Anticipated Purchase: This Likely Marks Amazon's Upcoming Major Buyout

Amazon (AMZN losing 2.21%) is predominantly recognized for its digital marketplace and cloud computing business. However, surprise, surprise! Amazon also has a presence in various other sectors such as streaming, entertainment, advertising, and more.

Amazon's ability to diversify its business over the years can be attributed to a series of purchases. Although the majority of Amazon's acquisitions have revolved around technology, the company has made some discrete moves in the healthcare sector recently.

In 2018, Amazon acquired an online pharmacy business named PillPack for $753 million. Few years later, in 2023, the company even went a step further by acquiring a membership-based primary healthcare provider called 1Life Healthcare for $3.9 billion.

These two companies have paved the way for Amazon to establish its presence in the healthcare sector, primarily through Amazon Pharmacy. In this post, I will discuss a potential company that Amazon could acquire next and why this acquisition could make perfect sense at the moment.

Amazon should acquire Hims & Hers Health

Hims & Hers Health (HIMS down 3.93%) is a telemedicine company that offers a range of lifestyle and wellness products, including treatments for skincare, hair growth, weight loss, anxiety, and sexual health, among others.

Back in November, Amazon Pharmacy announced an extension of its product offerings to include "common health, beauty, and lifestyle concerns" such as anti-aging skincare, hair regrowth, and erectile dysfunction.

Upon first glance, I can see a lot of similarities between the Hims & Hers platform and Amazon's enhanced offerings through its online pharmacy. Below, I will elaborate on what makes Hims & Hers an appealing asset for Amazon's ecosystem.

Why Hims & Hers Health and Amazon could be the perfect pair

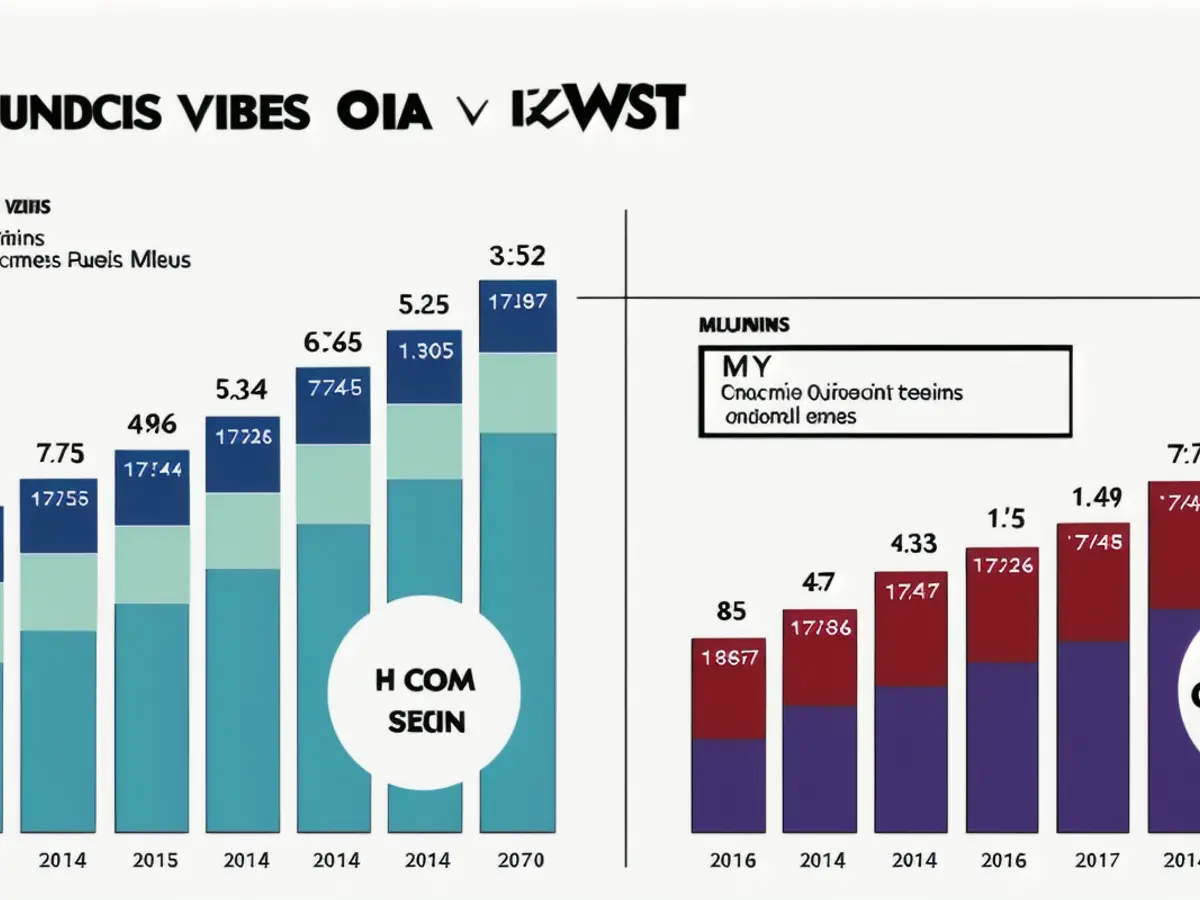

As per the chart below, the majority of Hims & Hers Health's revenue comes from online sales. And according to the company's 10Q filing, "the majority of our online revenue is subscription-based, where customers agree to recurring billing for regular delivery of products and services."

The reason I view Hims & Hers Health as such an appealing asset for Amazon is quite straightforward: Amazon Prime, the subscription service that provides members with benefits such as free shipping and access to certain entertainment content through Amazon's streaming platform.

I believe the potential synergy here could be for Amazon to incorporate Hims & Hers Health's subscriber base into the Prime membership platform, thereby strengthening its online pharmacy capabilities and adding a consistent stream of high-margin, recurring revenue.

This could be the perfect time to strike a deal

Hims & Hers Health presents an interesting case study. Although shares have soared by 216% this year, the stock has dropped by nearly 13% in December.

One of the major factors influencing recent price action for Hims & Hers Health relates to the weight loss market. At present, glucagon-like peptide-1 (GLP-1) agonists like Ozempic, Wegovy, Mounjaro, and Zepbound are used to treat diabetes and chronic weight management. All four of these blockbuster drugs are manufactured by either Novo Nordisk or Eli Lilly.

Although competition in the GLP-1 sector is limited, Hims & Hers has managed to find its niche by offering patients compounded versions of treatments like Ozempic. Compounded medications are not approved by the Food and Drug Administration (FDA), yet some patients opt for these alternatives due to their affordability and ease of availability.

For several months now, Novo and Lilly have voiced public concerns about compounded GLP-1 treatments and have been taking steps to make their weight loss medications more affordable and accessible.

Furthermore, earlier this week, the FDA removed tirzepatide - the main ingredient in Mounjaro and Zepbound - from its shortage list. This means that compounding facilities have a limited time (approximately 60 to 90 days depending on certain regulatory frameworks) to continue selling compounded GLP-1s. Once this restriction ends, Hims & Hers' ability to penetrate the weight loss market could become more challenging, and its growth could slow down significantly.

To me, these developments are directly contributing to the current decline in Hims & Hers Health stock. With a market cap of $6.2 billion, Amazon could easily acquire Hims & Hers Health using cash from its balance sheet.

Given the overlap in product offerings between Amazon Pharmacy and Hims & Hers Health, combined with the robust recurring revenue base that Amazon could incorporate into its Prime membership perks, I see a deal between the two parties as a perfect match.

After analyzing the market, it's clear that Novo Nordisk and Eli Lilly are taking steps to make their weight loss medications more affordable and accessible, potentially impacting Hims & Hers Health's market share in the weight loss sector. Given this situation, Amazon, with its substantial cash on hand, might consider a strategic acquisition of Hims & Hers Health to strengthen its position in the healthcare sector and expand its Prime membership offering, which already includes benefits like free shipping and entertainment content. Such a move could provide Amazon with an additional source of high-margin, recurring revenue, especially from Hims & Hers Health's subscription-based services.