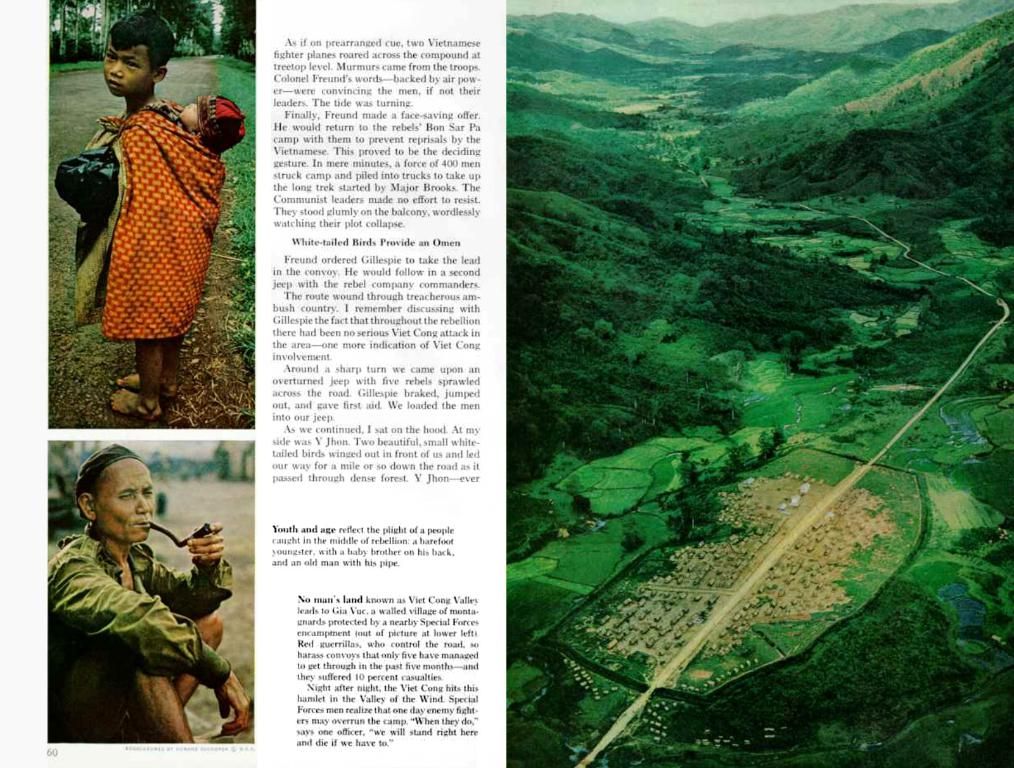

American artisanal beers, meticulously brewed in steel vats and packaged in aluminum cans, risk facing increased taxes

Craft breweries across the nation are bracing for the impact of President Donald Trump's latest tariffs. Set to take effect on March 12, these tariffs include a 25% duty on all steel and aluminum imports. For the U.S. brewing industry, this could mean higher production costs for critical materials, including aluminum cans.

This unfavorable timing comes at a challenging moment for the craft beer scene, which has been grappling with multiple setbacks in recent years. The COVID-19 pandemic drained taproom sales, forcing breweries to lean heavily on cans and bottles for takeout. Global supply chain disruptions caused key input shortages and price hikes, including for cans, which already saw an uptick in cost due to 2018 tariffs. Adding to their woes, a shift in consumer and retailer preferences towards beverages beyond beer left many breweries struggling to keep up.

In 2024, for the first time in nearly two decades, more craft breweries closed than opened. The situation is far from ideal for small, independent craft brewers, like Caleb Hiliadis, head brewer of Amherst Brewing Company. Hiliadis emphasizes the importance of aluminum cans to their business, accounting for approximately 75% of packaged volume and revenue.

Though Canada is not exempt from these new tariffs, it is among the top sources for U.S. aluminum imports, as well as steel. The Brewers Association, a trade organization for small and independent brewers, has warned of potential increases in aluminum prices due to these tariffs. According to economists, producer prices for steel and aluminum are expected to rise by 15-20% in the coming months.

For craft breweries that source their cans from Canada, like Spiteful Brewing in Chicago, these changes may bring an even bigger impact. Klein, co-founder of Spiteful Brewing, has experienced cost hikes in the past and is apprehensive about their flagship aluminum cans’ price increases.

Small breweries like these have to be both creative and resourceful to adapt to these changing landscapes. They have shifted from purchasing truckload quantities of cans to buy in smaller quantities each month, transforming their production areas into makeshift warehouses.

The Massachusetts Brewers Guild has also expressed concern, stating that smaller breweries will be hit the hardest. With canned beer accounting for over 60% of packaged beer sales for guild members, and Canada as a significant supplier of imported aluminum, brewers are strategizing to minimize losses and prepare for increased costs.

Small breweries are operating on thin margins and may struggle to pass further increases along to consumers. As Hiliadis, head brewer of Amherst Brewing Company, put it, they have reached the limit of what the market can handle for craft beer. With steel, a backbone commodity in craft brewing, added into the mix, the industry is set to experience further challenges.

In conclusion, the new tariffs on steel and aluminum imports projected by President Trump are expected to intensify challenges for the US craft brewing industry, particularly for small breweries with lower margins. With key inputs becoming more expensive, breweries will have to carefully navigate these changes to stay afloat.

The new tariffs could negatively impact the business operations of small breweries, causing an increase in their production costs due to the higher prices of critical materials like aluminum cans. This escalating economic burden may make it difficult for these breweries to maintain their profits and may require them to pass these increased costs onto consumers, potentially straining the craft beer economy further.