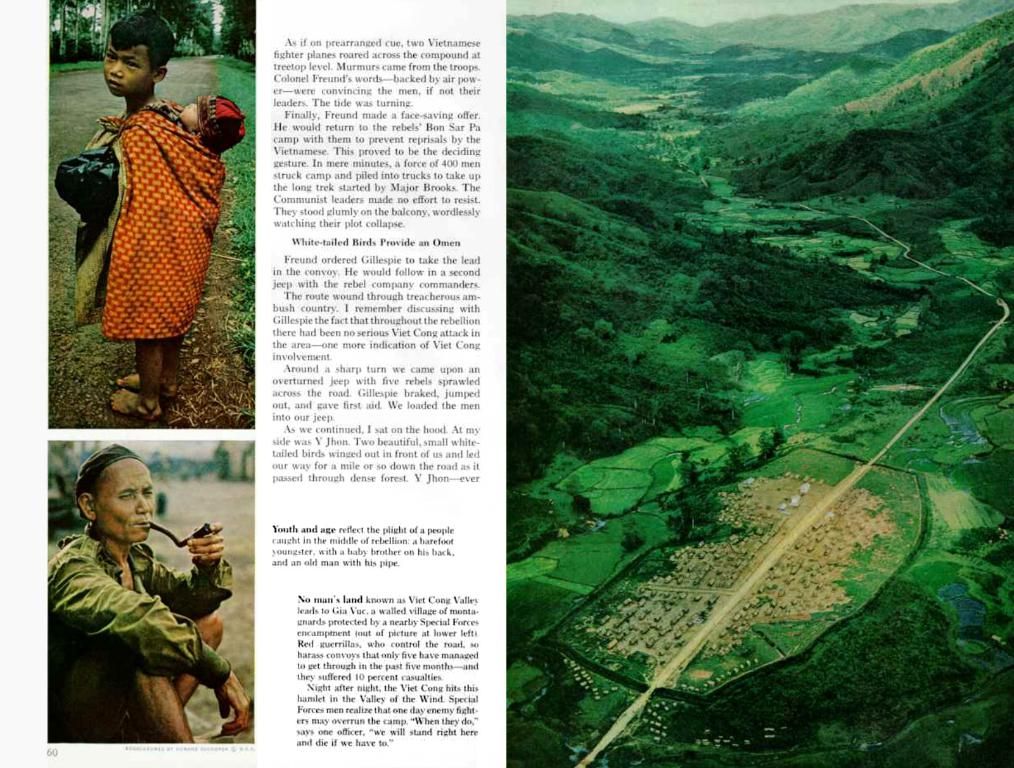

The Cybersecurity Landscape: AKA the Jungle

BlackBerry's foray into the cybersecurity domain hasn't been a smooth ride, as it finds itself caught in the teeth of cutthroat competition. Heavyweights such as CrowdStrike and Palo Alto Networks have been eating up market share, relying on advanced technologies and aggressive expansion tactics. As technology advances at breakneck speed and cyber threats persistently grow, companies are on the hunt for service providers offering more than just solutions—innovation. BlackBerry is now fighting tooth and nail to differentiate its offerings amidst market saturation.

Financial Facts and Stock Performance

The lowered revenue forecast sent shockwaves through the stock market, as BlackBerry's shares took a tumble. The sobering financial news underscores investors' concerns about the company's long-term profitability and growth potential. With this revenue guidance adjustment, BlackBerry is being urged to reevaluate its strategic positioning and product offerings within the cybersecurity realm.

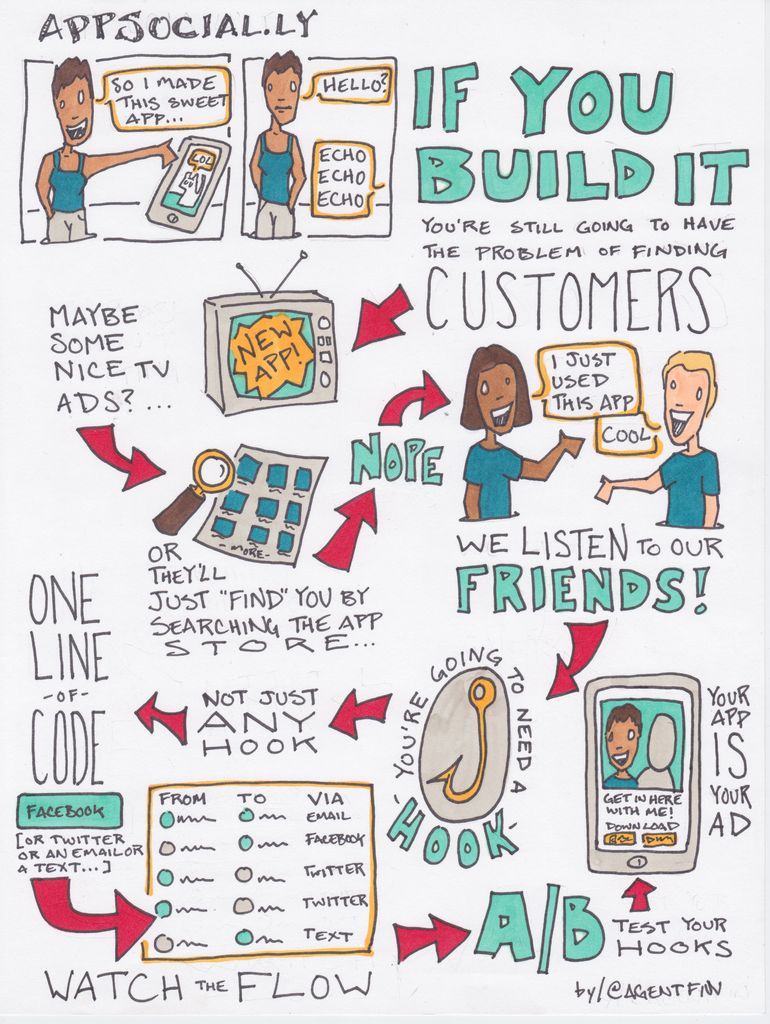

Stepping into Uncharted Territory: Strategic Moves

Amidst these financial disclosures, BlackBerry has hinted at undertaking strategic shifts to better align with market demands. While specifics are scarce, predictions abound that BlackBerry may explore partnerships, invest in technological R&D, or even acquire other firms in a bid to rejuvenate its cybersecurity business. Staying adaptable and innovative will be crucial for BlackBerry to re-establish itself and regain stakeholder trust.

Industry Insights from Experts

David C. Smith, a cybersecurity expert, weighed in, stating, "BlackBerry's predicament exemplifies how technology can rapidly outpace even established players. BlackBerry's goal now is to reassess its strategies and invest in innovative solutions that cater to modern cybersecurity needs." Smith's perspective offers a broader understanding of the industry trends affecting legacy firms trying to keep up with today's digital security landscape.

Conclusion

The whispers of BlackBerry's revised revenue forecast paint a tale not just of numbers, but of transformation, competition, and relentless technological innovation. As BlackBerry embarks on this critical juncture, its capacity to innovate and reinvent itself in the cybersecurity sector will be essential for its continued survival. The world watches expectantly, eager to see how BlackBerry tackles its challenges, with hopes that the company can resurrect its position in the industry.

BlackBerry, standing at a crossroads, represents a fascinating case study for companies navigating similar transitions within evolving marketscapes. The choices it makes have the power to shape the industry's future. Stay tuned. BlackBerry's story is far from over.

Interesting Tidbits

- Current Revenue: BlackBerry reported annual revenue of $534.90 million in fiscal year 2025, marking a 29.53% decrease from the previous year.

- Future Revenue Projections: BlackBerry's FY26 revenue is projected at $524 million, a slight decline of 2.04% year-over-year, with FY27 expected to rise 8.59% to $569 million.

- QNX Execution: BlackBerry generates substantial revenue through royalties from its QNX operating system, which currently stands at a royalty backlog of $865 million.

- Cybersecurity Focus: BlackBerry is betting on its expertise in cybersecurity to diversify and strengthen its offerings in this sector.

- Earnings Announcement: BlackBerry is slated to announce its earnings on June 24, 2025, offering a closer look at the company's financial performance and strategic execution.

- Despite being a veteran in the technology industry, BlackBerry's revenue projections for its cybersecurity services have shown a decline, indicating a challenging landscape amid competition from companies like CrowdStrike and Palo Alto Networks.

- In an effort to stay relevant and competitive, BlackBerry is exploring strategic partnerships, technological R&D investments, and possibly acquisitions to rejuvenate its cybersecurity business and adapt to market demands.

- Experts offer insights into BlackBerry's predicament, explaining that it serves as a stark reminder of the rapid pace of technological evolution and the need for companies to continually innovate to remain competitive in the cybersecurity sector.