Anticipation: This Enterprise Stands to Gain Significantly from Super Micro Computer's Challenges

Rampant expenditures in data centers are driven by our escalating need for data storage and computational power, as well as the substantial demands of artificial intelligence (AI) programs. While some data centers are fairly compact, others stretch beyond 100,000 square feet (often exceeding tens of millions of square feet). Giants of the tech world, such as Microsoft, Amazon, Alphabet, and Meta, are typically responsible for constructing these colossal data centers.

For instance, by 2025, Meta is planning to commence construction on a $800 million, 715,000-square-foot campus in South Carolina, while Microsoft will initiate a $1 billion project in La Porte, Indiana.

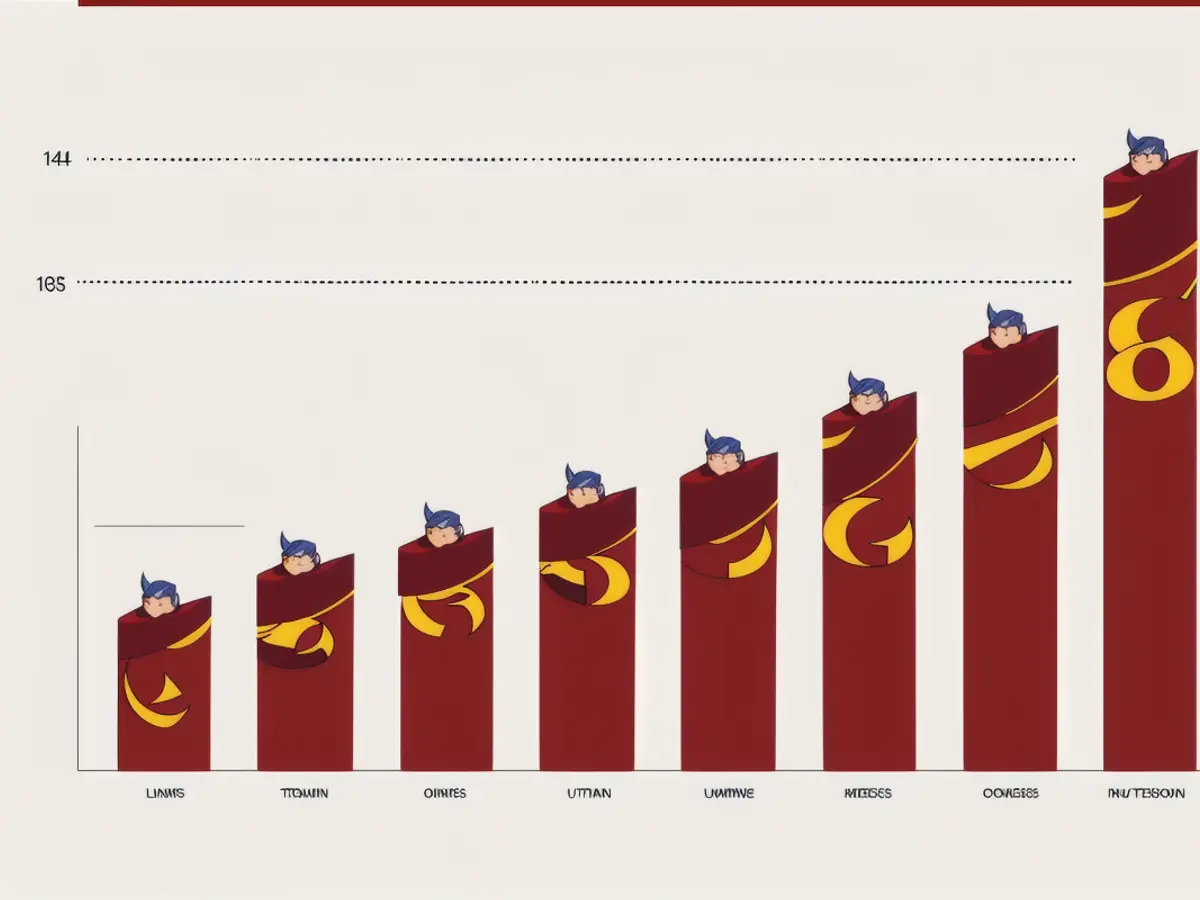

As shown below, there has been a significant surge in hyperscale centers.

This surge surpassed 1,000 in 2024 and is projected to increase by 120 to 130 annually. These centers rely on infrastructure such as servers, storage, and racks, making this a promising opportunity for investors.

Dell Technologies (DELL -5.67%) plays a significant role in the industry, with Super Micro Computer being another notable supplier. However, Supermicro is currently facing several challenges, which may present an opportunity for Dell.

Supermicro's challenges may benefit Dell

Supermicro's difficulties have been well documented, so I won't dwell on them excessively. Here is a concise timeline:

- August: Hindenburg Research released a damning short report, prompting Supermicro to postpone its annual 10-K filing.

- September: Nasdaq notified the company about the possibility of delisting for its delayed filing.

- October: Supermicro's audit firm, Ernst & Young, resigned.

- November: The company postponed its quarterly 10-Q filing.

As of now, the stock is trading at 84% below its 2024 peak.

SMCI data by YCharts

None of these incidents individually constitute a smoking gun; however, they raise legitimate concerns.

It would be logical for a data center operator to avoid the commotion and prefer Dell for its infrastructure needs instead of Supermicro, which reported $5.3 billion in sales in the fiscal 2024 fourth quarter ($15 billion for the fiscal year), with 64% attributed to large data centers. Dell's Infrastructure Solutions Group recorded $11.6 billion in revenue in its last quarter, which may translate to billions of dollars in revenue if they succeed in acquiring Supermicro's market share.

Should investors consider buying Dell stock?

Dell's performance in recent quarters is strong, but it's analyst expectations for the upcoming years that are truly exciting. Revenue rose by 9% in Q2 of fiscal 2025, touching $25 billion, while diluted EPS increased by 86% to $1.17. The Infrastructure Solutions Group, which caters to data centers, reported record sales of $11.6 billion, reflecting a robust 38% year-over-year growth.

Analysts forecast $7.87 in EPS for this fiscal year, followed by even more for the subsequent years. This optimism is the reason behind 20 out of 25 analysts recommending a buy or strong buy on the stock, with an average target price of $145 per share, representing a 10% premium over the stock's current price. However, analyst estimates may not fully account for Dell's potential of capturing market share from Supermicro. This could provide the stock with additional room to appreciated.

Additionally, Dell is appealing due to its dividend payments and stock repurchases. The company aims to return 80% of adjusted free cash flow to shareholders and increase the dividend, currently yielding 1.3%, by 10% annually. Adjusted free cash flow reached $5.6 billion in fiscal 2024 and $3.7 billion through two quarters of fiscal 2025. Free cash flow is expected to grow significantly alongside earnings.

The demand for data center infrastructure is on the rise, and Dell appears to be in the prime position to capitalize on this trend over the coming years. Tech investors should consider holding a long-term position in the stock.

Given Supermicro's challenges, as a data center operator, it might be prudent to opt for Dell's infrastructure solutions instead, considering Dell's strong revenue performance and growth in the data center sector. Investors might find Dell an appealing choice due to its dividend payments, stock repurchases, and potential to capture Supermicro's market share. With analysts forecasting positive EPS and a significant increase in free cash flow, investing in Dell could yield promising returns for tech investors aiming for a long-term position. [Finance, investing, money]

In light of Dell's robust infrastructure solutions group and its potential to capture Supermicro's market share, tech-savvy investors might consider diversifying their portfolios with Dell stock. The company's strong revenue growth, attractive dividend yields, and analyst optimism make it a promising investment opportunity in the rapidly growing data center sector. As data center infrastructure demands continue to surge, investing in Dell could offer a lucrative long-term strategy. [Investing, finance, money]